Investor risk appetite returned amid optimism that the US-China trade agreement could happen and the USD/JPY pair had a better chance of an upward correction to the 109.20 resistance early Tuesday, which could trigger bulls to push the pair into 110 psychological resistance, which supports the uptrend strength. Optimism about the future of the US economy continues to support the dollar's strength against other major currencies. As for the conflict with China, the latter has announced that it will lift sanctions on intellectual property violations. It will also lower the thresholds for criminal penalties for such violations and make it easier for victims to obtain compensation. This may seem like a concession to the United States, which has been pushing hard for greater protection of intellectual property rights. However, the problem is often not that China has wrong laws, but that laws are not enforced.

On the other hand. The International Monetary Fund (IMF) called on the Japanese government and the Bank of Japan to intensify their cooperation with the approval of Prime Minister Abe's financial plans (additional budget in light of the sales tax and insolvency increase). The fund suggested that the Bank of Japan target short-term interest rates while cutting its purchases of long-term bonds to increase the yield curve. The IMF also proposed that the central bank adopt an inflation target rather than a point target to strengthen its resilience, and reiterated its call for structural reforms. This year's GDP growth forecast was cut to 0.8% from 0.9% and a 0.5% in 2020.

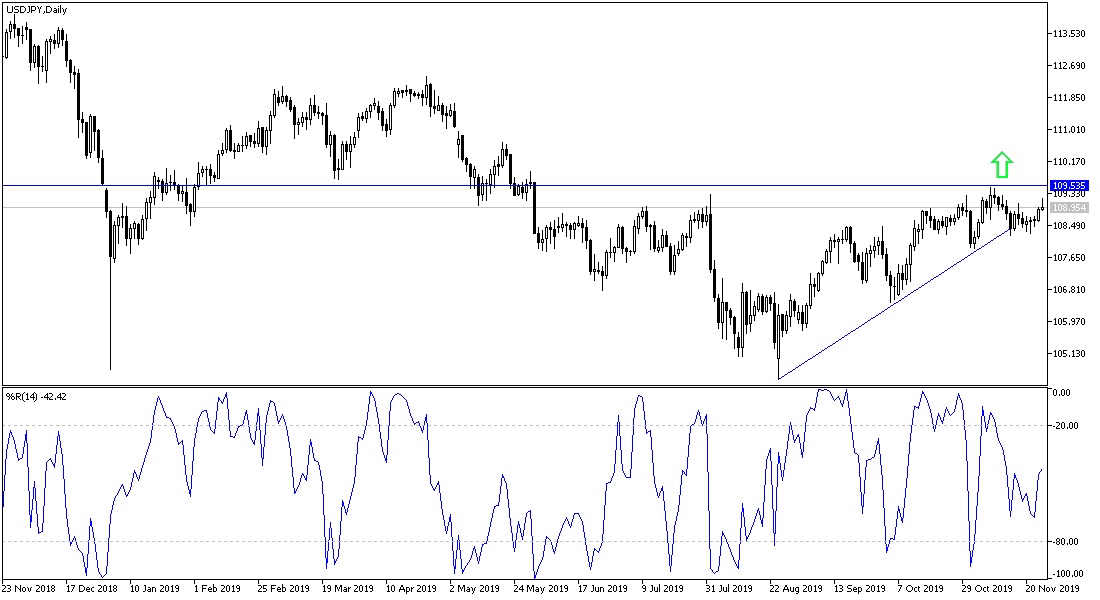

According to the technical analysis of the pair: The USD/JPY bullish trend is increasing support from stability above 109.00 resistance, because it stimulates the bulls to push the pair to 110 psychological resistance, which strengthens the trend. Only a move towards 108.00 support and stability below it would be a strong threat. The pair is in a cautious wait while monitoring the developments of trade talks between the United States and China and formally announcing an agreement to stop their tariff warfare that is plaguing the world economy as a whole.

As for the economic calendar data: From Japan, the CPI and producer prices will be released. From the US, consumer confidence, new home sales, Richmond industrial index and commodity trade balance data will be released.