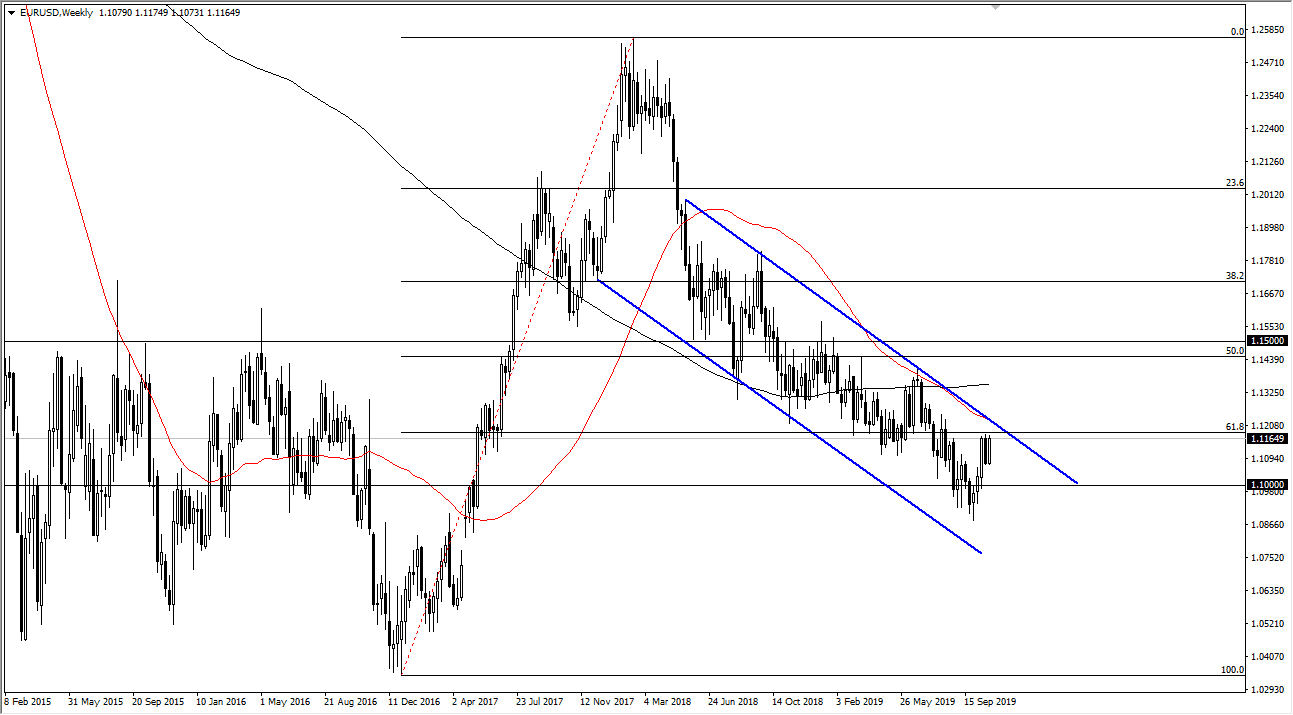

EUR/USD

The Euro has rallied during the week again, reaching towards the 1.12 level. At this point, the market is very likely to continue to go back and forth and I think the 1.12 level which is also the 61.8% Fibonacci retracement level, should continue to offer resistance. I anticipate more choppy behavior due to the European Central Bank offering more quantitative easing going forward. With this, it is probably going to be more sloppy and overall downward trading. Even if the market was to break above the 1.12 level, the 1.1250 level is more than likely going to cause resistance as well.

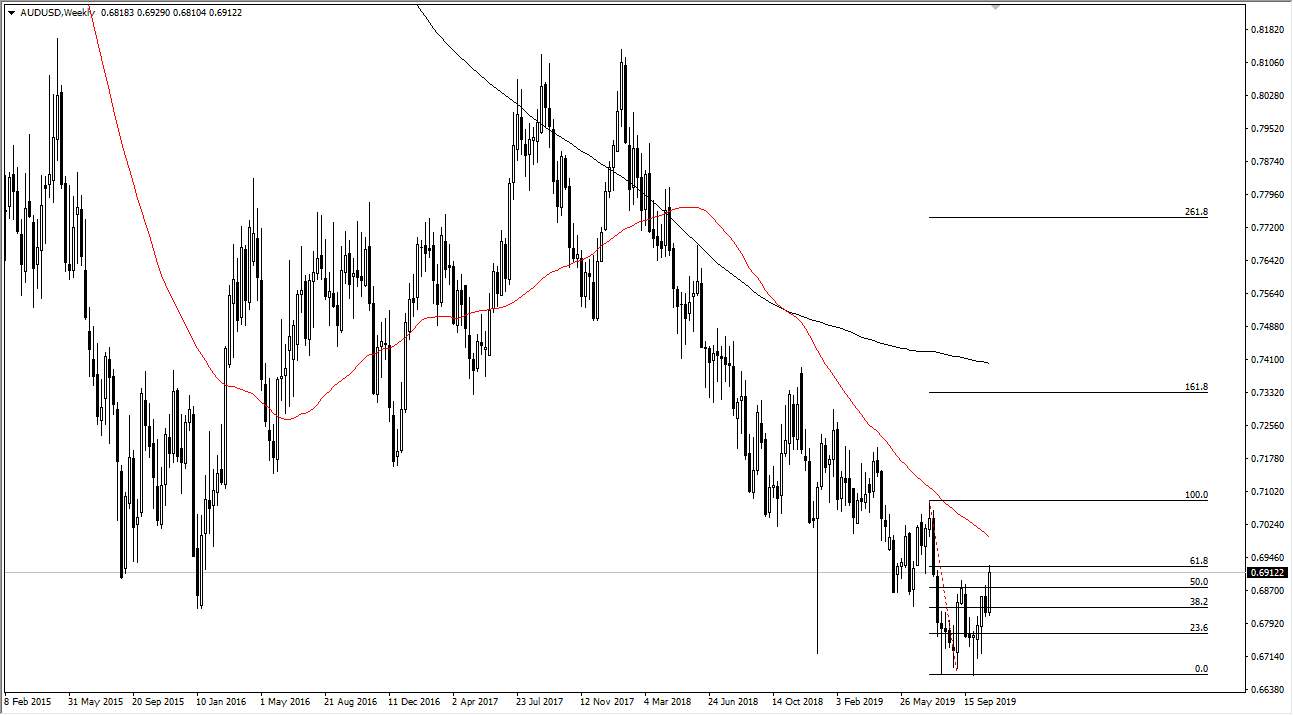

AUD/USD

The Australian dollar has rallied quite nicely during the week, testing the 0.69 level and the 61.8% Fibonacci level from the most recent selloff. At this point, it does look like it’s trying to break out, but I think we probably will see a short-term pullback between now and then before reaching towards the 0.71 level. That being said, remember that this pair is highly sensitive to the US/China trade noise, which seems to be all but never-ending.

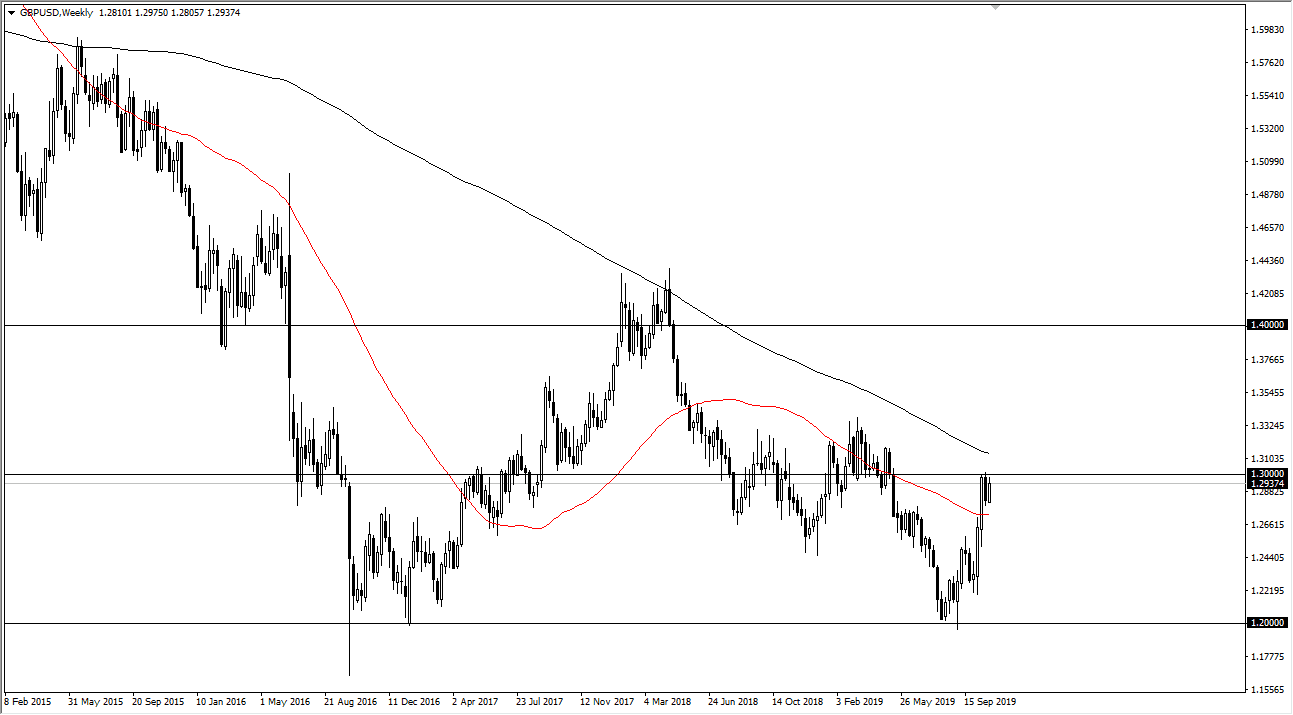

GBP/USD

The British pound has rallied again during the week as we continue to see a lot of trouble at the 1.30 level. There is a lot of noise above here extending all the way to the 1.33 level, so I think it’s can it take a certain amount of momentum building in order to break out to the upside. If the market does pull back, I would expect the more .27 level to offer support, and most certainly the 1.25 level do the same. I don’t like the idea of shorting this market, so therefore when it does fall, I look for buying opportunities, perhaps on shorter time frames as the specter of a “no deal Brexit” starting to fall by the wayside.

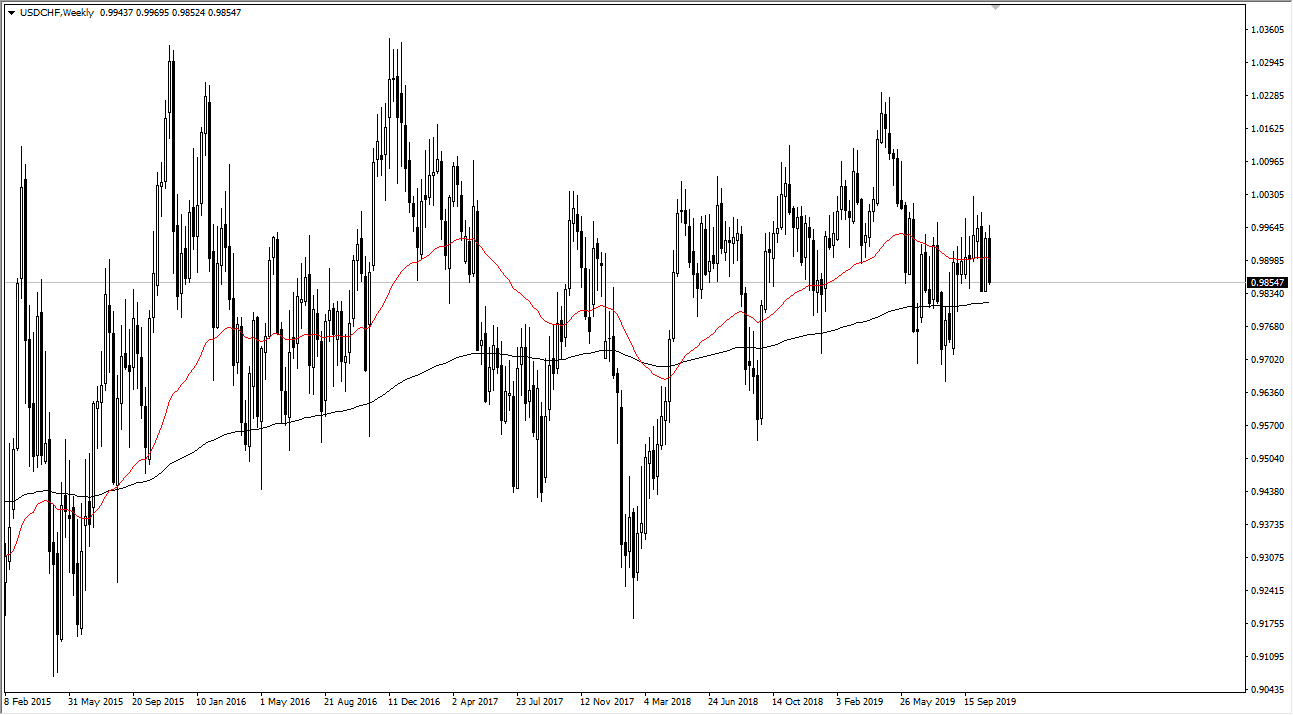

USD/CHF

The US dollar fell against the Swiss franc during most of the week, but as you can see, we have been shopping around quite a bit recently. The 200 week EMA is just below with the 50 week EMA slicing through the middle of the last several candlesticks. Both of these moving averages are relatively flat, so this tells me that it’s more than likely going to be a marketplace that continues to show more of the same sideways action. It looks as if the 0.98 level offer significant support, while the parity level offers significant resistance. I anticipate more of the same.