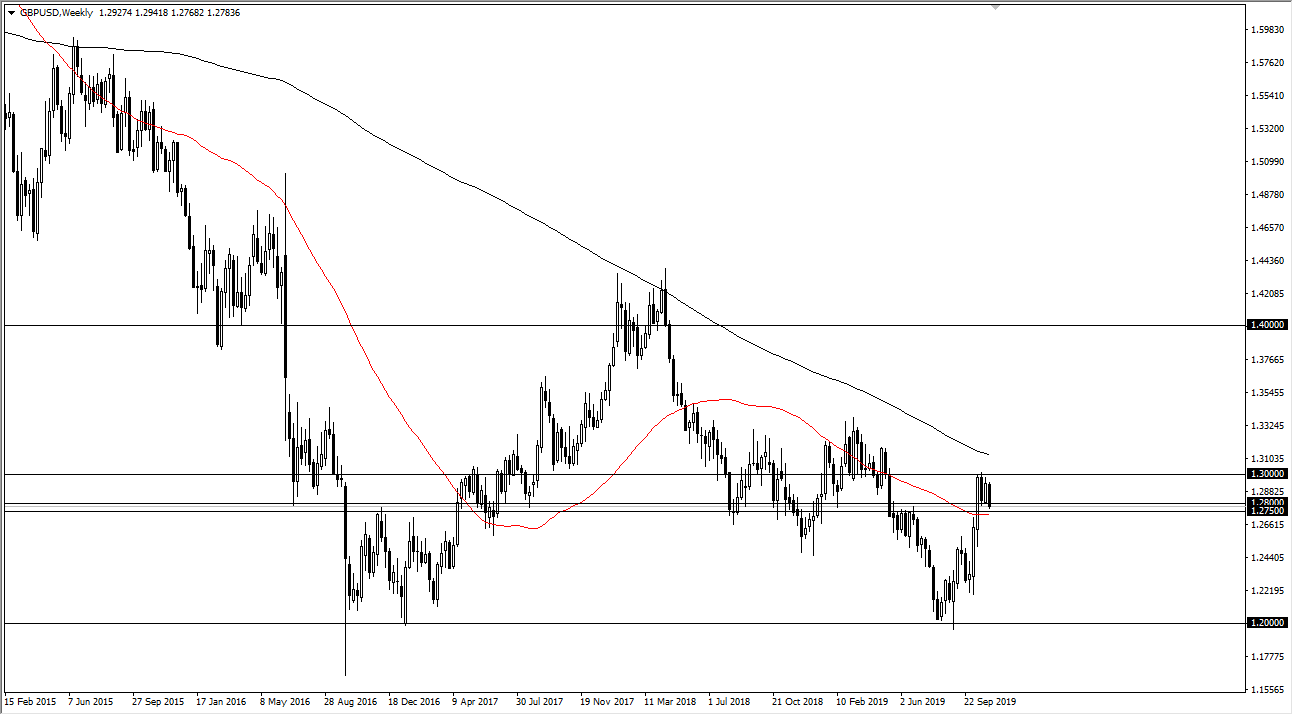

GBP/USD

The British pound spent the week falling but is presently forming a bit of a flagging pattern. It looks as if the 1.2750 level should offer support, especially now that the 50 week EMA is trading just below. At this point, the market looks likely to continue building a bit of a bullish flag, so it very well could break out to the upside. If the British pound were to break above the 1.30 level, then it sends this market much higher.

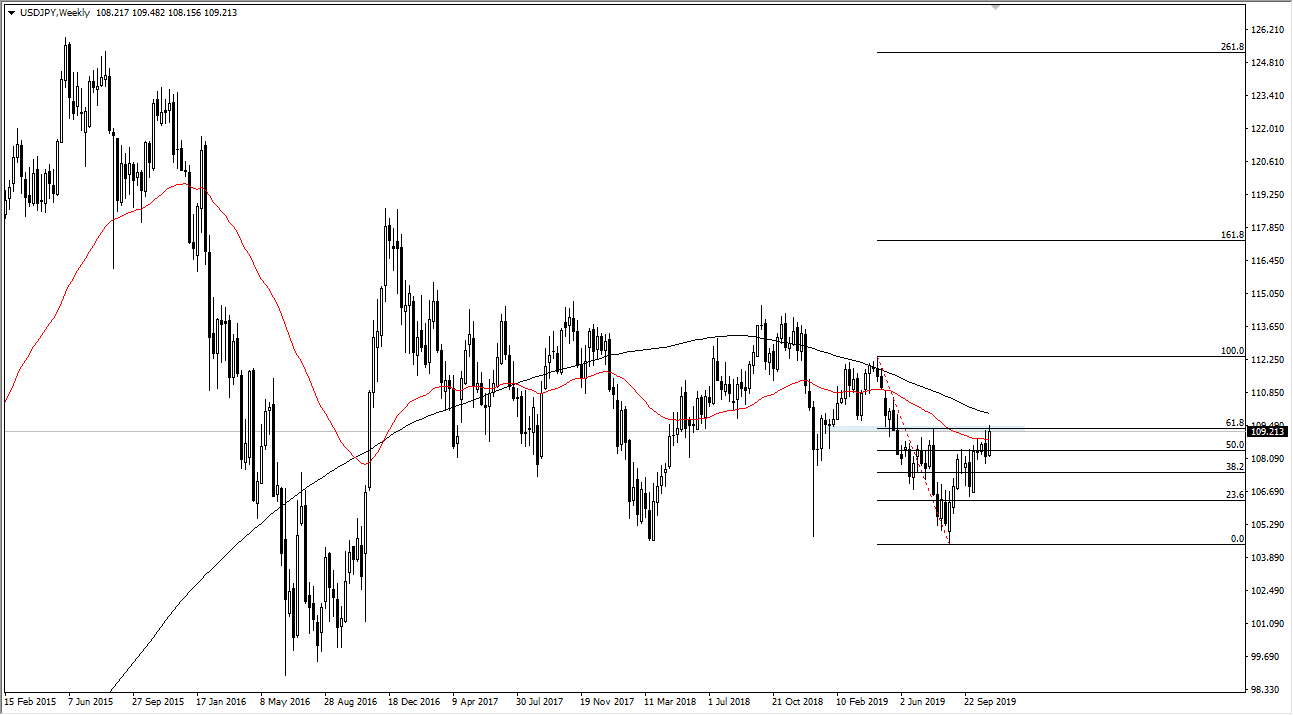

USD JPY

The US dollar has rallied significantly against the Japanese yen during the week, slamming into the 61.8% Fibonacci retracement level. That coincides with the ¥109.50 level that has a bit of a 50 PIP buffer extending to the ¥110 level. If we were to clear the ¥110 level though, the market more than likely will go to fill the gap at the ¥111 level, and then possibly the ¥112 level.

Ultimately, if the market were to pullback from here it’s likely that the traders will find plenty of support at the ¥108 level, as it is a bit more interesting and choppier on the shorter-term charts. Keep in mind that this pair will be highly sensitive to the US/China trade situation, rallying on good signs of conciliatory action, and falling on negativity.

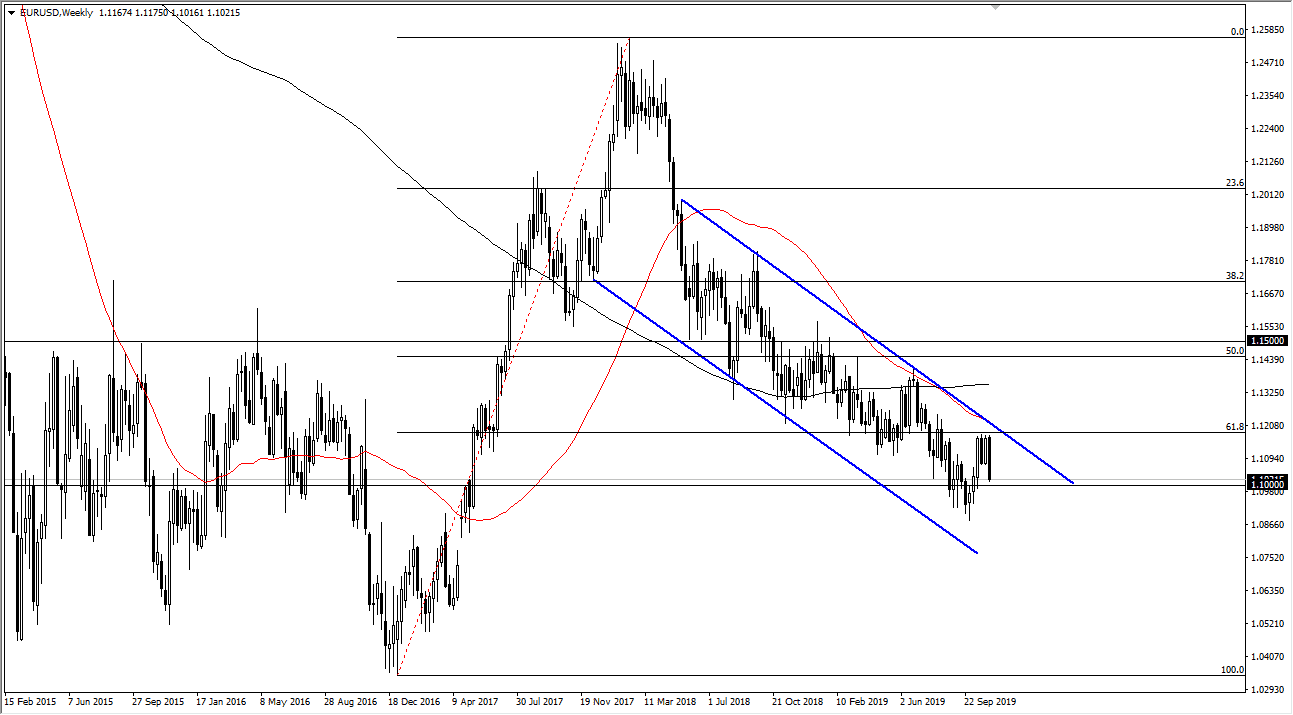

EUR/USD

The Euro has fallen rather hard during the week, and more importantly for me at least, has formed a “four high, with a lower close” formation. This means that the 1.12 level continues offer a lot of resistance, and the fact that we are broken down so hard, it’s likely that the market was likely to break down below the 1.10 level, perhaps the 1.09 level as well. This market has been in a descending channel, and as a result this overall trend looks very likely to continue. With the ECB loosening monetary policy, and the Federal Reserve sitting on the sidelines, fading short-term rallies and fresh lows will continue to be the best way to trade this market. I have no interest in buying.

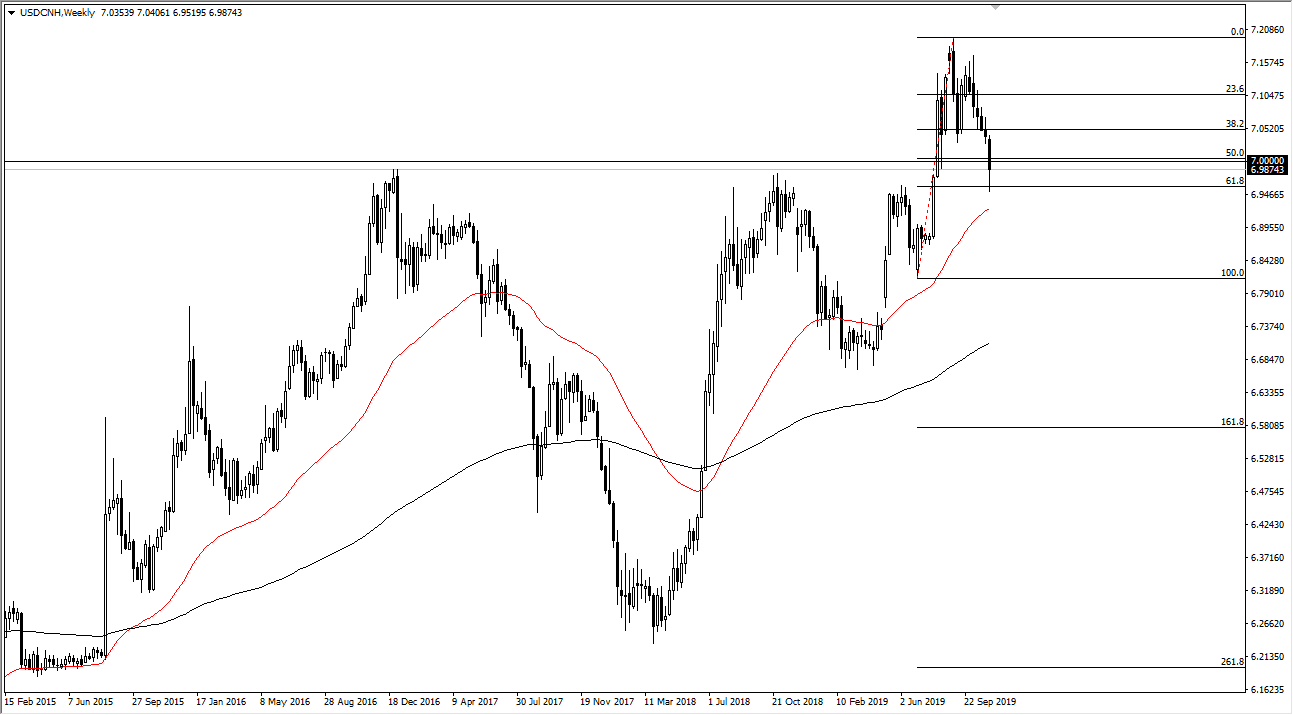

USD/CNH

The US dollar fell against the Chinese Yuan during the week, reaching down below the 7.0000 handle. Ultimately, this is a market that is very important, even if you don’t trade it. This is because it is a massive risk barometer, and at this point it looks as if the market is going to continue to test the overall area, which features this 6.95 handle which coincides nicely with the 61.8% Fibonacci retracement level. The fact that we have bounced from here it’s not a surprise as Donald Trump isn’t sure whether or not he’s ready to roll back tariffs, and thereby this could send the US dollar higher against the Chinese Yuan if the US/China trade situation continues to deteriorate. There had been serious hope during the week, and that’s part of what brought this pair down. However, on Friday we have seen a bit of a turnaround. At this point, it certainly looks as if the market is going to go higher if we can clear the 7.0000 level again.