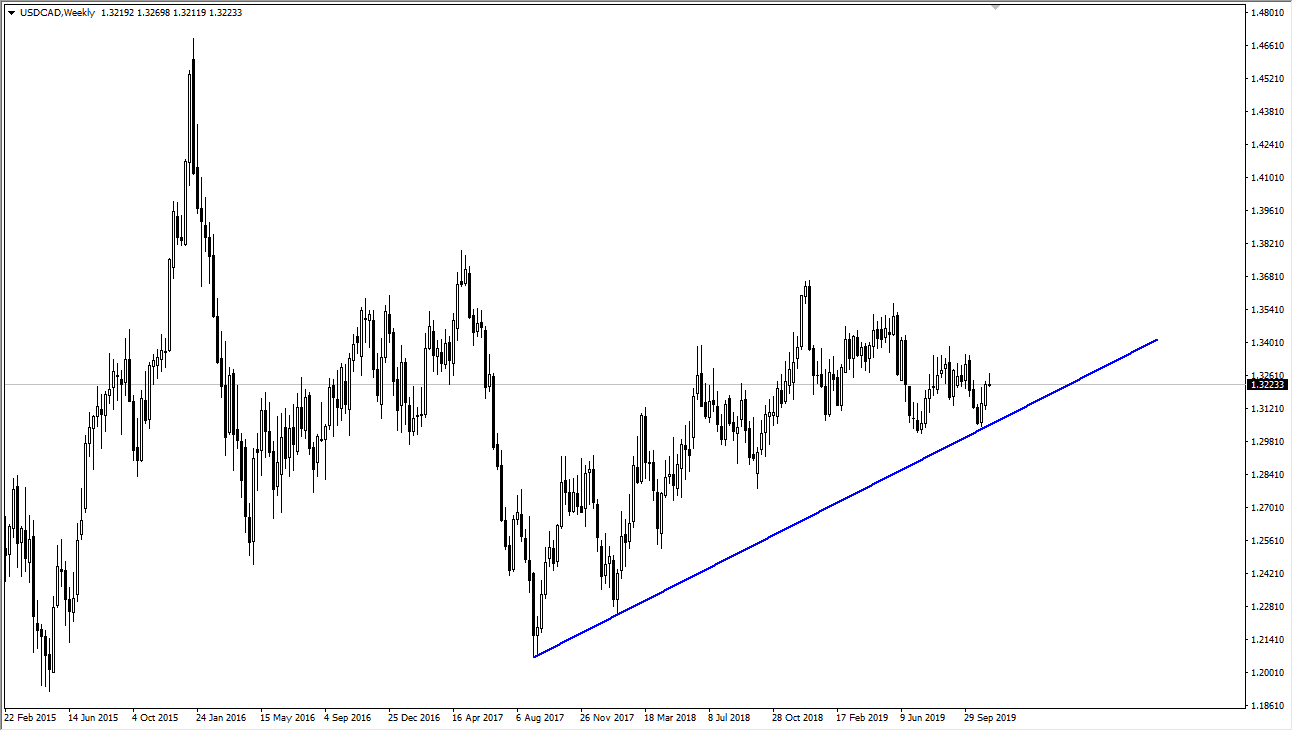

USD/CAD

The US dollar tried to rally against the Canadian dollar during the trading sessions that made up the week but gave back the gains to end up forming a bit of a shooting star. It looks as if we are going to continue to drive a bit lower and try to get down towards that uptrend line, and therefore it’s likely that this market shows a bit of negativity. I’m not looking for a major move, but I think somewhere around 80 pips lower would be reasonable.

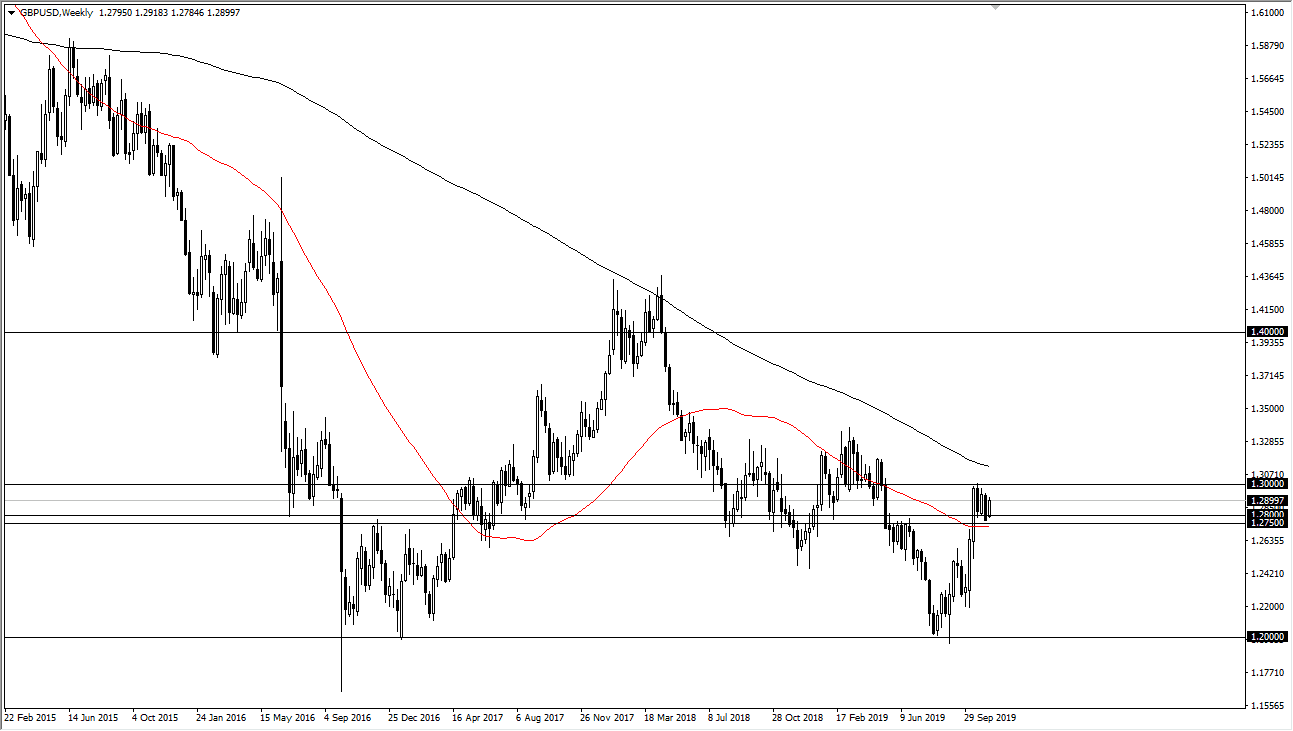

GBP/USD

This pair is going to continue to build on the flag that we have been working with for some time, and one of the worst kept secrets in the Forex world is that the British pound is trying to build up enough momentum to break out to the upside. If we can clear the 1.30 level, I would be a buyer of the British pound expecting a 300 bit move. Beyond that, if we pull back, I think that looking for signs of support on short-term charts should continue to offer buying opportunities based upon value as well.

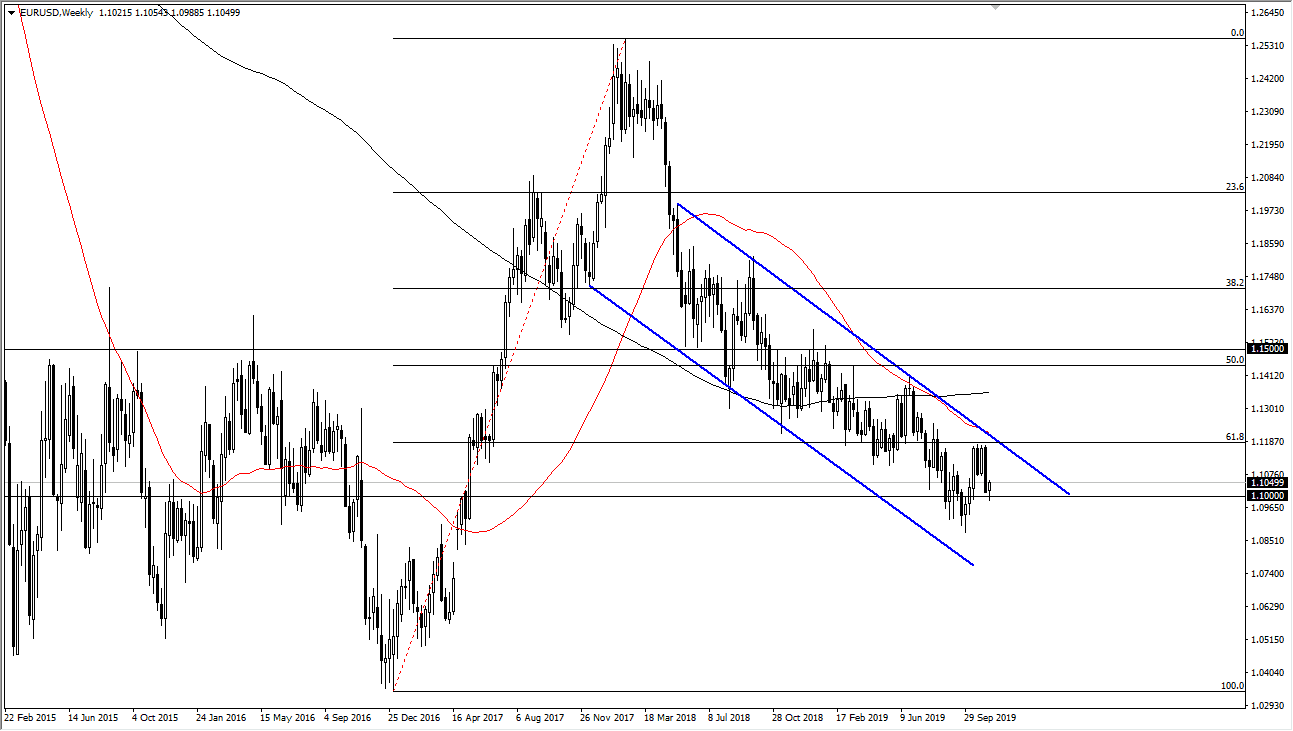

EUR/USD

The Euro broke down a little bit during the week but then turned around to show signs of life again. This pair has been very choppy for almost 3 years, so I think we are about to see a short-term balance that gets sold into and eventually breaks lower than this previous week’s action. I still favor shorting the Euro in general, but I also recognize that this is a short-term traders type of market and therefore it’s hard to hang on to anything for a significant amount of time.

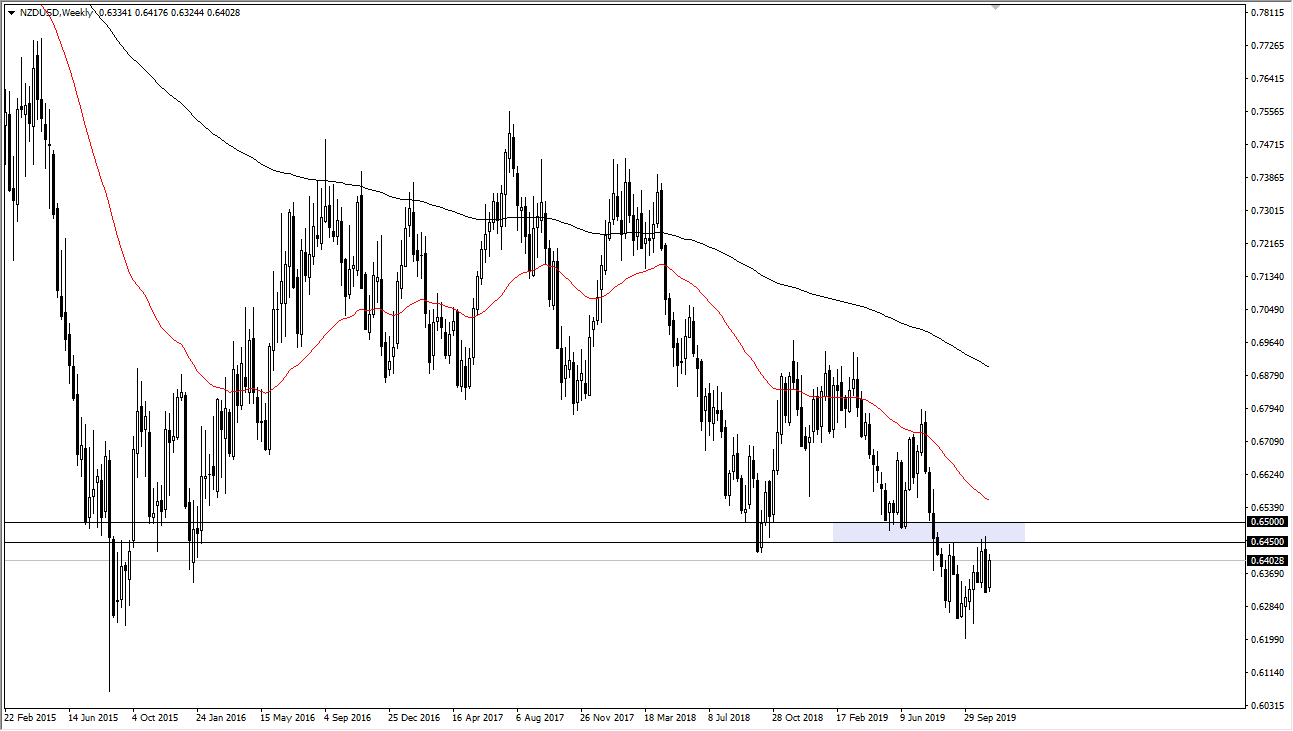

NZD/USD

The New Zealand dollar has been grinding back and forth for some time, and is at a historically important low level. If we can break above the 0.65 handle, it’s very likely that the New Zealand dollar will continue to go higher, although it isn’t going to be the easiest trade in the world. On the daily chart, we already have seen the market try to make “higher lows” and show the first signs of a reversal.