Gold markets have fallen a bit during the trading session on Friday, reaching down towards the $1460 level. The market has even more support just below at the $1450 level. This a market that is certainly in trouble, mainly because the US/China trade talks had gotten a little bit more optimistic, which works against the so-called “safety trade.”

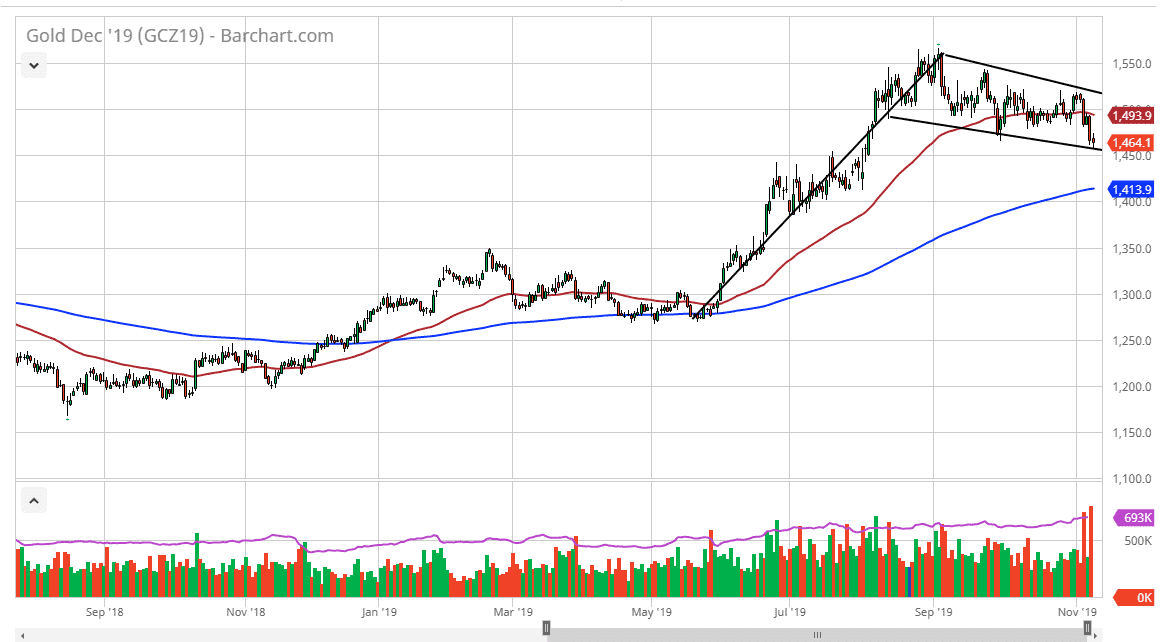

Looking at the chart, you can see that the 50 day EMA is above and curling lower, so that suggests that there are sellers coming back in again. At this point, rallies will probably run into trouble at the 50 day EMA, which could cause quite a bit of noise. Just above the 50 day EMA, we have the $1500 level and that should be something worth paying attention to as well as it is a large, round, psychologically significant figure. If we were to break above there, then it’s likely that we could go higher, perhaps trying to break above the downtrend line above and kicking off the bullish flag. If the bullish flag was to kick off to the upside, the market could very well reach towards the $1800 level given enough time. Ultimately, at this point in time it’s very likely that the market will make some type of larger and more important decision soon, as we are at a crucial crossroads.

The $1450 level should be supportive based upon the fact that it was the top of an ascending triangle, and if that gives way it’s probably going to signal that the gold rally is over, at least for the moment. If we break to the upside, it will be noisy, but it will probably be due to some type of very negative headline involving the United States and China. At this point, those headlines come in both directions, so this is a market that is going to continue to be held hostage by the latest twist or turn in that scenario. If the news comes out as good, gold markets will continue to drop. On the other hand, if we get some type of negativity coming out, that could send gold markets higher. Unfortunately, this can happen at any given moment so paying attention to the levels will be crucial if you choose to be involved in gold over the next several days as we are most certainly about due for a decision.