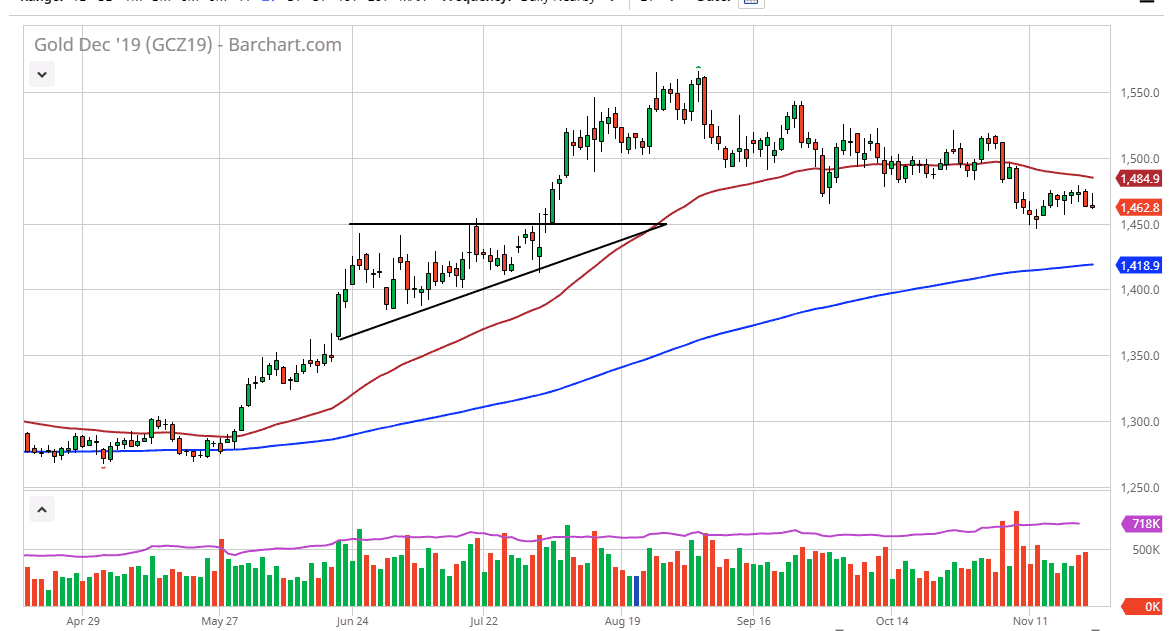

Gold markets initially tried to rally during the trading session on Friday but gave back the gains to end up forming a bit of a shooting star shaped candle. This was interesting, because there were signs of both “risk on” and “risk off” trading around the world. At this point, I think the gold markets are simply trying to build some type of base, and I think that base is just below the $1450 level.

That being said, it’s an area where we had seen a lot of resistance in the past, based upon the ascending triangle that was broken out of. At this point, the market is likely to continue to find buyers in that area based upon “market memory”, so having said that it’s likely that we will continue to see buyers, but if we were to break down below the $1450 level, the market then could go down to the 200 day EMA which is closer to the $1418 level. Importantly, this is a market that is going to be highly sensitive to the nonsense coming out of both Beijing and Washington, as the US/China trade war continues to play havoc with risk appetite.

If we were to break above the top of the candlestick for the Friday session, meaning basically the $1475 level, the market could take off to the 50 day EMA about $10 above, and then eventually towards the $1500 level. That’s an area that will of course attract a lot of psychological and structural interest, but if we were to break out above there it’s likely that the market could go looking towards the $1520 level after that. With this, the market is very likely to continue to be very choppy and erratic, so it’s more or less a short-term day trading environment that we are in right now. All things being equal, this is a market that need some type of catalyst to get moving in one direction or another. When looked at from a longer-term standpoint, the market is still in a bullish mode, but we are most certainly pressing the issue in this area, so if we were to break down below the 200 day EMA it could change a lot of different things. With everything that’s going on between the United States and China, it would not be a huge surprise to see an impulsive candle relatively soon. Until then, back-and-forth trading is the way to go.