The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Monday, but then broke back down to slice through the 200 day EMA again. This is a market that has a lot of noise involved in it, which makes quite a bit of sense considering that we have multiple issues right now involving the price of crude oil. After all, OPEC is expected to do something about production cuts during the December meeting, as the market has been so soft for crude oil. However, it’s not as simple as cutting production to boost pricing because quite frankly most of the issues out there are external, and out of the hands of OPEC.

The United States pumping out more oil than ever is not helping the situation, and as a result it’s very likely that the market will continue to see significant problems with the supply. Beyond that, we are starting to get reports of various countries around the world finding large deposits of crude oil. In the last couple of weeks, we had heard reports that the Iranians have found a new field that should contain somewhere around 52 billion barrels.

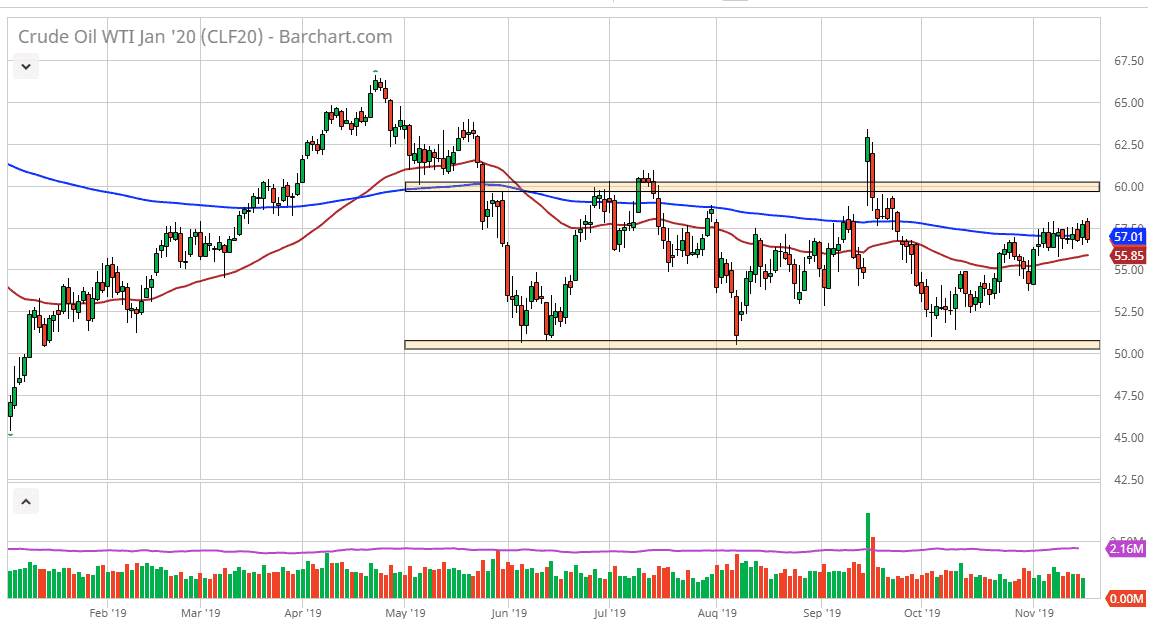

Looking at this chart, we are essentially just chopping back and forth, and I think that’s going to be a big problem. If you are a longer-term trader, you are going to continue to struggle but I think if you look at shorter-term charts you probably have an opportunity to make some money here. After all, the market has been hovering around the 200 day EMA for quite some time and until we get some type of clarity it’s difficult to imagine a scenario where it’s easy to hang on to a bigger position or one for longer-term move. At this point, the market will probably find support at the red 50 day EMA underneath which is currently trading just below the $56 level. Alternately, if we can break above the top of the candlestick for the trading session it’s likely that the market will then go to the $60 level above. At this point, it’s probably best to trade small positions on something smaller like a 15 minute chart in order to pick up the “reversion to the mean” type of situation that this market seems to be stuck in at the moment.