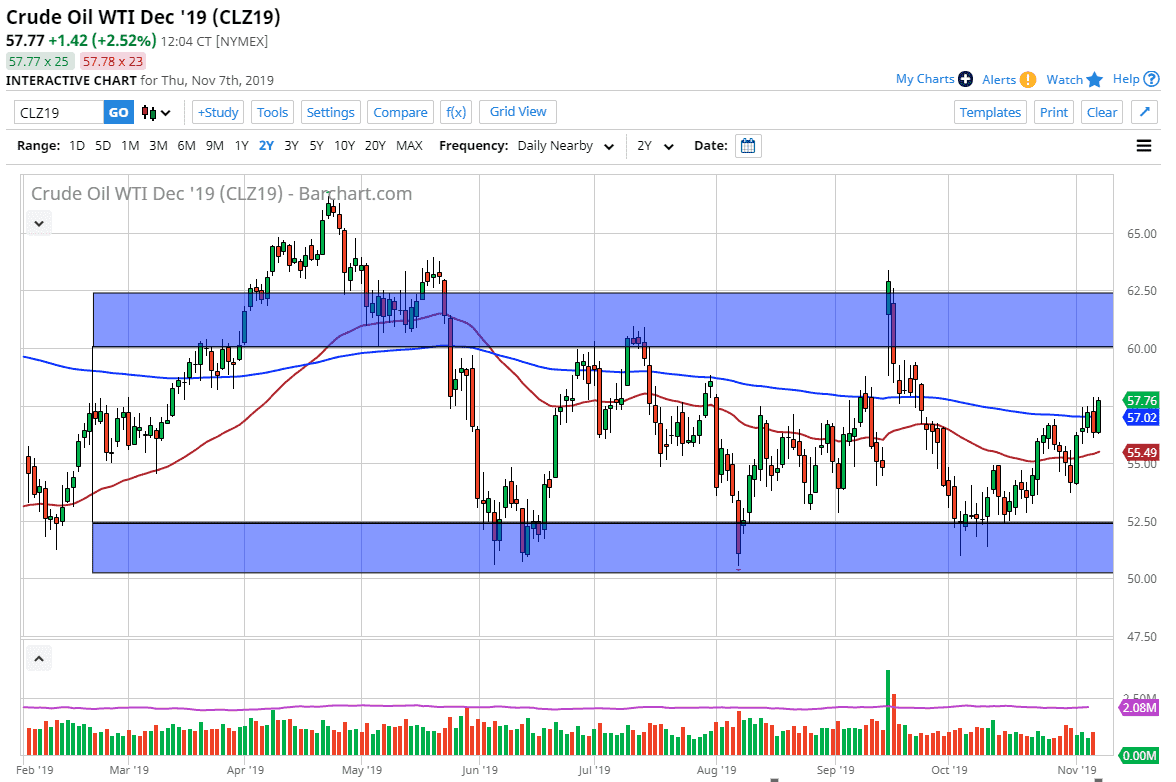

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Thursday, as we have recovered all of the losses from the very bearish Wednesday session. Because of this, the market is very likely to continue going higher, perhaps breaking above the $58 level in the short term. The 200 day EMA sits in the middle the candlestick, and now that we are closing towards the top of the range for the day, then it makes quite a bit of sense that we should see some continuation. However, the market has been very noisy as of late so there is a specific way that you should be trading this market.

Looking for short-term charts that show signs of pullbacks and then bouncing is probably the best way to go point forward. At this point, it’s very likely that the market will find a bit of a floor underneath at the $56 level, which is essentially what has offered as support over the last several days. At this point, I like the idea of buying pullbacks on the short-term charts in order to pick up little bits and pieces on the way higher. However, this is a market that will continue to be very noisy so you should be careful but your position size.

At this point, selling isn’t much of a thought, because we have so much in the way of bullish pressure. Ultimately, the market has been grinding higher for some time now, and now people are starting to factor in the idea that OPEC may start cutting production in the future. However, there are signs that may not come to be, so at this point it’s a temporary factor more than anything else. On the other side though, we have a certain amount of oversupply and therefore I think it’s only a matter of time before the sellers come back in. This would be at the top of the rectangle that I have marked on the chart, especially near the $60 level. At this point, a sign of exhaustion in that area would probably be a selling opportunity. Overall though, I think that we will go up there to test that level yet again. If we were to break above the $62.50 level, then it would change everything, but I just don’t see that happening anytime soon.