The Australian dollar fell a bit during the trading session on Thursday, reaching down towards the bottom of the Wednesday candlestick as retail sales in Australia fell flat. Because of this, that was a bit of a negative fundamental issue but at the end of the day nobody cares about the Australian economy, what they care about is the Chinese economy. The Chinese economy dictates how many raw materials China will be buying from Australia, and as a result the Australian dollar is quite often used as a proxy for China. With the Chinese Communist Party in power, most financial assets in the mainland are either manipulated or highly restricted, so this is the easiest way to play the China in an open and transparent market.

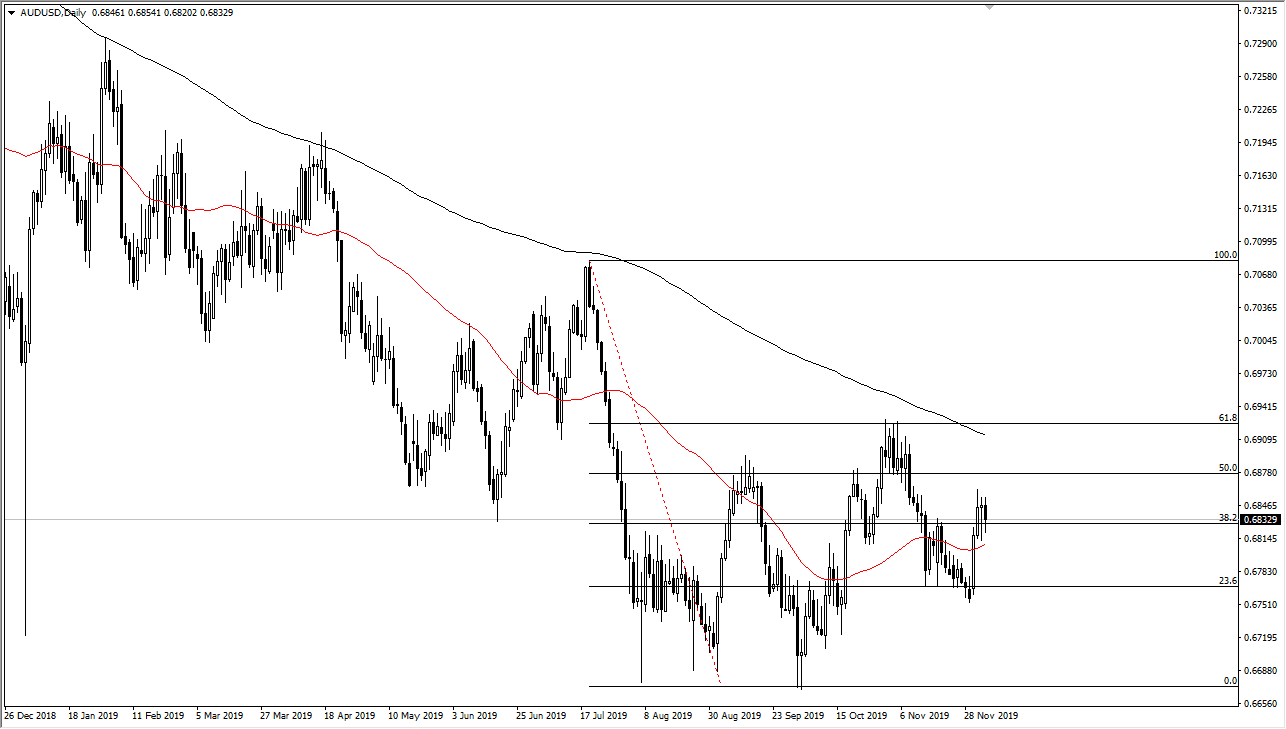

The 50 day EMA underneath has offered support the last couple of days, and that was no different on Thursday. As the jobs number comes out at 830 in the morning on Friday in New York, there will probably be some noise in the currency market. Look at pullbacks as potential buying opportunities as long as there is some hope about a “phase 1 deal” being implemented between the United States and China. The theory of course is that if the trade deal gets signed, that will release some of the tariffs on the Chinese, and drive up more demand for global trade, especially between the United States and China itself. If that is the case, then China will need copper, aluminum, gold, and many other hard materials that Australia is a major exporter of.

To the upside I see the 200 day EMA as causing some issues closer to the 0.69 level, and of course there is the 61.8% Fibonacci retracement level just above there. That is an area that will probably cause some issues, but if we break above there then the trend will have changed. I don’t think we get above there today, but I do think that we are going to continue to see buyers come in and pick up bits of value in the Aussie as it occurs. Buying on the dips continues to be the way I play it, and I would also point out that there is a bit of a “double bottom” down at the 0.67 handle that was followed by a “higher low” at the 0.6775 level. We are in the process of trying to turn things around and now all we need is a little bit of follow-through.