Gold gains stalled around the $1484 resistance, before settling around $1477 at the time of writing, after Bloomberg reported that the trade agreement between the United States of America and China is still possible before the 15th of December, when more tariffs are set to be implemented on the remaining China's products to the US, therefore, China's overall imports will be under US tariffs, which were the result of a chronic trade conflict between the world's two largest economies that is going on for months, and weakened the global economic outlook.

China's Caixin Composite PMI rose to a seven-month high at 53.5 (from 51.1). The manufacturing PMI rose to 51.8 from 51.7. Also, the Services PMI rose to 53.2 from 52.0. This combination is largely in line with ideas that the external sector (manufacturing) has been hit by the trade war with the US, while some parts of the local economy (services) are beginning to improve.

India is competing with the UK and France this year to be the world's fifth largest economy. However, the Indian economy is slowing and the Reserve Bank of India is likely to cut interest rates for the sixth time this year. This year's repo rate began at 6.5%. It is now at 5.15%. China's economic slowdown warrants attention. However, India, with a completely different political system and economic structure, is suffering a sharp decline despite price cuts, taxes and assistance to troubled companies. Investors were surprised that the Indian economy saw a 4.5% growth over last year in the third quarter, the first reading below the 5% rate in six years.

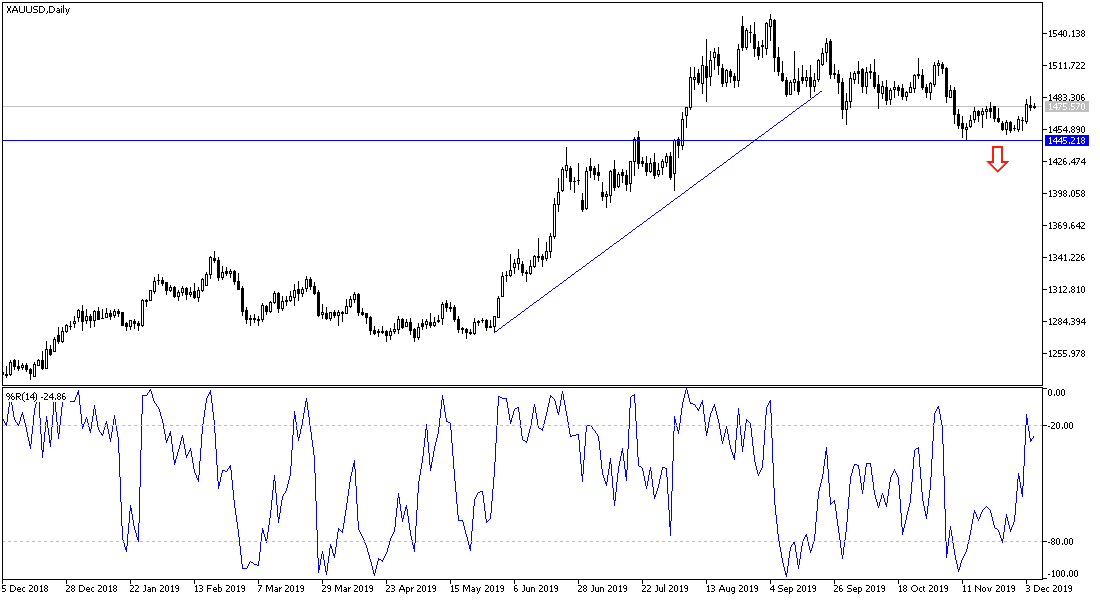

According to the technical analysis of gold: I continue to keep my technical view that the stability of gold above the $1480 resistance will pave the way for a move towards the $1500 psychological resistance very soon, which may turn the overall trend altogether. In return, if a US agreement with China was announced before Dec. 15, then the price of the yellow metal would fall to support levels at 1468, 1455 and 1440 as a first stage. Overall I still prefer to buy gold from every bearish level.

As for the economic calendar data: Gold, will react to renewed trade and political tensions around the world, as will as the release of Eurozone data on GDP, retail sales, and the US Unemployment Claims, Trade Balance and Factory Orders.