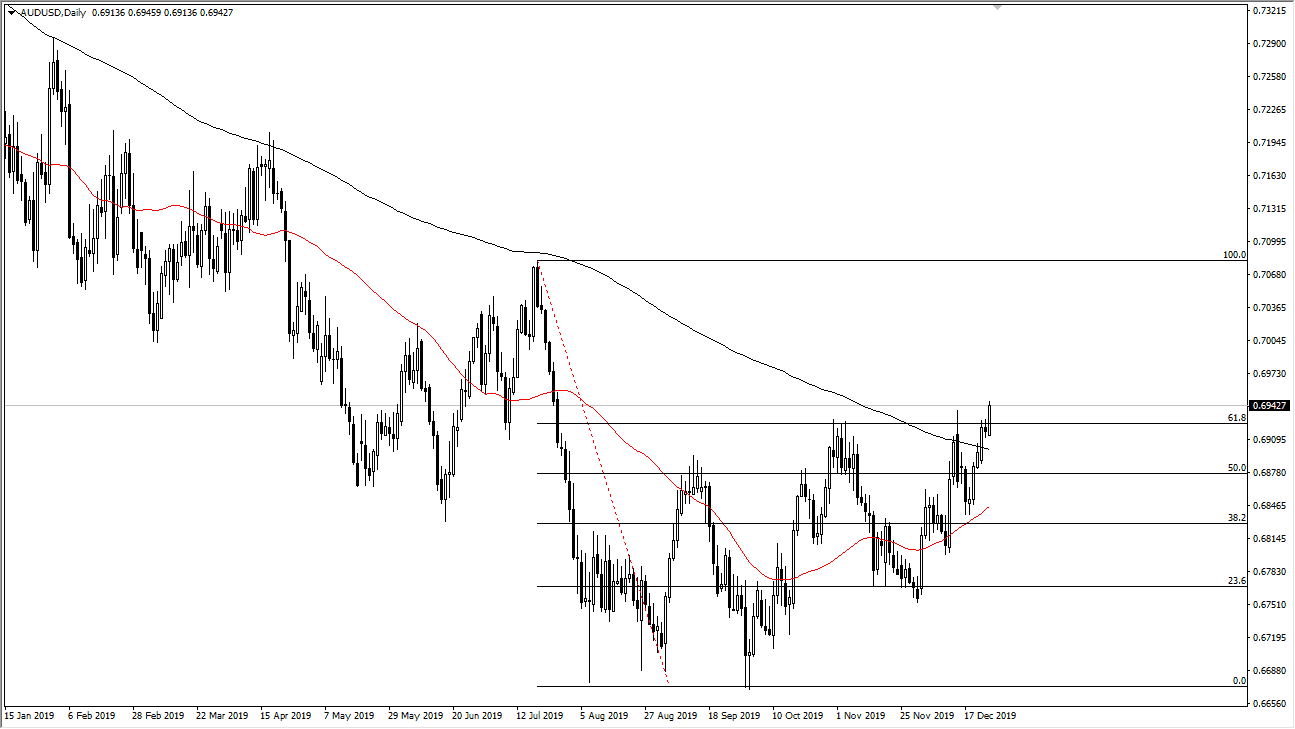

The Australian dollar has rallied a bit during the trading session on Thursday, breaking above the recent high and confirming that we are in fact ready to find buyers given enough time. Short-term pullback should be buying opportunities as we are clearly above the 200 day EMA. At this point, the market is likely to continue reaching towards the upside and now that the 61.8% Fibonacci retracement level has been cleared, it’s very likely that we will go looking towards the 100% Fibonacci retracement level, closer to the 0.71 handle.

On pullbacks, I would anticipate that the Australian dollar will continue to find buyers, all the way down to the 200 day EMA which is currently right around the 0.69 handle. Ultimately, if the market was to break down through there, then I believe that the 50 day EMA will come into the picture, as it is sloping to the upside. All things being equal though, I believe that the Australian dollar is trying to bottom out for the longer-term, and therefore if we can avoid making a “lower low”, I think that we will have seen the absolute bottom for the Australian dollar this cycle. That makes quite a bit of sense if you think about it, as the United States and China are starting to get along a little bit better, and that of course should drive more money into Australia. Beyond that, the copper markets are showing signs of strength, and therefore it makes sense that the Australian dollar will continue to gain because of the process of providing China quite a bit of the raw materials needed to not only do construction, but also that massive export machine on the eastern coast. Ultimately, Australia is locked hand-in-hand with the Chinese, and if the Chinese situation gets better, so will Australia’s.