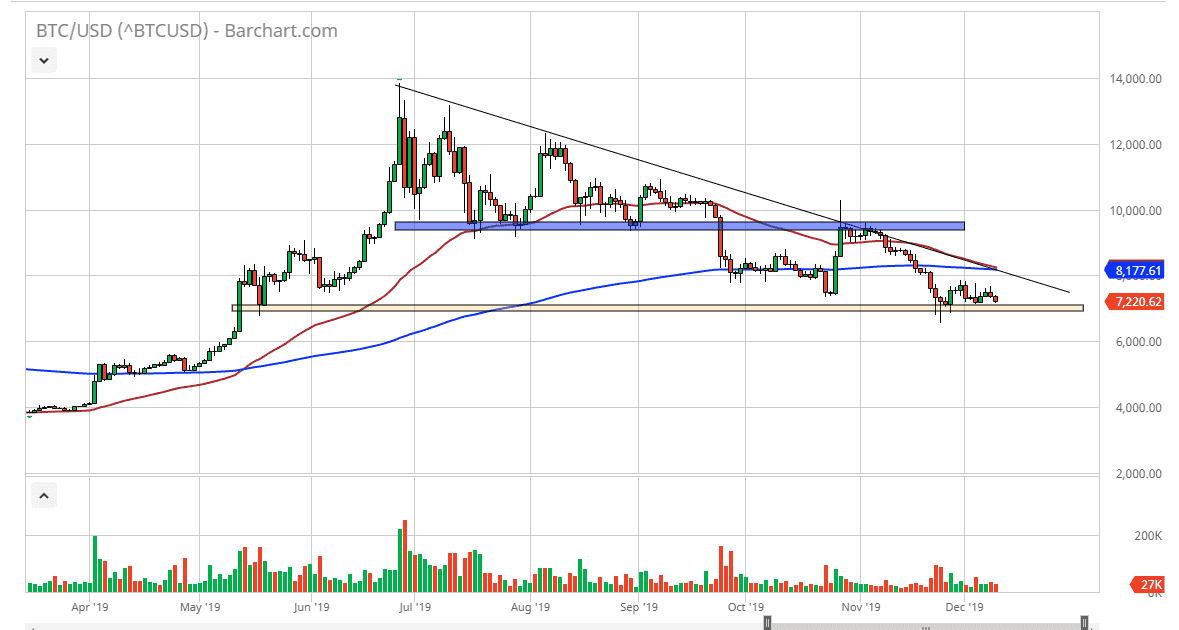

Bitcoin markets have drifted a little bit lower during the trading session on Tuesday, showing signs that we are ready to continue to go much lower. Ultimately, it looks as if the market is still ready to go lower, breaking below the $7000 level. That is of course a large, round, psychologically significant figure, and it should attract a lot of attention. Quite frankly, Bitcoin can’t get out of its own way and I don’t think that there’s any real hope of a bounce. Even if we do rally from here, it’s very unlikely that we continue to go much higher for the longer-term.

The 50 day EMA is crossing the 200 day EMA currently, and that shows a “death cross” starting to happen. That of course is a longer-term negative sign, as we cross right at a major downtrend line. At this point, it looks very likely that rallies will continue to find plenty of sellers above, and quite frankly that’s been the best way to trade Bitcoin for months now. Ultimately, the market should continue to go to the downside, perhaps as low as $4800 based upon the ascending triangle that was broken down from previous action, and it looks as if we are ready to make that move here soon.

At this point, a break down below the $7000 level on a daily close signifies that we are ready to go much lower. Until then, I think it’s simply a matter of fading rallies as Bitcoin shows no signs of taking off to the upside. Looking at this chart, there is nothing good about it and I believe at this point Bitcoin is suffering from the one simple fact that nobody is truly using it. Yes, there are uses occasionally in various countries around the world but at the end of the day it’s been a huge bubble for years and the reality that there hasn’t been a consistent use of block chain for the last decade, and quite frankly this promising technology seems to be more of a solution looking for a problem. At this point, market participants continue to use this as a speculative market more than anything else, and until the price of Bitcoin stabilizes, it won’t be able to be used as money. At this point, selling Bitcoin on rallies and breakdowns both make plenty of sense. Buying is all but impossible until we get a complete change of attitude.