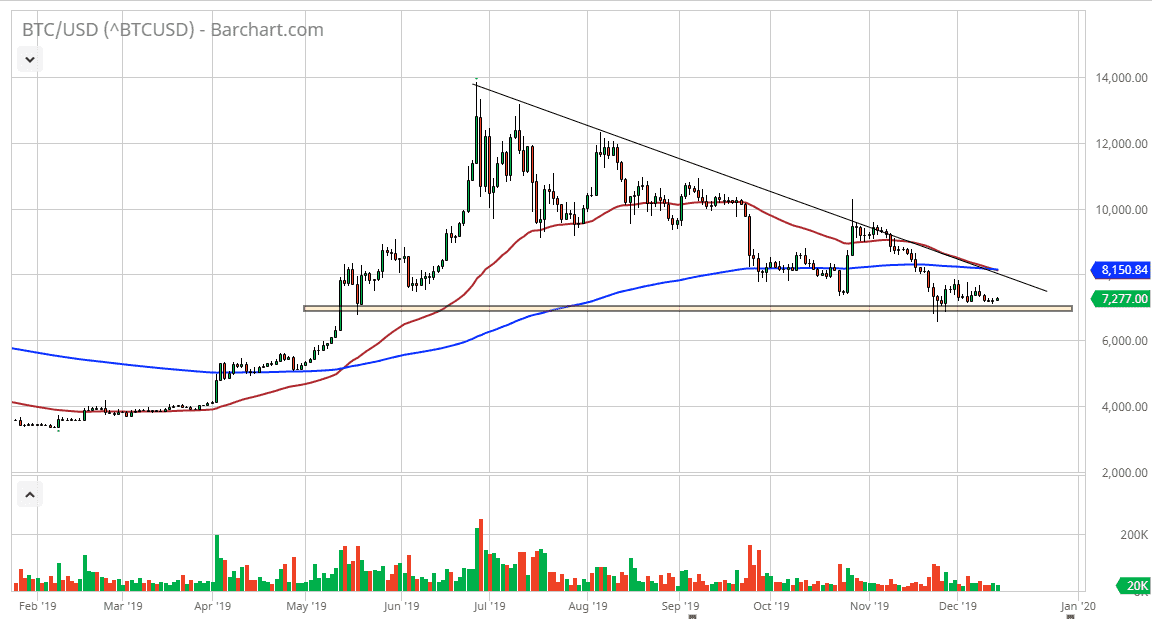

Bitcoin markets did almost nothing again during the trading session on Thursday as we flounder around the $7200 level. At this point, I believe that the 7000 level will be extraordinarily important, and if we can break down below there it’s likely that we will open the floodgates to the downside. Based upon a descending triangle above, the market is scheduled to go down to the $4800 level given enough time.

From that descending triangle, we had broken through support at near the $10,000 level, and then fell to just above where we are now before bouncing towards the $10,000 level again. We found sellers there and we have continued to go lower. Simultaneously, we have the 50 day EMA crossing below the 200 day EMA, the so-called “death cross.” The downtrend line that meets with those moving averages makes for an argument to the downside as well, so therefore I think there are a whole host of technical factors out there stacking up to the negative side. Having said that, we could get a short-term bounce but that short-term bounce for my money is probably best faded.

Otherwise, if we were to break down below the $7000 level, we will eventually break down towards that $4800 level but there are a couple of different places that could come into play as potential support. For example, the $5000 level will attract a lot of attention as it is a large, round, psychologically significant figure. You can also make an argument for $6000 being supportive as well, as it is a large, round, psychologically significant figure also. Ultimately, this is a market that continues to go lower over the longer term because nobody is interested in Bitcoin at this point. Volumes are anemic yet again, and adoption just isn’t becoming a reality.

10 years have gone by and use of block chain technology is still extraordinarily limited. Bitcoin is a common way to play the underlying block chain, and as it’s not being used on a widespread basis, I believe that Bitcoin will end up lower yet again. If you look at historical charts for Bitcoin, the selloffs tend to be horrific as those who purchase it at low levels tend to leave retail traders holding the bag after a super spike. I think at the end of the day this will end up being the same situation, whereas soon as the idea of Bitcoin riches creep back into the media, that’s when the holders transfer the asset over to the “dumb money.”