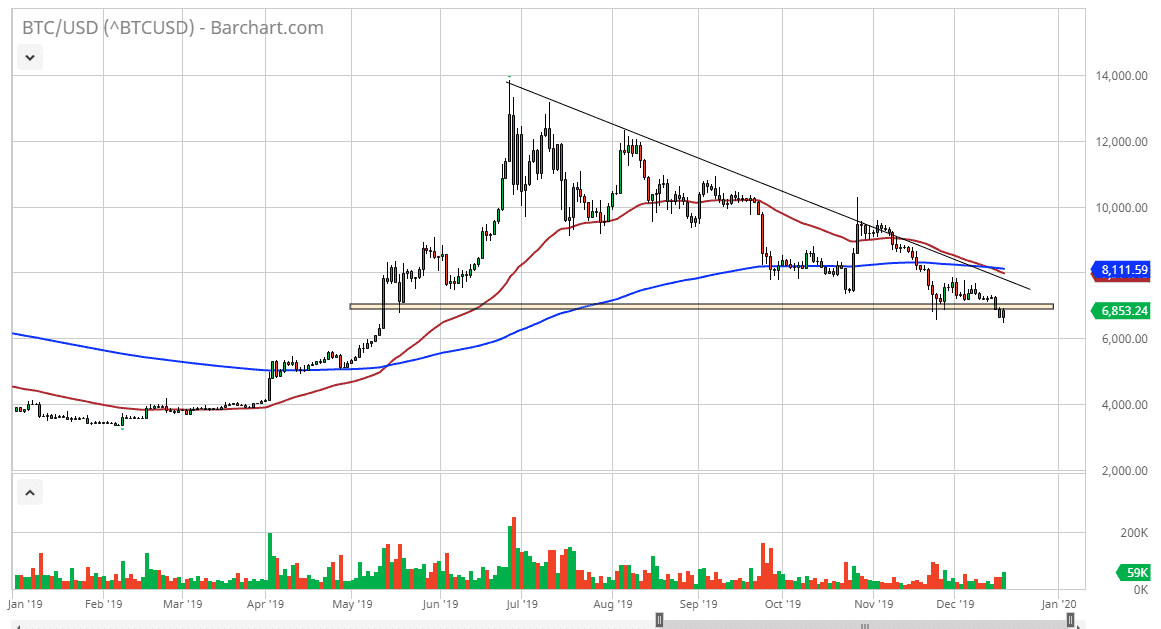

Bitcoin markets initially pulled back a bit during the trading session on Wednesday, but then turned around to show signs of strength. By doing so, it is retesting the area that we have just broken through, and now it looks as if a little bit of “market memory” looks to be coming into focus. Remember, “market memory” is simply the tendency of support to become resistance later on and vice versa.

Looking at this chart, you can see that the market continues to break down and we have recently had the “death cross” when the 50 day EMA is breaking down below the 200 day EMA. That is just above the downtrend line that continues offer a lot of resistance, so quite frankly at this point in time I think that Bitcoin will continue to offer selling opportunities on signs of exhaustion. Ultimately, this is a market that I think continues to see a lot of negative pressure upon it. After all, even though they are going to see the halving in May 2020, quite frankly there is no adoption in general. Bitcoin has basically been one bubble after another, and it seems as if what happens is that as soon as everybody gets excited, the holders of Bitcoin from lower prices start dumping into the market. In that way, it’s very much like a “pump and dump” scheme.

Adding more concerning is the Plus Token scandal coming out of China. This was a massive billion dollar Ponzi scheme involving Bitcoin, and it looks as if there are still 20,000 Bitcoins out there that need to be liquidated from this scam, as the Chinese government continues to deal with that situation. There have been six people arrested for this, but overall, it’s very likely that the downward pressure will continue just from that simple liquidation. Quite frankly, if this market rallies enough it will bring in a ton of fresh selling. I’m looking for signs of exhaustion above the take advantage of what is an obvious downtrend and breaking below the bottom of the candlestick for the trading session on Wednesday will also bring in fresh selling. All things being equal, the market is one that should only be sold and not barred, and quite frankly at this point we would need to recapture the 200 day EMA at the very least to start thinking about going long, and even then, I’d be very leery of doing so.