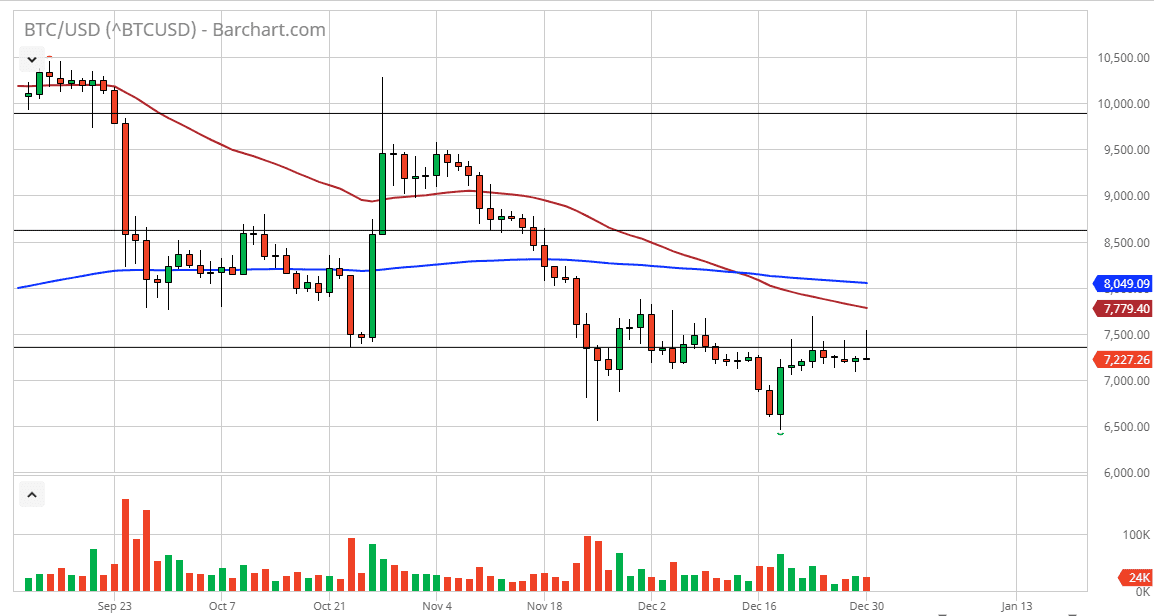

Bitcoin has rallied a bit during the trading session on Monday, breaking above the $7250 level and even reaching above the $7500 level initially before pulling back and showing signs of exhaustion. The candlestick looks very much like one that is going to form a bit of a shooting star, and that is of course another negative sign. This is a market that has been in a downtrend for some time, and now that we are getting close to the 50 day EMA it’s likely that there will be a longer-term sellers jumping in.

Bitcoin has struggled over the last several months, and at this point I think that we saw further to go based upon longer-term analysis, not the least of which was the descending triangle above that aims to reach down towards the $4800 level. Granted, that is still quite a way from here, but we have seen massive selloff like that in bitcoin before. This would be more of the same, and at this point I think that there are plenty of traders out there willing to sell into any signs of strength.

I realize that there is the halving coming in May, but most people don’t seem to care. Bitcoin is not been adopted so therefore there is only a certain amount of value with the coin itself. It can’t be used as money it simply isn’t stable enough quite yet. If it ever is to be used as a currency for any significant amount of volume, it’s probably years down the road as we would need to see stability. After all, you can’t accept payments with a currency that can lose 20% of its value and just a few short trading sessions. You can’t do business that way, and that is going to continue to be one of the major issues dogging Bitcoin.

From a technical standpoint, if we can break above the 50 day EMA and then the 200 day EMA at the $8000 level, then it should send this market much higher. At this point, the market will have changed the attitude drastically, but it seems very unlikely considering that we have been in a major downtrend for several months. The $6500 level underneath should offer support, and of breaking of that level of course is very bearish and continues the overall beat down that Bitcoin has seen for some time.