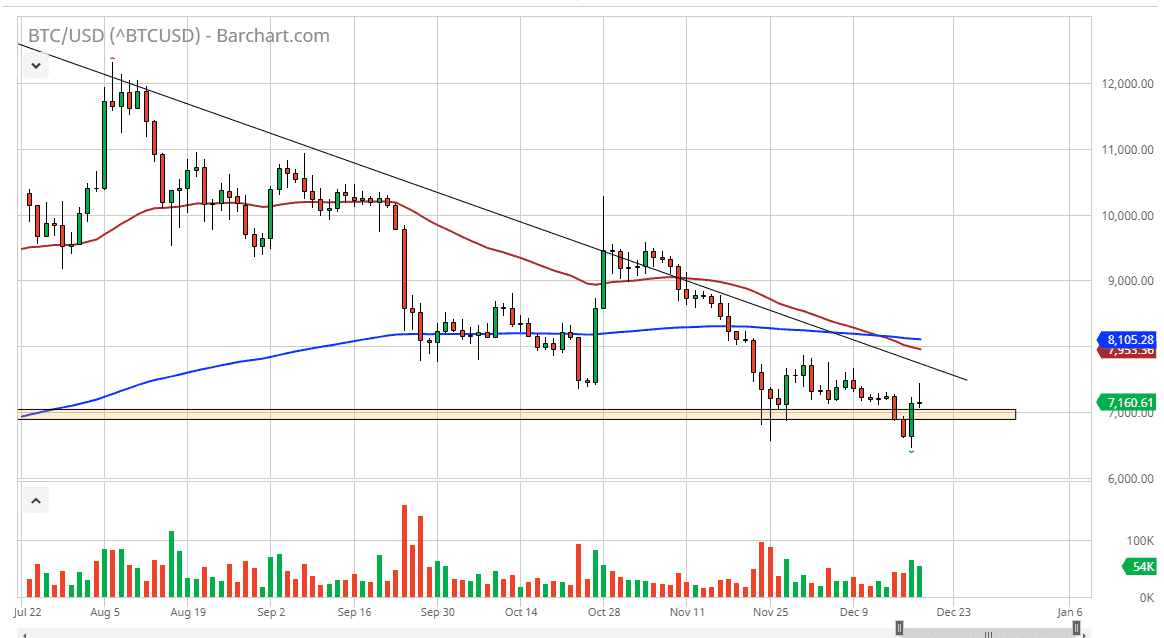

Bitcoin has tried to rally a bit during the trading session Thursday but has given back all of the gains in order to form a massive shooting star. The shooting star of course is a very negative sign and considering that we are at the very bottom of the overall trading range that we have been in for some time, it’s likely that we are going to continue to rollover from here. On a breakdown below the $7000 level it’s likely that fresh money will come back into short the Bitcoin market. After all, crypto markets continue to struggle and it’s likely that we see more of the same going forward.

Ultimately, if the market were to break above the top of the shooting star would be a very bullish sign, but there are a few other resistance barriers that will come into play. The downtrend line of course is something that should be paid attention to, and that of course the moving averages that have recently crossed suggests that we are going to continue to go lower. The 50 day EMA is going to offer a significant amount of resistance as well.

All things being equal it’s very likely that this market continues to reach towards the $6000 level, and then eventually the $4800 level as it has been my target for some time. By breaking down below that descending triangle above, it measures for a move to that level and we have yet to hit it, so I do believe that it’s only a matter of time before we get more momentum to the downside. This is something that we are seeing all over the crypto markets, and if Bitcoin cannot rally, it’s very unlikely that any of the others will for a significant amount of time either.

If we were to break above the 200 day EMA at the $8100 level, then I could consider buying Bitcoin, but it seems to be very unlikely. If we were to break above there, then the market is likely to go looking towards the $9000 level next. At this point I think we continue to short this market every time it rallies, and the candlestick for the trading session certainly suggests that we are about to see again in spades. I think pressure is building to the downside and it’s likely that we continue lower through the holidays.