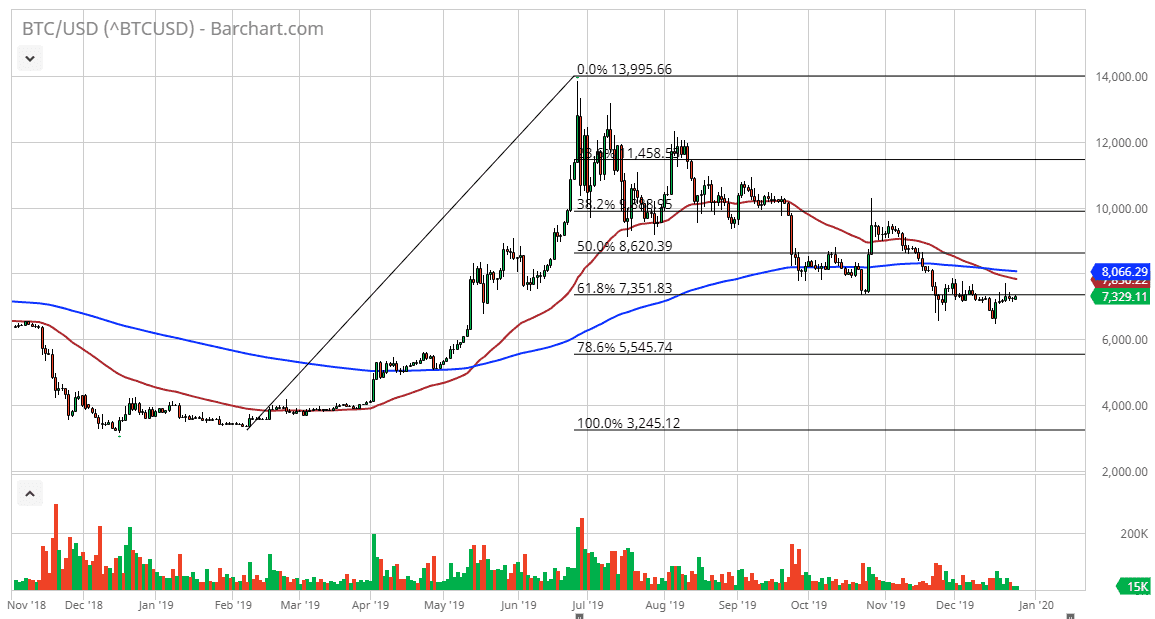

The bitcoin markets rallied slightly during the trading session on Thursday, reaching towards the 7400 level. Ultimately, this is a market that has been churning back and forth at this area, and the market has broken down significantly over the last several months. At this point, the 50 day EMA is likely to cause some type of dynamic resistance, just as the shooting star from last week in. Ultimately, the market looks likely to continue to go much lower, as we have formally formed the “death cross” about two weeks ago. This is a longer-term sell signal, and that means that the market is likely to continue to attract long-term sellers. That being said though, if we were to break above the 200 day EMA it would wipe that level out.

To the downside, I think that the initial target would be the $6500 level, but then possibly even the $6000 level next. All things being equal, there was a descending triangle previously that we had broken out of just below the $10,000 level, and then even came back to test that area for resistance. By showing signs of exhaustion at that point, the market then broke down from there as well.

The descending triangle measures for a move down to the $4800 level, so having said that it’s likely that we will continue to go much lower, but I would also point out that we are in a bit of the descending channel as well. Overall, this is a market that I think will continue to find plenty of selling pressure, unless of course something changes quite drastically. There is a huge amount of money flowing out of China right now and there are even reports of bank runs. That does help Bitcoin, but China has crack down on a lot of Bitcoin transactions, so this may be part of what has been pushing gold higher. I would point out that Bitcoin is not followed along. While we could get a decent bounce from here, I think that given enough time the sellers will return. I would definitely anticipate that the 200 day EMA should be resistance, which is currently at the $8066 region. All things being equal, this is a bearish market, but it looks like we are very quiet mainly due to the holiday season and the lack of liquidity/volume in the marketplace. Because of this, we may not get that move for a couple of weeks.