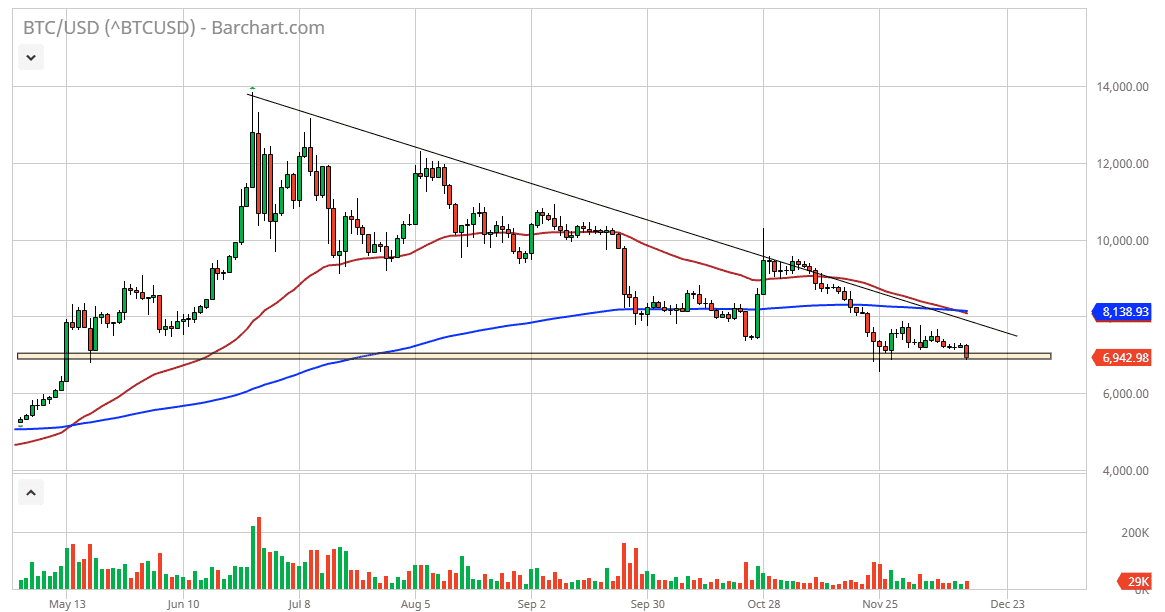

Bitcoin has fallen again during the trading session on Monday, to kick off the week. At this point, the market looks likely to break down again, and finally smashed through the last vestiges of support. Bitcoin continues to fail at every turn, and now it looks as if we are going to finally break down below the $6500 level relatively soon, breaking the bottom of the hammer from November 25. If and when it does, the market is free to go much lower, perhaps finally fulfilling my longer-term target of $4800.

There was a descending triangle that we broke down from previously with support near the $10,000 level that now looks likely to send the market down to the measured move of $4800. There’s quite frankly nothing in the Bitcoin market that looks even remotely bullish at this point, although there is talk of the halving coming up in May 2020, which is when they cut the reward for solving a block in half, thereby slowing production of coins. However, we are now to the point where traders are starting to get burned every time, they get overly bullish.

One of the major problems Bitcoin continues to struggle with is the fact that it simply isn’t being adopted. There is the other bullish argument because of all of the great potential of block chain technology. However, think about it for a minute: how much block chain technology have you seen actually used? 10 years later and we don’t really have a use for it. Yes, it’s a great idea but at the end of the day it just isn’t being used. Bitcoin has been relegated to what it may have been in the first place: a simple speculation device. That’s fine but call it for what it is.

At this point, the technical analysis looks horrible. The 50 day EMA is crossing below the 200 day EMA, sitting just above a downtrend line. This so-called “death cross” will continue to be looked at by longer-term chart analyst, and now that we are starting to see a continuation of the downward pressure, there’s really nothing here that tells me it’s time to start buying. I had previously suggested that rallies are to be sold but we may not even get that rally to sell. At this point, $4800 seems very realistic, but it may take some time to get there.