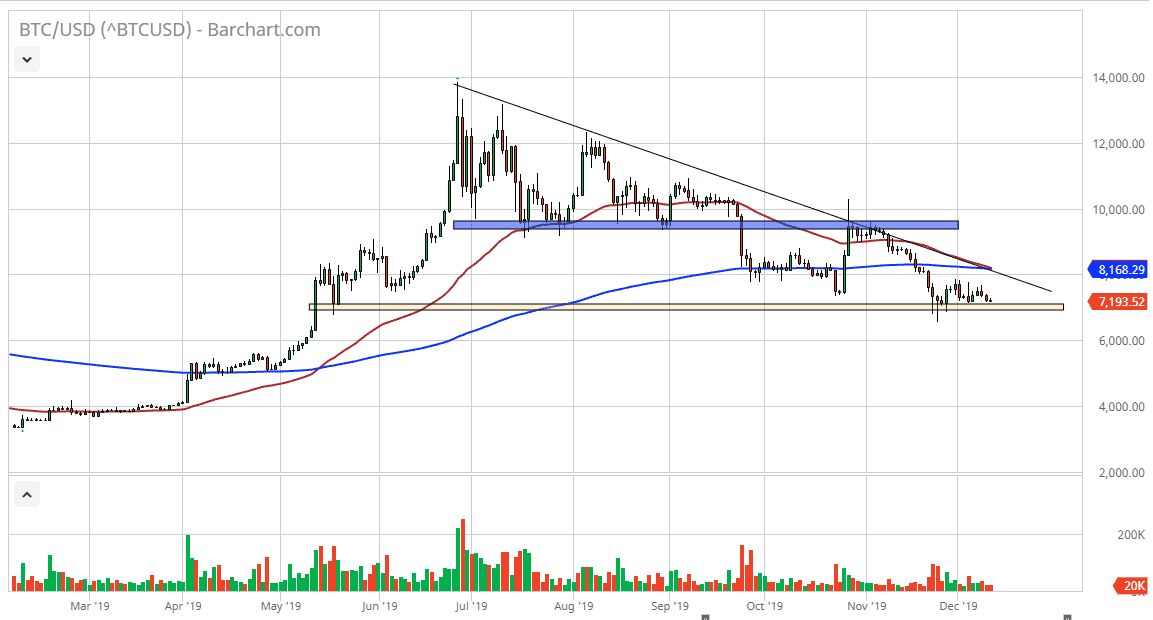

Bitcoin has tried to rally slightly during the trading session on Wednesday, but yet again we continue to see a complete lack of interest. At this point, this obvious support level should attract attention, but it simply is not as volume is falling off yet again. If we were to break down below the $7000 level on a daily close, then it’s likely that the market could go a bit lower, perhaps down to the $6500 level initially. If we were to break down below there, then the market is free to go much lower at that point.

The market has been very negative for some time, and there’s nothing on this chart that shows it’s about the change. In fact, during the trading session on Wednesday we are getting the so-called “death cross” when the 50 day EMA starts to cross below the 200 day EMA. That’s a longer-term sell signal, and a lot of people will be paying close attention to it. Beyond that, the moving averages are crossing at the downtrend line, and therefore it’s another reason to think that area will be a massive resistance barrier. The market is very unlikely to continue above there, so any time we rally I’m looking to sell Bitcoin as it has proven itself to be soft yet again.

The ascending triangle above continues to point towards the idea of a move to $4800 underneath, and I think that happens in the next couple of months. The one thing that does look at lease “less bearish” is the fact that we have stopped breaking down so methodically. We are simply just bumping around on support right now, but until somebody can find real demand out there, Bitcoin become something that you should be selling and not buying. Rallies at this point are nice opportunities to make profit to the downside, as after a decade we still have no real use for Bitcoin. It can’t be money, it’s not stable enough. Usage is much more than it once was, but that still is but a blip on the radar when it comes to currencies. Beyond that, several central banks around the world are working on their own crypto, which of course will be the death of Bitcoin for all but the most diehard users. Quite frankly, if the general public doesn’t warm up the Bitcoin, it will have no real value down the road.