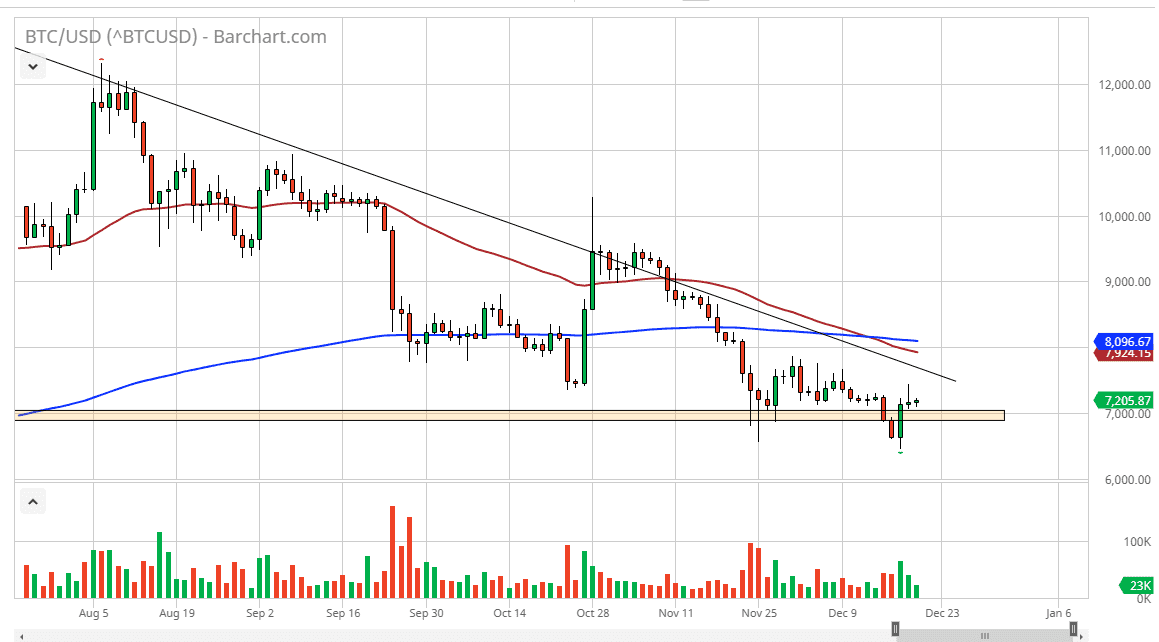

Bitcoin did very little during the trading session on Friday, as the market is probably focusing more on the holidays than anything else. However, as I told you after the Thursday session, we had formed a shooting star right where you would want to see it if you are a short seller. It looks as if the $7000 level will be threatened again and if we can break down below there it probably opens up the door to a much lower move in the Bitcoin market.

However, I do recognize that Bitcoin tends to kind of work in its own universe. Ultimately, this is a market that should continue to see plenty of sellers above and I think that the weekend could be interesting because it does tend to attract a lot of retail traders, and more importantly “true believers.” As a general rule, those are the people who buy this coin every time it drops, and therefore it’s likely that the market may see a bit of noise on both Saturday and Sunday. However, Monday should bring in a little bit more volume and I think that the traders out there will be paying attention to the downtrend line, and the fact that we have recently formed a “death cross” when the 50 day EMA has broken below the 200 day EMA.

To the downside, if we are below the $7000 level it’s likely that the market goes looking towards the $6500 level and then possibly even lower. Because of this, I believe that the $6000 level underneath will be targeted and then finally the $4800 level which I have been talking about for some time. This is the target based upon the descending triangle above that we had broken just below the $10,000 level and has been revisited in that massive spike after the Chinese suggested they were going to study block chain. With this, we have confirmed that market participants are looking for reasons to sell, because that spike was over the weekend when the larger funds were available. In fact, when you look at the chart you see this massive spike it would make a lot of sense that larger funds unloaded on the retail trader as the market has seen quite a bit of drift lower before that happen. We have wiped all of that out and now continue to go lower. This is a horrible looking chart.