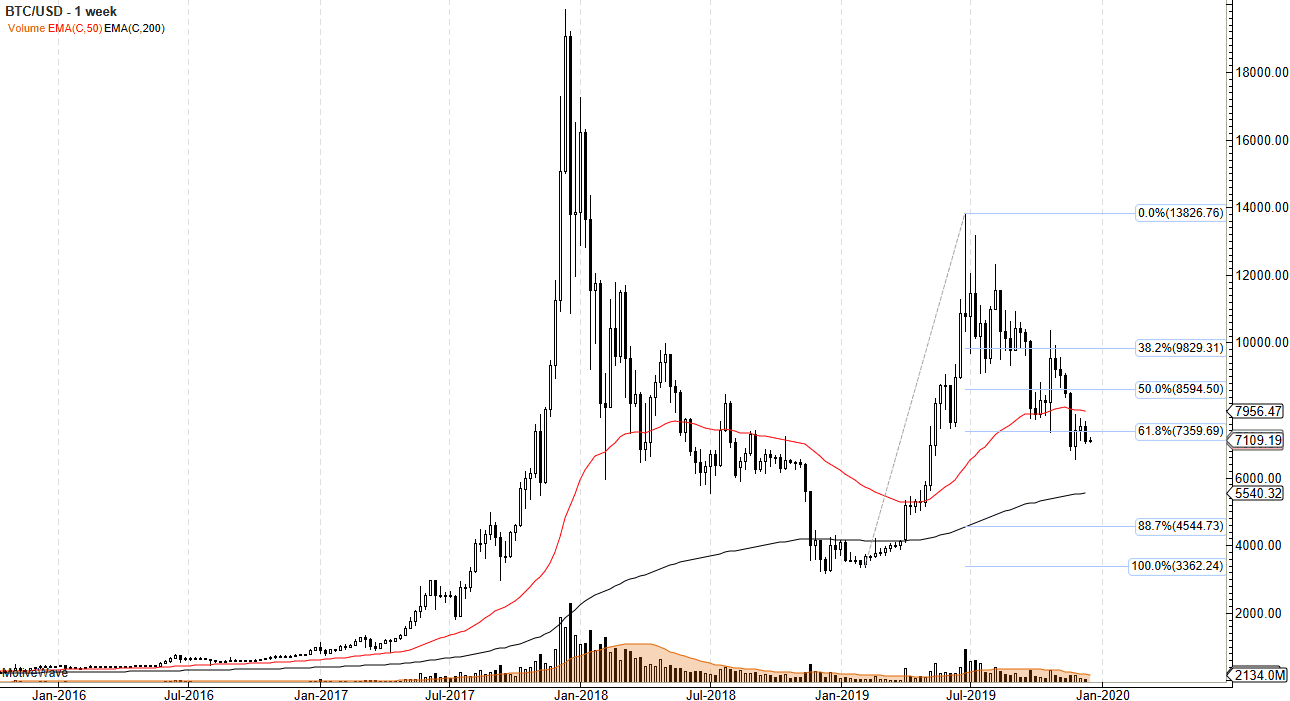

The Bitcoin market has been absolutely miserable for the last seven months or so. Originally very bullish looking for the year 2019, you can see that there was another “pump and dump” that started early spring but failed at $14,000 and has done nothing but fall since. There have been little brief fits and starts to the upside, most notably when the Chinese announced that they were going to research block chain, but at the end of the day the People’s Bank of China turned everything right back around by suggesting that block chain was not Bitcoin and therefore it should not be speculated upon.

In fact, the market did try to spike above the $10,000 level after a horrific fall, but then started to sell off yet again. One of the main drivers for Bitcoin prices going higher has been money leaving China, and as the Chinese economic conditions have been deteriorating, Bitcoin has been a way that wealthy Chinese have gotten money out of the country. As soon as the wealthier done though, the Chinese Communist Party suddenly starts cracking down on Bitcoin. This has been seen before, so it should not be a huge surprise that they are starting to do so again.

At this point, the main bullish case is going to be for the halving coming in May 2020. The idea is that every time a block is solved, it halves board. In other words, it slows the minting of new coins. However, one of the biggest problems with Bitcoin is that nobody is using it. It’s used to get money out of countries in financial situations, but until it’s adopted by the wider population, it is simply a speculative instrument. In other words, it’s a lot like a penny stock in the sense that it is “pump and dump.” Looking at the longer-term chart you can see how this is the case.

That being said, I do fully anticipate that Bitcoin will probably get a little bit of a bump from the change in May, but ultimately that bump is probably to be sold into. During Q1, I fully anticipate the Bitcoin will continue its downward trajectory, perhaps down towards the $6000 level. The rate of descent probably slows down, but towards the end of the quarter we may see a little bit of a bounce in the value of Bitcoin, only to see it squashed again shortly after. The first couple months of 2020 will be negative, followed by a slight “dead cat bounce.”