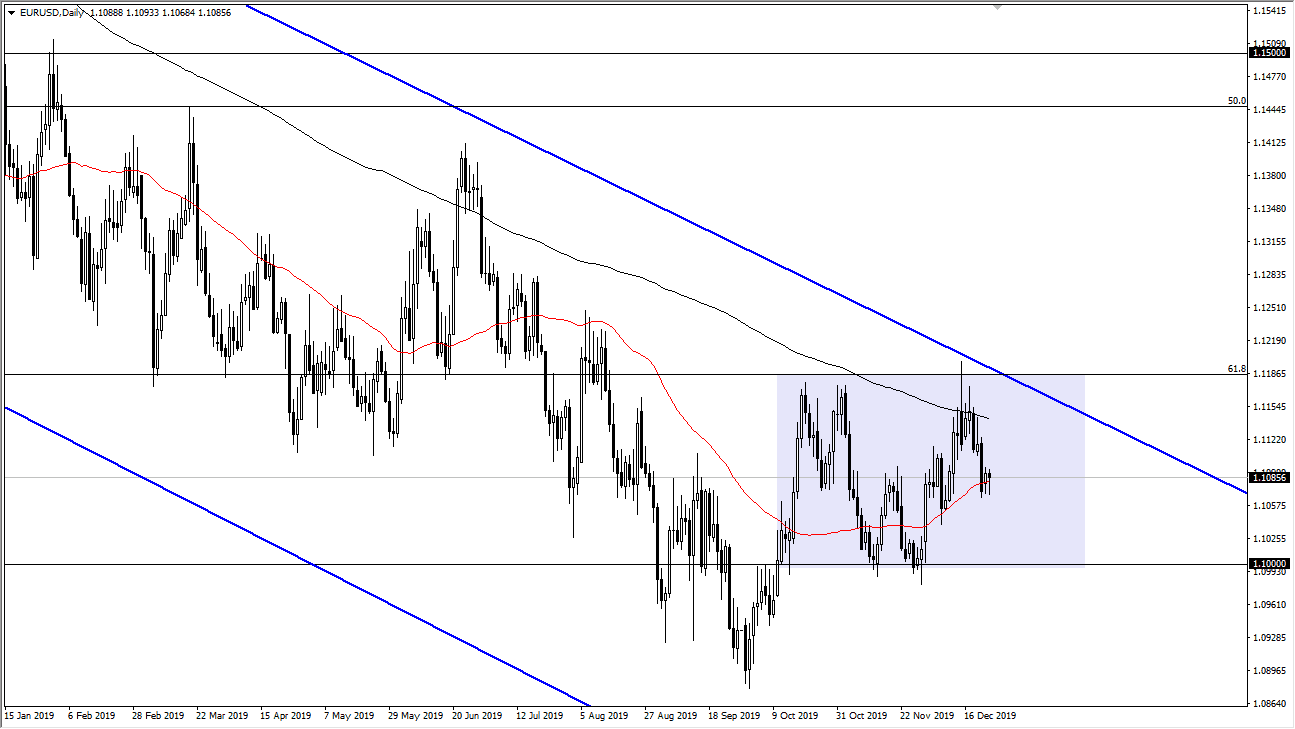

The Euro went back and forth during the trading session on Tuesday, as the Christmas Eve trading of course will have had very little in the way of volume. We are currently trading right around the 1.11 handle, which is the middle of the overall consolidation area that the market has been in. The 1.12 level above is significant resistance, just as the 1.10 level underneath is support. The 200 day EMA sloping lower and showing signs of resistance is something to pay attention to, but you can say the same thing about the 50 day EMA sloping higher and offering support. We are simply going back and forth in general and therefore it’s likely that not much happens in the short term.

The downtrend line from the overall descending channel also offers resistance and continues to drive this pair lower longer-term. The Euro has been in a downtrend for a very long time, and therefore I do feel much more comfortable shorting this market rather than buying it. If we were to break down below the bottom of the purple box on the chart, which is at the 1.10 level, then I would be interested in taking a longer-term “sell and hold” position. By breaking below the 1.10 level it’s very likely that we could go down to the 1.09 level, and then possibly even the 1.0750 level after that which is the scene of a gap.

On the other hand, if we were to break above the downtrend line at the 1.12 handle, then the market could go towards the 1.14 level, and that of course the 1.15 handle. That could be the beginning of a trend change but right now I’m not overly excited about that move, and I think we will continue to see resistance above offering to precious market lower, and perhaps make a move towards the US dollar. However, if we do break out to the upside it might not actually be the Euro you should be trading, but rather you should be buying gold. However, the next couple of days will probably be more or less choppy behavior, and therefore I think that the market will probably be one that it’s more or less going to be made for somebody looking to scalp back and forth. I do put heavier weight and position size on to the downside on signs of exhaustion though.