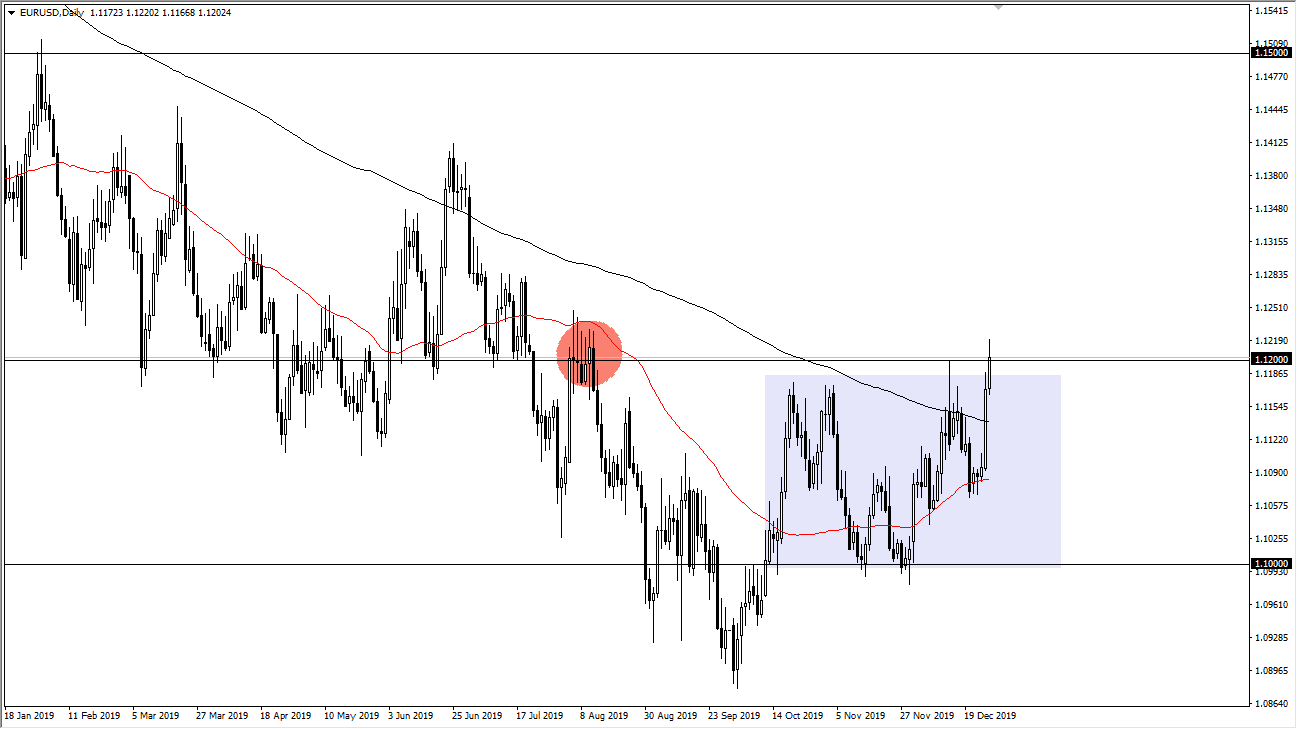

The Euro has rallied significantly during the trading session on Monday as traders came back from the weekend. At this point, we did break above the 1.12 handle which is of course crucial, but now the question is whether or not we will find any type of follow-through? If we were to break above the 1.1250 level, that would blow through major resistance, and then should continue to go much higher for a bigger move towards the 1.14 handle. That being said though, this is a market that is still in a downtrend, so at this point it’s not until we get that daily close above the 1.1250 level that I am completely convinced.

Keep in mind that it is a relatively thin time of year as well, so be aware that the movements may be a bit exaggerated. That’s not exactly rare at this time a year but that’s why we give the market a little bit more room to move. If we pull back from here, if the market was to break down below the 1.1170 level it’s likely that we could break down towards the 50 day EMA. That’s an area that I do anticipate offering support though, so having said that I’d be looking to buy the Euro in that area if we bounce. Otherwise, then we could reach down towards the 1.10 level.

All things being equal, the market is very likely to continue to be very choppy and noisy in general. All things being equal, this is a market that I think will be difficult to trade for a longer-term move, although we are typically in a downtrend, and therefore I think that fading rallies should continue to be the way going forward. All things being equal though, this is a market that continues to be very noisy and therefore I like trading short-term only. I have no interest in trying to force the issue, but I do recognize that if we get a break higher it could be the beginning of a longer-term trend change. We have been in a bit of a descending channel for some time, and we are testing the top of it so we will have to make a decision rather soon as to whether we break out or continue going lower given enough time. The next couple of weeks will be crucial when it comes to this currency pair.