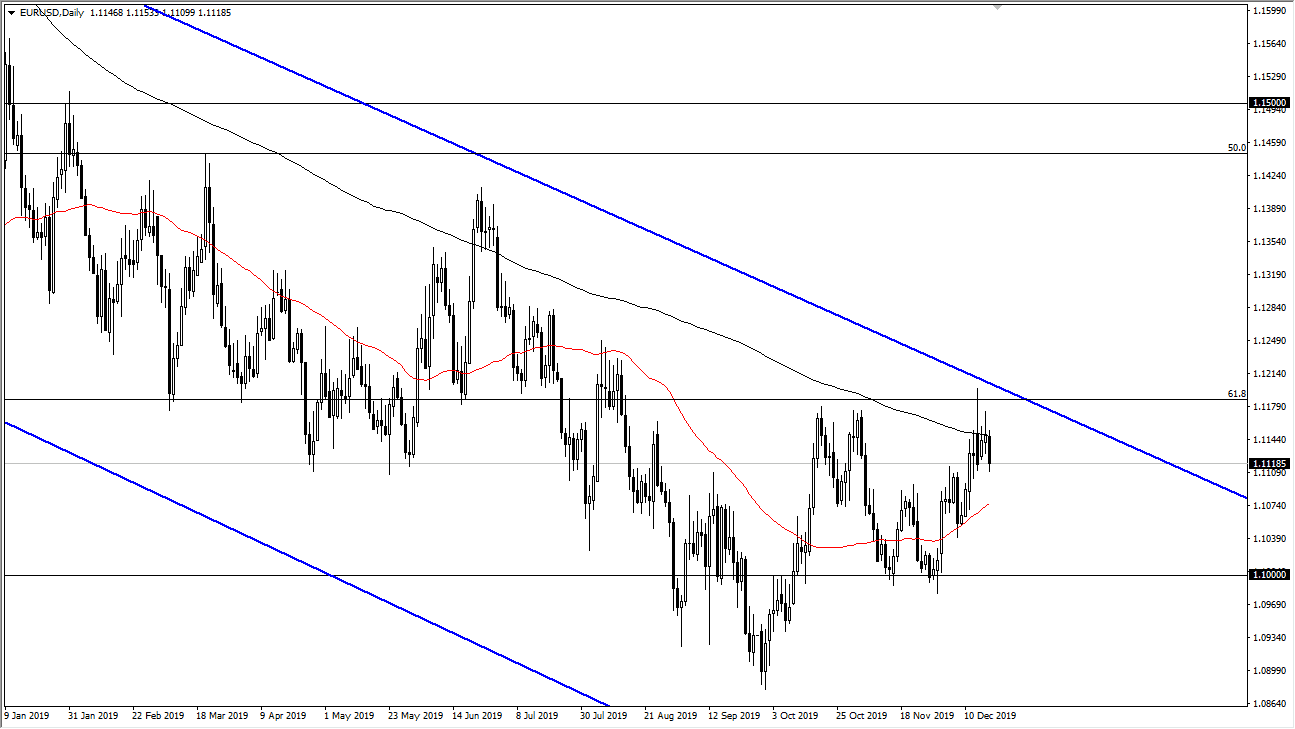

The Euro has rolled over a bit during the trading session on Wednesday, reaching down towards the 1.11 handle. That is essentially what I see as “fair value”, as the market has been consolidating between the 1.12 level on the top and the 1.10 level on the bottom. The market should continue to be very choppy, and that’s not a huge surprise considering that the pair is typically choppy. Why would be any different now? Ultimately, this is a market that has been in a downtrend for some time and the negative candlestick for the trading session ended up reaching right into the middle of the overall trading zone that I see right now. I believe that we will stay in this 200 PIP range for the rest of the year, as there is no reason to get excited in general.

The downtrend line from the descending channel that is so important on the longer-term chart will continue to cause a lot of resistance as well, and at this point it would take something rather drastic to get this market to get moving rather quickly. I think that the market is probably going to simply grind into the new year, as most of the volume will have drifted off. Ultimately, I think that the downtrend continues but if we were to break above the 1.12 level, then it’s possible that we may go looking as high as 1.14 eventually. However, the markets breaking down below the 1.10 level opens up the door to the 1.09 handle, which is a major bottom recently, and a break down below there it’s likely that we go down looking towards the 1.0750 level, which has been a gap on longer-term charts. I have no interest in trying to get too big with my position, as the Euro is essentially the realm of day traders and high-frequency algorithmic traders. All things being equal though, I do think that it’s more of a descending channel that will be driving this market more than anything else as the European Central Bank continues to soften its monetary policy. Ultimately, I think that we continue to simply drift around somewhat aimlessly as volume start to drop heading into the holiday season. Ultimately, this is a market that will continue to be very noisy and difficult, so do not use large amounts of money trading this market.