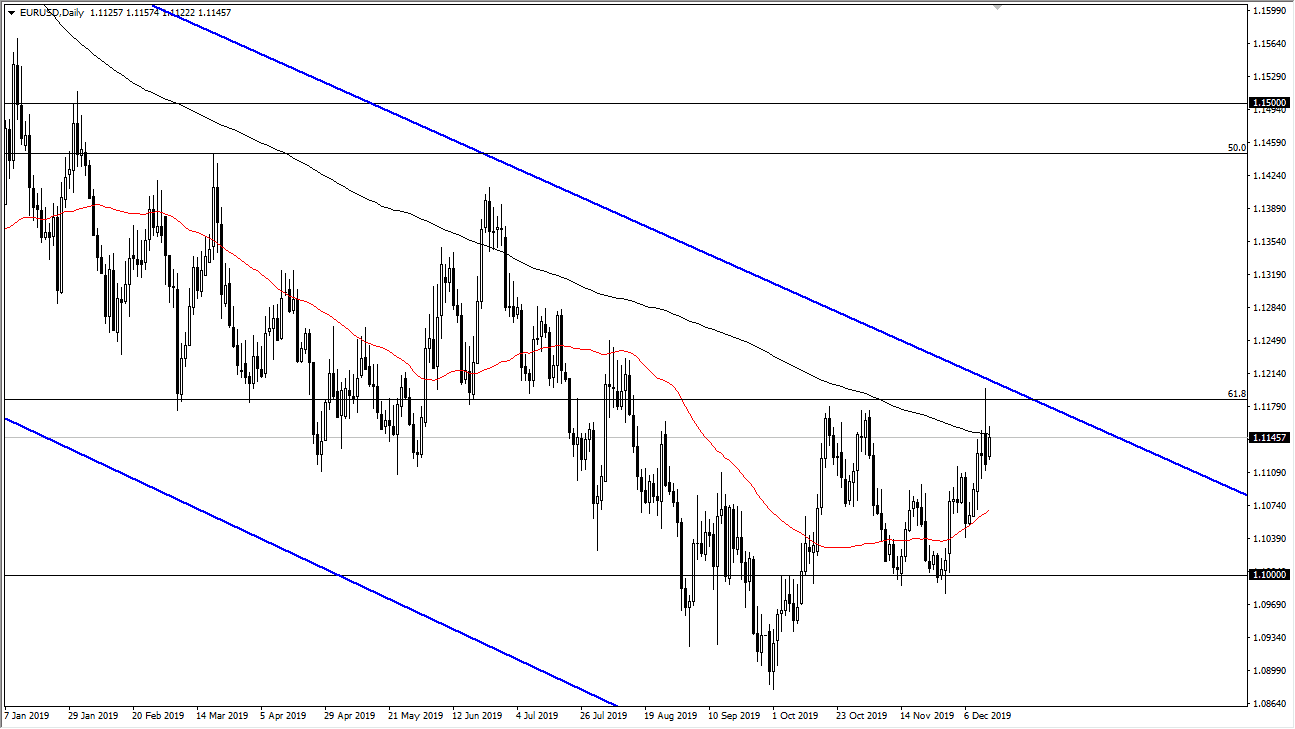

The Euro has rallied a bit during the trading session on Monday, reaching above the 200 day EMA initially. However, the market has pulled back from there slightly and it now looks like we are going to continue to struggle in this general vicinity. I believe than the market is going to continue to be very choppy, but when you look at the longer-term charts, it does in fact makes sense that we would continue to go to the downside as we have been in a downtrend for quite some time. Ultimately, the market has seen a bit of a pushback closer to the 1.12 handle, which is a large, round, psychologically significant figure.

Beyond that, it is also the previous 61.8% Fibonacci retracement level, which should act as resistance going forward as it was once support. Beyond that, the 200 day EMA of course offers a lot of resistance. Ultimately, this is a market that should continue to see a lot of choppiness in volatility, but when you look at it through the prism of the longer-term set up, it certainly seems as if selling rallies should continue to be the way going forward. In fact, it’s not until we break above the 1.12 level that I would be interested in buying the Euro, and even then, I believe that a small position would be necessary.

The market should have gone higher due to a “risk on” attitude, but quite frankly we have not seen that translated into this pair. That being the case, it’s likely that the market is simply going to go sideways with more of a proclivity to fall than rise. To the downside I see the 1.11 level as potential support, as well as the 50 day EMA which is currently higher. Underneath there, then it’s likely that we would see the 1.10 level should offer a significant amount of support as well. Breaking down below there then it opens up the floodgates to much lower prices. If we were to break out to the upside, the rallies are probably going to struggle to break above the 1.15 handle anytime soon. If it were to break above there, then a longer-term “buy-and-hold” scenario probably comes into play. That being said though, with the ECB being loose with monetary policy, it’s likely that the Euro will have limited upside at this point.