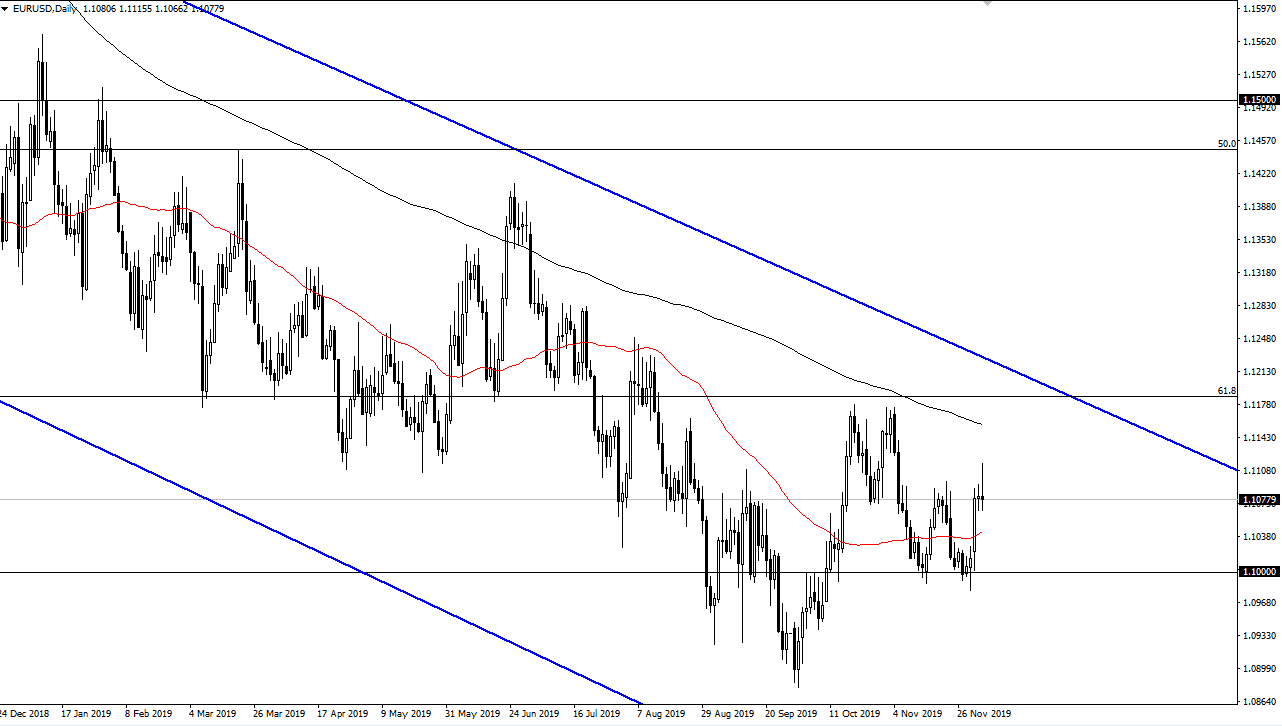

The Euro initially tried to rally during the day on Wednesday but ran into a buzz saw of resistance in the area just above the 1.11 handle again. By rallying the way it has and then giving up the gains, we ended up forming a shooting star which of course is something to pay quite a bit of attention to. This will certainly attract the attention of a lot of traders out there, and therefore if we break down below the bottom of the shooting star, then it’s likely that we go looking towards the 1.10 level yet again. When I look at this chart, there are three levels that I am paying attention to the most right now.

The initial level as the 1.11 handle, which is essentially “fair value” when it comes to the EUR/USD pair. To the upside, I see the 1.12 level has been massive resistance, and it should also be noted that the 200 day EMA is sitting right around the same area as well. Any move towards that area will more than likely continue to attract a lot of resistance. On the other hand, if the 1.12 level is massive resistance, the massive support that we see in the market currently is the 1.10 level. That’s a target for short-term selling, and therefore my initial take profit.

That being said, if the market was to break down below the 1.10 level significantly, then it opens up the ability to reach down to the 1.09 level underneath which has been massive support. Below there, then we have the 1.0750 level which features a gap that has yet to be filled. Furthermore, when you look at the European Central Bank and its future plans, and the almost all coincide with some type of quantitative easing. At the same time, the Federal Reserve is likely to sit on the sidelines so therefore by default they are going to see the greenback strengthen a bit. Furthermore, if we get more “risk off” type of headlines out there, it will drive money into the US bond markets, which of course demand US dollars. Ultimately, this is a market that has been in a long term downtrend anyway, so I do like the idea of fading any type of rally as it comes. I have no interest in buying the Euro, at least not until we break above the 1.12 level significantly.