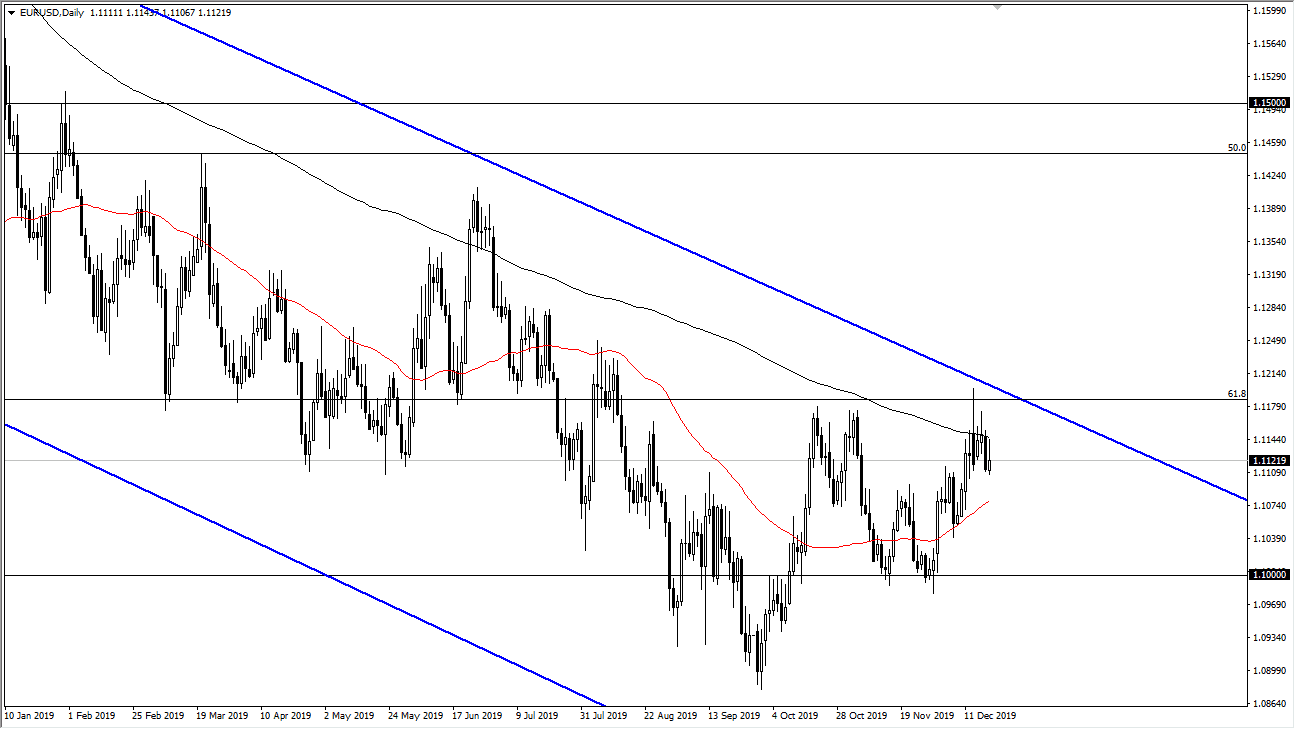

The Euro rallied a bit during the trading session on Thursday but continues to find trouble near the 200 day EMA. By doing so we have ended up forming a bit of an exhaustive looking candle and it looks like we are ready to go lower. At this point, rallies are to be sold as the market continues to look very soft in general. The downtrend line above continues to offer resistance, just as the 1.12 level, which is the top of the range. This point, I believe that the market continues to trade between that level and the 1.10 level underneath. There is a significant amount of noise in this market, mainly because there is so much significant noise in the world right now.

The European Central Bank continues to have a very loose monetary policy and therefore of course it will continue to weigh upon the Euro in general. That being said, so the economic numbers out of the United States have not been overwhelming anytime soon, and therefore it’s likely that the market will have trouble favoring either currency for a big move. This is typical for this pair anyway, so that’s yet another reason to think that we may not be going anywhere anytime soon.

If the market was to break down from here it’s likely that we will see a lot of noise on the way down, so I think it’s probably easier to simply fade this market on signs of exhaustion after short-term rallies. That being said, if we did break above the 1.12 handle, the market is likely to go looking towards the 1.14 level after that. The market being able to break down below the 1.10 level would be very negative for the Euro, as we go down to the 1.09 level next and then the 1.0750 level underneath at the gap on the longer-term charts. All things being equal though, we are in a down trending channel so therefore I think it’s only a matter of time before the sellers do get involved time and time again. We have been falling for a couple of years now, and unless something else happens, we will probably see more of the same. Whether or not we are trying to form a bottoming pattern is a question that we may have to explore in January, but between now and then I wouldn’t expect too much as it is the holidays.