The Euro has rallied of the last couple of weeks as I write this article, but at this point it is still very much in a downtrend. While there has been an attempt to rally from the lows, the Euro will continue to struggle at the hands of the European Central Bank. After all, the ECB is very likely to continue loosening monetary policy and add to quantitative easing. Because of this, it will continue to weigh upon the Euro itself.

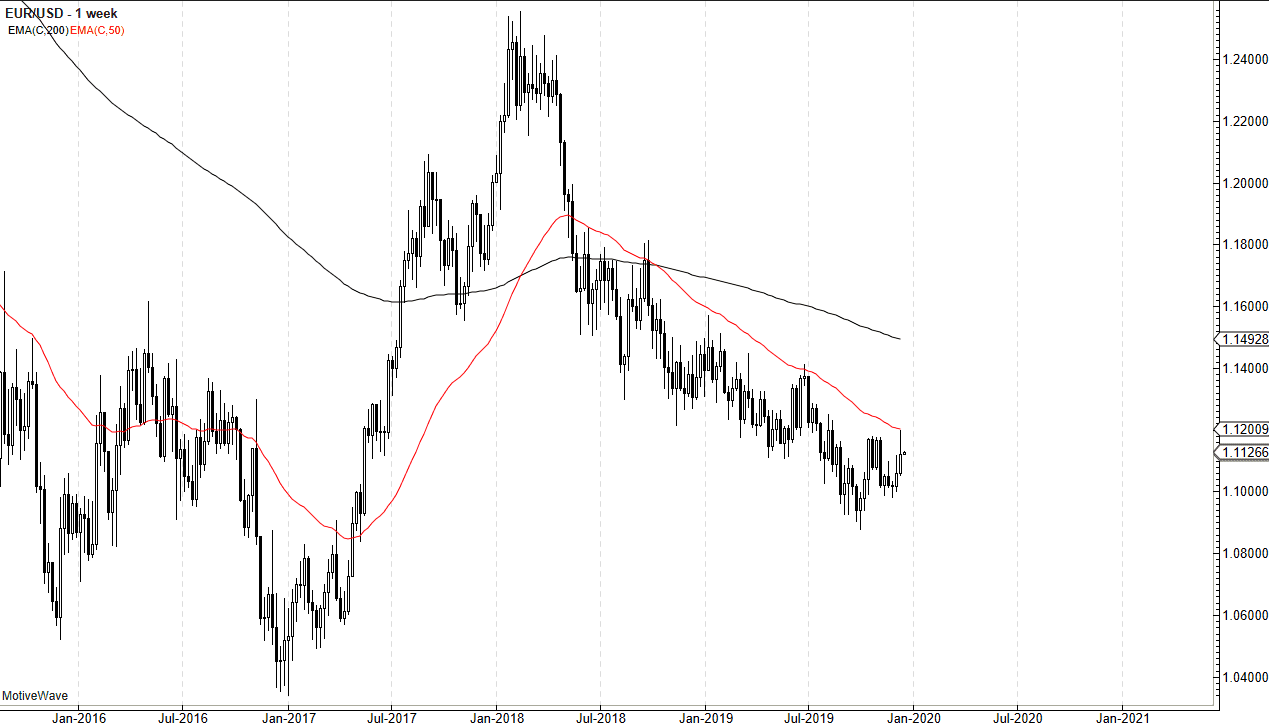

Looking at the weekly chart, the 50 week EMA has been very resistive. At this point, the market has been in a downtrend over the last couple of years, reaching below the 1.10 level. I think at this point we will probably continue to see more choppiness to the downside, with the 1.12 level above offering massive resistance not only because of the recent actions, but also the 50 week EMA mentioned previously. At this point, we may very well rally from there, and if the market does it’s likely that the EUR/USD pair will go looking towards the 1.15 handle. That being said, I believe that sellers will come in at that area probably in an even more aggressive manner. Going forward into Q1 I still believe that selling the rallies should continue. It’s not until we break above the 1.15 handle that a longer-term move to the upside makes sense.

By the end of Q1, it would not surprise me at all to see this pair back to the 1.10 level, possibly even the 1.09 level after that. That being said, there is also a gap down at the 1.0750 level that has yet to be filled, so it’s very likely that has to happen sooner or later. That being said, this is a pair that barely moves most of the time and as you can see it’s been nothing but a grind lower in a very slow manner since the month of March 2018. We are getting close to some major supportive areas, so ultimately, it’s very likely that the market would bounce a bit, but then I believe we will make another attempt at the lower levels in order to break down and sift a bit lower. Expect choppy and grinding momentum to the downside as per usual, but even if we break out above the 1.15 handle, I wouldn’t expect much in the way of easy trading anyways, as the grind lower will cause a lot of noise on the way back up as well. I’m bearish, but I do recognize that the 1.15 level is crucial.