In the beginning of this week’s trading, the Euro will react to the announcement of the purchasing managers' indicators for the industrial and services sectors, which are the most affected by the length of the global trade war. Last week, amid optimism about the possibility of a commercial agreement between the US and China, the upward correction opportunity for the EUR/USD was strong, and allowed the pair to rise to the 1.1200 resistance, the highest level for 4 months before closing the week’s trading around the 1.1117 level. The pair was also affected by the results of the first meeting of the European Central Bank under the leadership of Christine Lagarde. At this meeting, the bank decided to hold the interest as expected. Lagarde announced its intention to conduct a review of all the bank’s plans, the extent of effectiveness, and to choose the best ones to accelerate the process of reviving the Eurozone economy.

Before that, the US Federal Reserve decided to keep the US interest rates unchanged, and the bank reaffirmed its confidence in the performance of the American economy and the success of monetary policy in pushing the American inflation rates forward and the continuing decline of unemployment in the United States to its lowest levels in 50 years. The Fed is concerned with ensuring continued economic growth and increasing price pressures. Jerome Powell seems to have stressed the decline in unemployment without increasing inflation. Minor adjustments were made to the economic outlook, and the reference to "uncertainties" was dropped in the outlook. Long-term unemployment rate is between 4.1% and 4.2%. The US economy is expected to grow by 2% in 2020 and 1.9% in 2021. Thirteen Federal Reserve Board officials believe that any change in the bank's policy will be appropriate next year. Four of them believe that an increase in interest is needed. The average forecast is consistent with no increase in 2020 and a possible rise in 2021 and 2022.

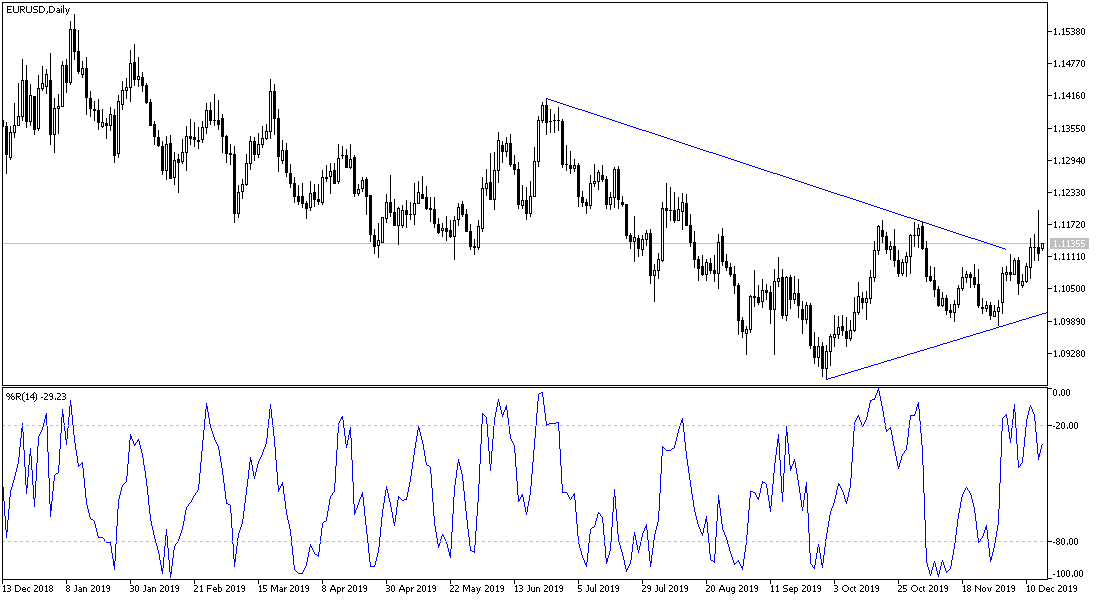

According to the technical analysis of the pair: As we emphasized in the recent technical analyzes of the EUR/USD pair, stability above the1.1120 resistance gives the pair an opportunity for an upward correction. If it fails again to overcome the 1.1200 resistance, as it happened last week, this means that the upward correction faces obstacles, and that technical indicators have reached overbought areas, and if the economic data results from the Euro area do not improve, the downward pressure on the pair will return again and this will be supported by the return of the movement towards support levels at 1.1090, 1.1020 and 1.0945 respectively.

As for the economic calendar data: From the Eurozone, the purchasing managers' indicators for the industrial and services sectors of the bloc economies will be announced. From the United States, the Manufacturing and Services Purchasing Managers Index data will be released.