For the second day in a row, EUR/USD is trying to correct higher even after Eurozone inflation data for November surprisingly achieved higher than expected gains, and the reaction was limited as the data did not change the pessimistic ECB interest rate expectations. The single currency faces German political risks as well as a new threat from more US tariffs next week.

Eurozone inflation reached 1% in November, up from 0.7% in the previous release, well ahead of expectations of 0.8%. The core CPI, seen by policymakers as a more reliable measure of price trends, rose from 1.1% to 1.3%, while expectations were for an improvement of only 1.2%. The base figure ignores the prices of energy elements, which are mostly affected by performance in world markets, as well as commodities regulating prices such as alcohol and tobacco. Core inflation movements generally tend to get a greater market response than the announcement of key prices.

Markets are paying attention to inflation statistics because central banks are obliged to use interest rate policy to keep price growth within predetermined criteria. The ECB's goal is to ensure that the average consumer price index is “close to, but less than 2%” in the medium term, but inflation is sensitive to growth, which means that the pulse of the economy is important to expectations.

The European economy has come under further pressure this year due to the ongoing trade war between the United States and China, growing uncertainty over the eventual Brexit outcome and obstacles to the important European auto sector. Growth prospects across the board point to a general recession in the Eurozone. The ECB has already cut interest rates below zero and has resumed its quantitative easing program to boost growth and inflation over the coming years.

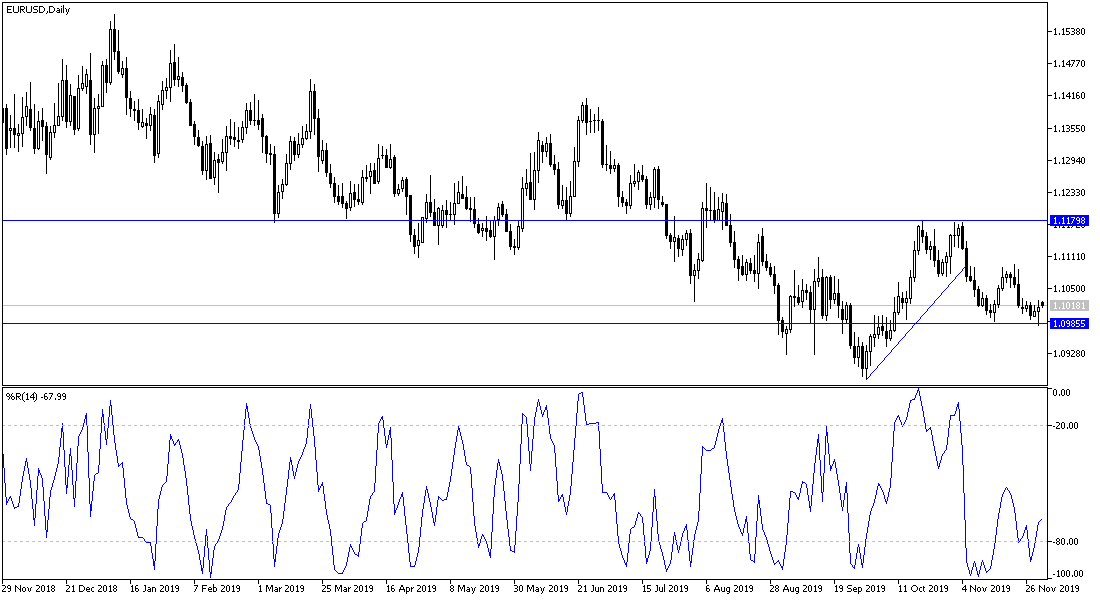

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD, the general trend is still bearish and the success of breaking below the 1.1000 psychological support increases support for this trend, while at the same time confirming the technical indicators reaching oversold areas and that bulls may have control over performance in the coming period. As we expect, there will be no strong bullish rebound for the pair without moving towards 1.1120 resistance. Conversely, stability below the 1.1000 psychological support could support a move to stronger buying areas that are currently closest to 1.0965 and 1.0880 respectively.

As for the economic calendar today: From the Euro-Zone, the Manufacturing PMI will be released. Later on, comments will be made by Governor of the European Central Bank Lagarde. From the US, the ISM Manufacturing PMI and Construction Spending Index data will be released.