In light of the Christmas and New Year holidays, liquidity in the markets is low, and investors are far from making deals until the markets return to the full nature of their work. Since the beginning of trading this week, the price of the EUR/USD pair has been moving in a narrow range between the 1.1070 level and the 1.1095 level. Economic issues in the calendar are next to none. Yesterday, the US Durable Goods Orders were announced at their lowest level in six months. This is due to a significant decrease in aircraft and spare parts orders.

The US Commerce Department announced that durable goods orders fell by -2% last month, the largest drop since May. Orders dropped during the past two months. October number was revised to 0.2% from 0.6%. Transportation equipment orders fell by -5.9%, the biggest drop since May. With the exception of transportation, the new orders were stable. Most analysts had expected a rebound in total orders of more than 1% for November, and a bounce is likely to be expected due to the end of the GM workers' strike. The strike lasted 40 days over two months and caused durable goods orders to decline in September and October.

American industry has been affected by a long-term trade war with China and a slowdown in the global economy.

On the other hand, US new home sales increased at a seasonally adjusted annual rate of 719,000 last month. Sales increased in the north-east and west, but were steady in the Midwest and decreased in the south. New home sales have risen 9.8% so far this year. The increase largely reflects the steady decline in mortgage rates, which has made borrowing cheaper and bringing more people seeking to upgrade their home to the market.

However, prices have risen as a result of declining demand for construction. The average price of new home sales was $ 330,800, an increase of 7.3% over last year.

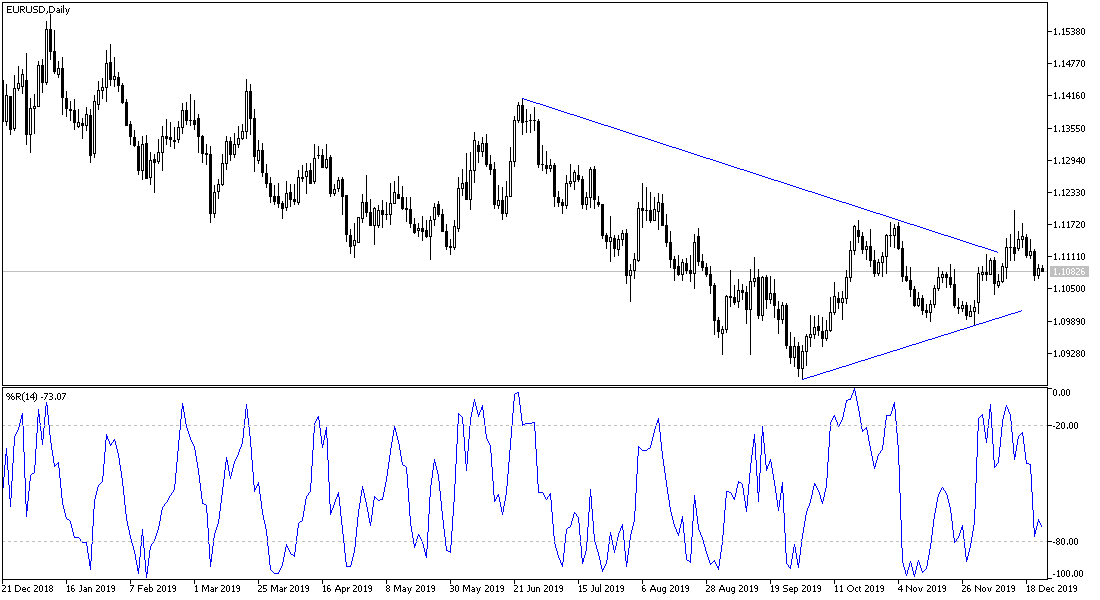

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD performance, as the retreat to the vicinity of the 1.1000 psychological support will bring the strength back to the downside. On the other hand, stability above 1.1120 resistance paves the way for the 1.1200 resistance, which motivates bulls to push the pair to stronger peaks. There are no important data affecting the performance of the pair during today's trading.