The EUR/USD is trying to hold on to its recent gains, that push it towards the 1.1200 resistance, its highest in four months, before settling around 1.1148, and for the third trading session, it awaits stronger incentives to complete the bullish correction. Despite reassuring statements by the German government and the German central bank about the future economic performance of the country, investors want to translate this optimism from the results of economic data.

The Eurozone private sector recorded moderate growth during December, as the fourth quarter ended with production increasing at the weakest pace since the economy began to recover in the second half of 2013, according to IHS Markit survey data. The Composite Output Index remained steady at 50.6 in December, indicating very modest growth in the manufacturing and services sectors. The result was slightly higher than the forecast of 50.5. The industrial recession deepened at the end of the year, while the services sector showed signs of resilience.

According to the statement of the German Central Bank. The German economy is likely to remain stable in the current quarter after avoiding a recession during the summer, and the Bundesbank wrote in its monthly report for December that “German economic output may decline in the last quarter of 2019”. Christen Lagarde did not present at her first meeting as head of the ECB anything new, as she kept interest rates at its record low, but announced a review of the bank’s policy in the coming months.

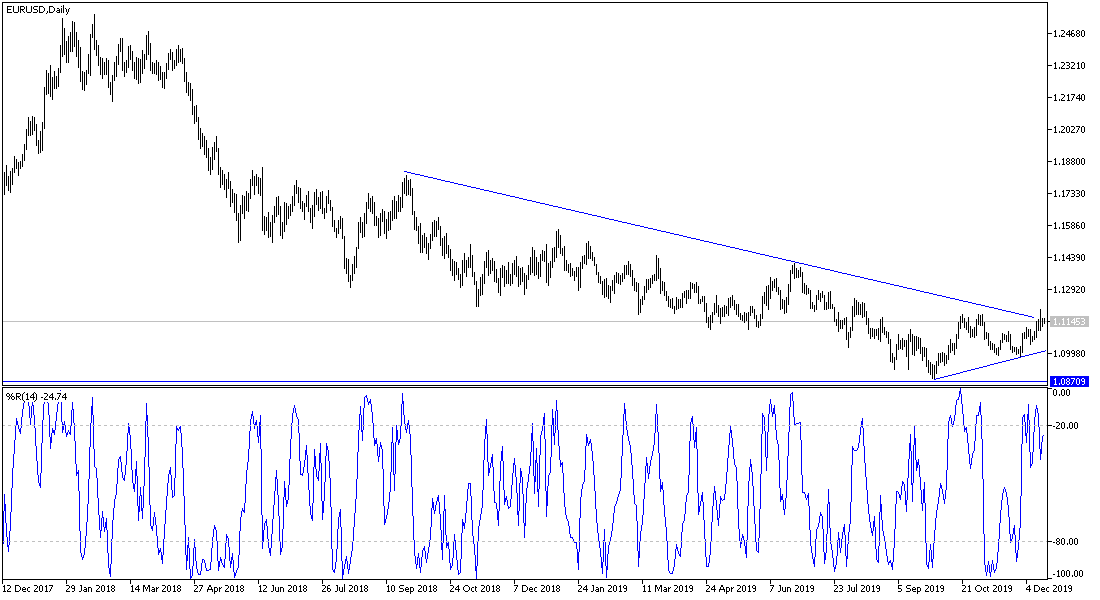

According to the technical analysis of the pair: The EUR/USD pair still needs to stabilize above the 1.1200 resistance, in order for the chance of an upward correction to be stronger. Optimism still surrounds the markets after the announcement of a Phase 1 agreement to resolve the trade dispute between the United States of America and China, which contributed to the slowdown of the Eurozone economy. On the downside, the closest support levels for the pair are currently at 1.1100, 1.1055 and 1.0980 respectively, and the last level is a return to the downside strength again.

As for the economic calendar data today: From the Eurozone, the trade balance will be announced. From the United States, housing data and building permits will be announced, then industrial production data will be announced.