The gold markets rallied a bit during the trading session on Tuesday but have given back quite a bit of the gains. That being the case, it makes sense that we continue to simply go sideways going forward as there are concerns about the US/China trade situation. After all, Sunday is the deadline for the next round of tariffs against the Chinese, so traders will be paying attention to headlines between now and then as to what we are getting ready to do. At this point, the market will probably continue to move back and forth over the next couple of days, and it’s very difficult to imagine a scenario where we move without some type of headline involving this situation.

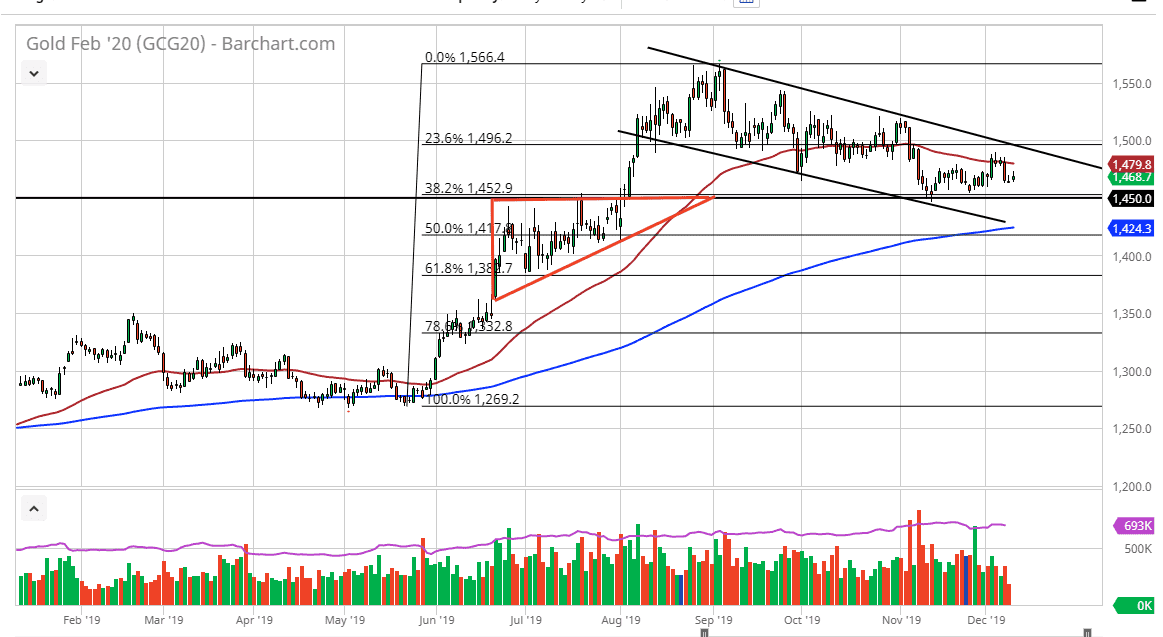

Underneath, we have a significant amount of support at the $1450 level, which was the top of the previous ascending triangle. Market memory suggests that there should be plenty of buyers there to support market as it had broken out. That being said, if we were to break down below the $1450 level, the market is likely to go down towards the 200 day EMA which is closer to the $1425 level.

At this point, that coincides nicely with the descending channel that I have marked on the chart as well, so it’s very possible that might happen as well. Ultimately though, that would be based upon some type of headline suggesting more of a “risk on” type of move. With that, it’s likely that we could see a significant break down based upon a headline that suggests that the tariffs would be delayed or perhaps even some type of an agreement between the Americans and the Chinese being signed.

Ultimately, if there is some type of discrepancy or negativity, it’s likely that the market will go looking towards the 50 day EMA, and then perhaps even break above there to reach towards the $1500 level. However, a rally from here is not as impressive until we were to break above the $1500 level. If that does happen, then gold should get a huge boost higher. Until then, I suspect that this market is probably one that you will continue to fade on short-term rallies, and therefore it’s likely that we will continue to see plenty of volatility and choppiness between now and then, so having said that it’s likely that the short-term back-and-forth trading community will love this market.