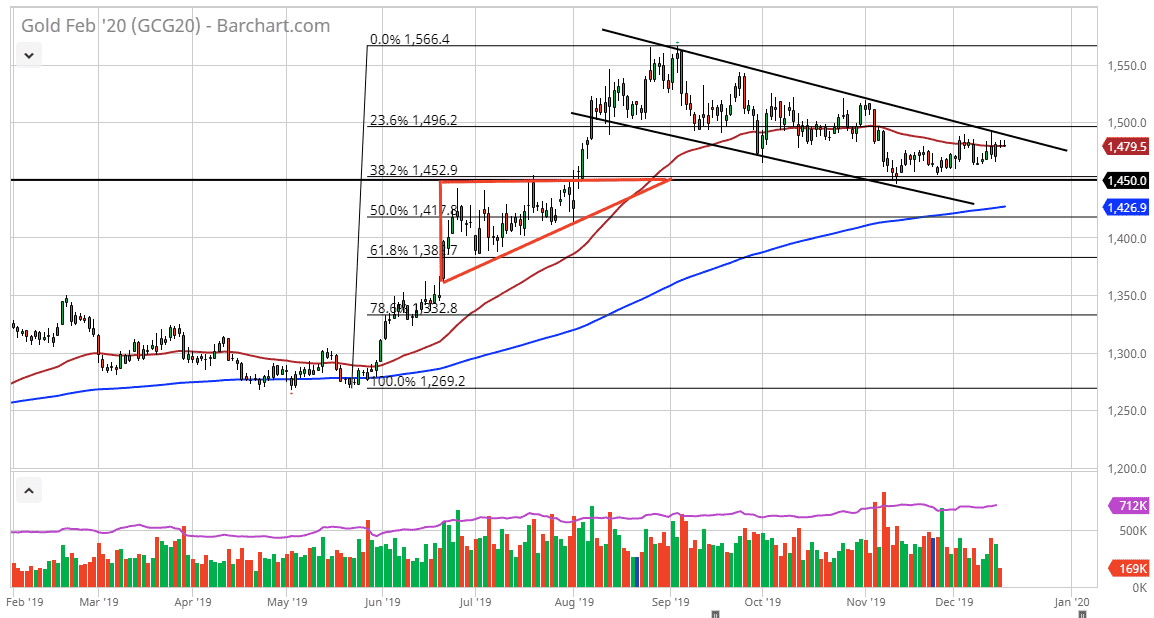

Gold markets initially tried to rally during the trading session on Tuesday but continue to find plenty of sellers above. The market is hanging around the 50 day EMA, which of course is a significant technical indicator that traders will pay attention to. The fact that we are hanging about the 50 day EMA suggests that the market isn’t quite ready to break out to the upside at this point. Ultimately, the downtrend line above will also offer plenty of resistance, right along with the $1500 level. Breaking above that $1500 level would be a very bullish sign, it could send this market much lower. Ultimately, this is a market that I think will continue to find plenty of reasons to rollover, but there is a likelihood that any breakout to the upside would have something to do with the US/China trade situation. If that breaks down, it’s likely that gold will shoot straight up in the air.

Granted, the US/China trade situation has been supposedly agreed-upon at the “phase 1 deal”, but we still haven’t signed that agreement so quite frankly it would not be surprising at all to see participants step away and blow the deal up. They have done it before but the one thing that is a little bit different this time is the fact that the Chinese have even had a press conference suggesting that they were moving forward.

Having said that, the market has to digest the idea of what exactly the agreement is, and quite frankly this point it looks a bit underwhelming. However, the fact that the tariffs were delayed and avoided over the weekend should be somewhat bullish for equities, and negative for gold. It should have more of a “risk on” feel, but there is a significant amount of support underneath at the $1450 level. Breaking below there would be a major breach of support, but I think in the short term we are simply going to go back and forth in this general vicinity as we are getting close to the end of the year, and therefore a lack of volume in trading. With that in mind, gold can have sudden moves but the best way to trade it during this time year is to simply pay attention to this to levels, and trade accordingly if we can break out of this short-term range. Expect a lot of choppiness.