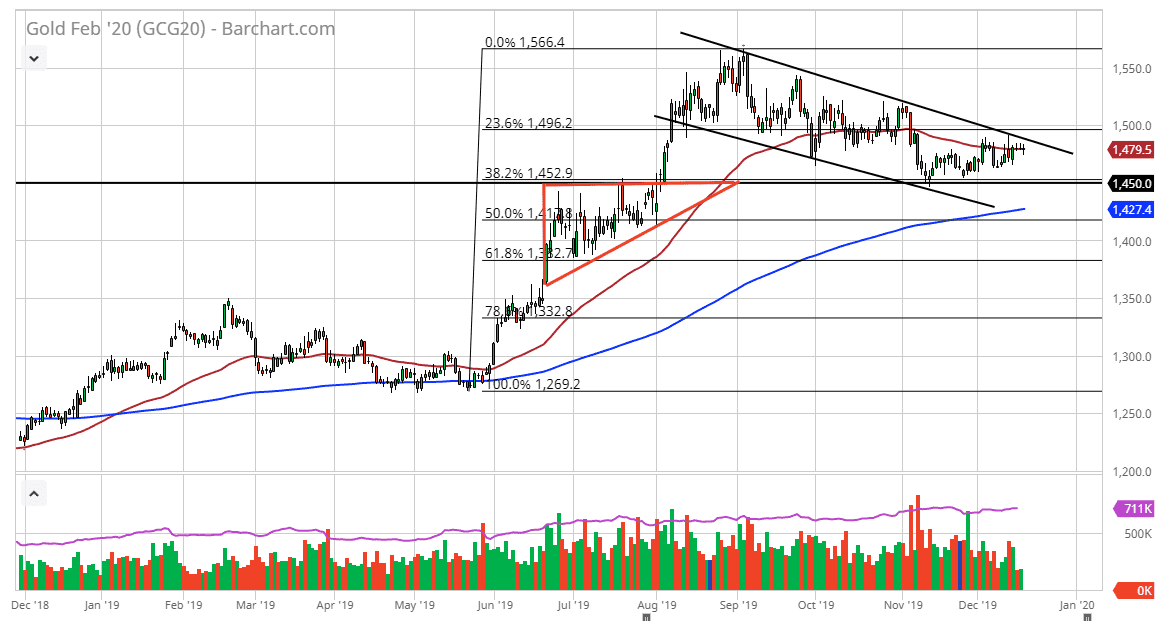

Gold markets have done a lot of back-and-forth trading as of late, as we continue to hang about the 50 day EMA. With that being the case it’s very likely that we will continue to see a lot of sleep inducing trading. We are currently looking at the downtrend line above that could come into play as well, and therefore it’s likely that the markets will continue to be very choppy and negative in general. Ultimately, the $1450 level underneath will be massive support, as it has shown itself to be recently. It’s the top of the previous ascending triangle that I have been talking about for a while, and therefore it makes sense that it will continue to attract attention.

Ultimately, this is a market that will probably be very quiet over the next couple of days as we head into the holidays, and of course have gotten past the UK election and the idea of a “Phase 1 deal” between the United States and China. We have no real details at this point, so gold is simply hanging about the 50 day EMA, looking for some type of reason to move. We don’t have one right now, and all things being equal I think we will continue to drift a little bit lower.

To the upside, the market breaking above the $1500 level would be a very bullish sign. Overall, then the market looks likely to continue going towards the $1550 level. Otherwise, if we were to break down below the $1450 level it’s likely that we will go looking towards the 200 day EMA underneath. Breaking below there will probably end the overall uptrend and bring in fresh selling. Quite frankly, there’s so much noise out there that it makes sense that the gold markets have no idea where to be. I suspect that the next couple of days probably won’t be worth trading, but if I was forced to take a position in this market, I would then suspect that we are probably going to go looking towards the $1450 level between now and the end of the year. I do not expect this market to break any of the major levels though, and therefore back-and-forth range bound trading on short-term charts might work, but beyond that it’s going to be very difficult to place any real money in this market in the meantime.