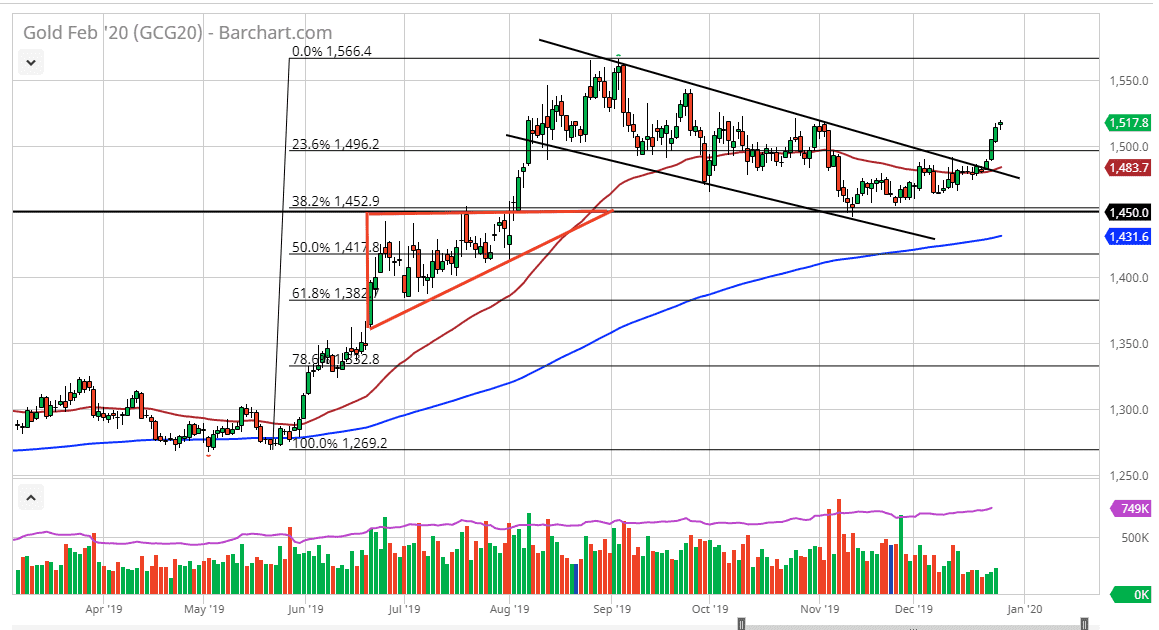

Gold markets look like they are ready to pull back a bit during the next couple of days, as we have seen a lot of bullish pressure and a sudden surge higher. With that being the case, I think that we need to pullback in order to offer an of value for traders to get involved, but clearly the gold markets have broken out. Beyond that, we are well above the 50 day EMA now and also a couple of other resistance barriers.

Looking at the downtrend line that is clearly snapped through, we are now out of that descending channel and it looks like we are going to try to build up enough momentum to go much higher. That being said, we have gone straight up for the last couple of days, so I think that a pullback makes quite a bit of sense as people will be looking for value. The $1500 level should be an area that attracts a lot of attention, so I like the idea of buying anything that looks remotely like a bounce from that general vicinity. To the upside, I see a lot of resistance built in at the $1520 level, so if we can get above there then I think we will get a pull back and we will simply continue to go higher. The target at that point would probably be $1540.

To the downside, as long as we stay above the $1450 level, the uptrend will be relatively intact, and it should be noted that the $1450 level has offered not only support, but it is also the top of the previous ascending triangle that I have marked on the chart and it is also the 38.2% Fibonacci retracement level. Typically, when an uptrend finds enough support to turn around and continue going higher at the 38.2% Fibonacci retracement level, it shows a lot of momentum longer-term and we should continue to go much higher. As far as a target longer-term is concerned, I think that the highs would be the initial target for anybody looking to hang onto a bigger move, but quite frankly I think we go much higher, perhaps as high as $1800 by the end of the next year. Pullbacks continue to offer value and that’s exactly how I plan on trading this market as central banks around the world continue to cut interest rates, and offer quantitative easing.