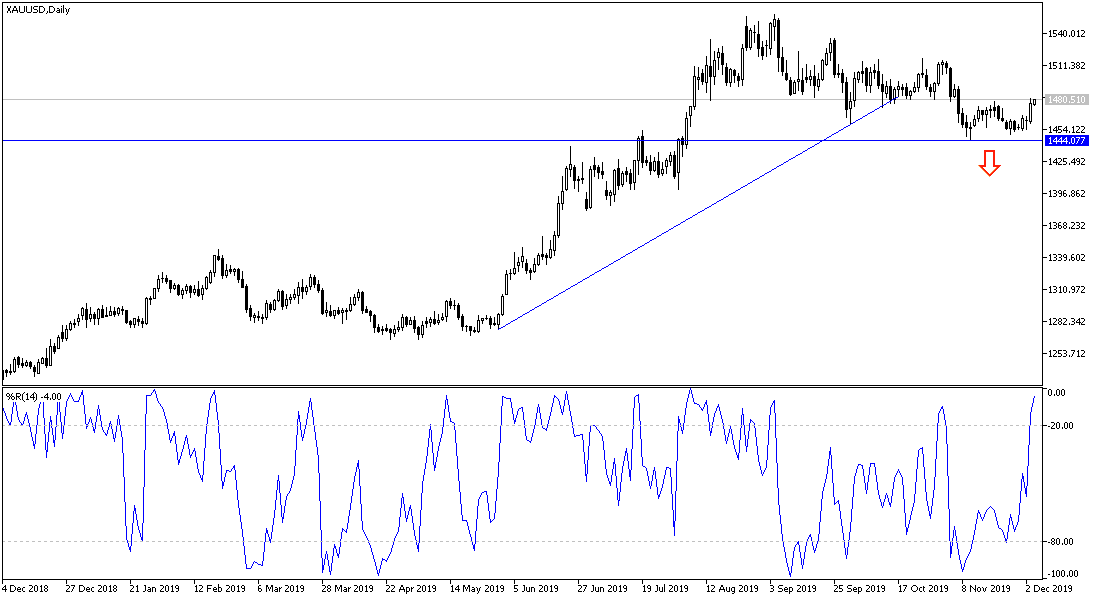

Gold markets rallied significantly during the trading session on Tuesday, as Donald Trump suggested that the China deal might be better off being done after the election, and that of course causes a lot of fear. With this, people start to worry about the tariffs being added on December 15, and as a result that would probably cause a lot of fear on Wall Street. Looking at this chart, we have been bearish for some time, and the nice rally that has happened stopped right at the 50 day EMA, that is something to be paying attention to.

The $1450 level continues to offer a significant amount of support, and therefore the question now is whether or not it is a “double bottom”, or as if it will continue to break out. If it were to break that level it would be extraordinarily negative, reaching down towards the 200 day EMA. This has been a nice gentle descent from the highs, so it hasn’t necessarily been a massive selloff, but it certainly has been relentlessly negative. At this point, it does look as if we may have a little bit of bullish pressure, but this was mainly due to a headline, and those tend to come and go. I will be looking for signs of exhaustion between here and the $1500 level that I can take advantage of and start shorting yet again.

To the upside, if we were to break above the $1500 level, that would be an extraordinarily bullish sign and it send this market much higher. That being said, we would need to enter some type of really negative type of environment, perhaps a massive selloff in the stock markets. We did get hammered during the trading session on both Monday and Tuesday, but the stock market has been relentless in its move higher, and it is probably only a matter of time before we find value hunters coming back in. Because of this, I like the idea of shorting gold as soon as we get some type of negative candlestick on a short timeframe. However, above the $1500 level I think we are more than likely going to go looking towards the highs again closer to the $1550 level. One thing is for sure, this market is going to continue to be very choppy and volatile as the market continues to have a major issue with directionality.