Gold markets have rallied a bit during the trading session on Thursday, as traders came back from Christmas. As liquidity picks up, we continue to see gold rally, but I also see that there is a bit of resistance near the $1515 level, perhaps extending to the $1520 level. A pullback from here makes quite a bit of sense, as the market has been a little overextended at this point, it makes quite a bit of sense that perhaps we are running out of steam. Beyond that, the holiday season will have the markets moving a little bit quicker at times, because it doesn’t take a lot of volume to move the markets.

There are reports of money flowing out of China right now, and even a couple of bank runs. Chinese were using Bitcoin to get money out of the country, but it seems likely that the gold markets are starting to attract some of that flow. That being said though, from a technical analysis standpoint this is a market that is very strong.

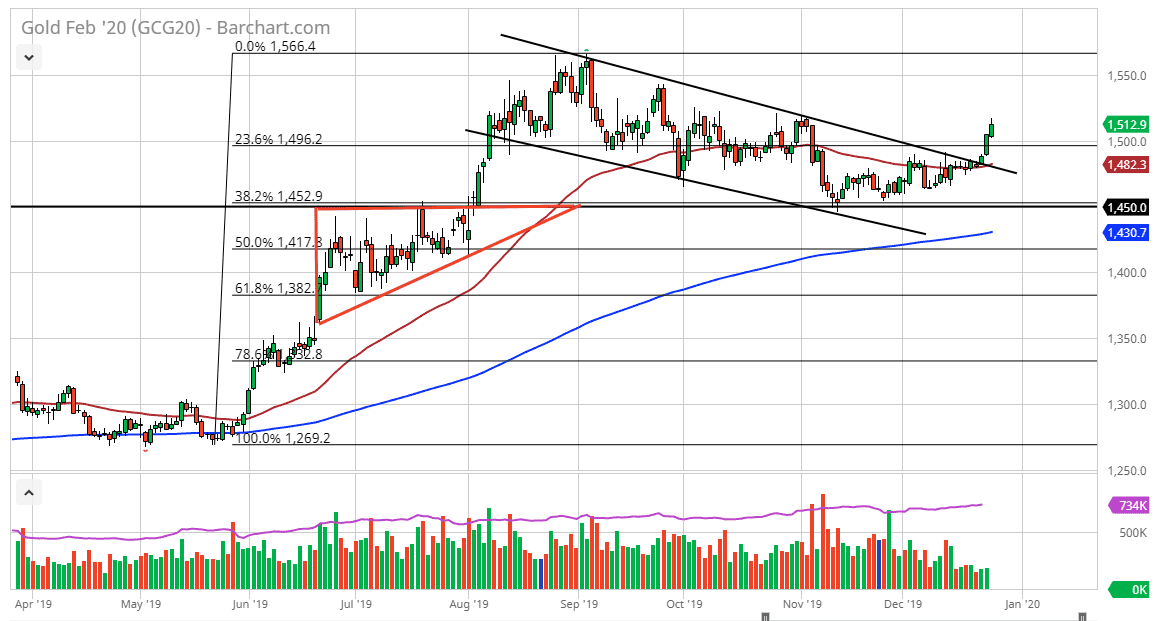

When I look at the chart, the 50 day EMA has offered dynamic support and is starting to curl higher. Beyond that, we have also broken above the $1500 level which of course is a bullish sign. The $1500 level will have a certain amount of psychological significance attached to it as it is a large, round, psychologically significant figure. All things being equal, now that we are above the $1500 level, I would anticipate that it should offer support. A pullback from here makes quite a bit of sense and it’s likely that the buyers will return based upon value. We have clearly broken out of the descending channel, and the entire world knows this. Beyond that, the pullback that we have seen to the $1450 level suggests that the market looks at that as a “floor” longer-term now, especially considering that it with a 38.2% Fibonacci retracement level. At this point, this is a market that should continue to find plenty of interest, and now that we are going to have more volume in a week or so, that should supercharge this market and have it running towards the upside longer term. With interesting is that many people thought that gold was moving based upon the US/China trade situation, but it also is getting a boost for central banks around the world being very loose monetarily.