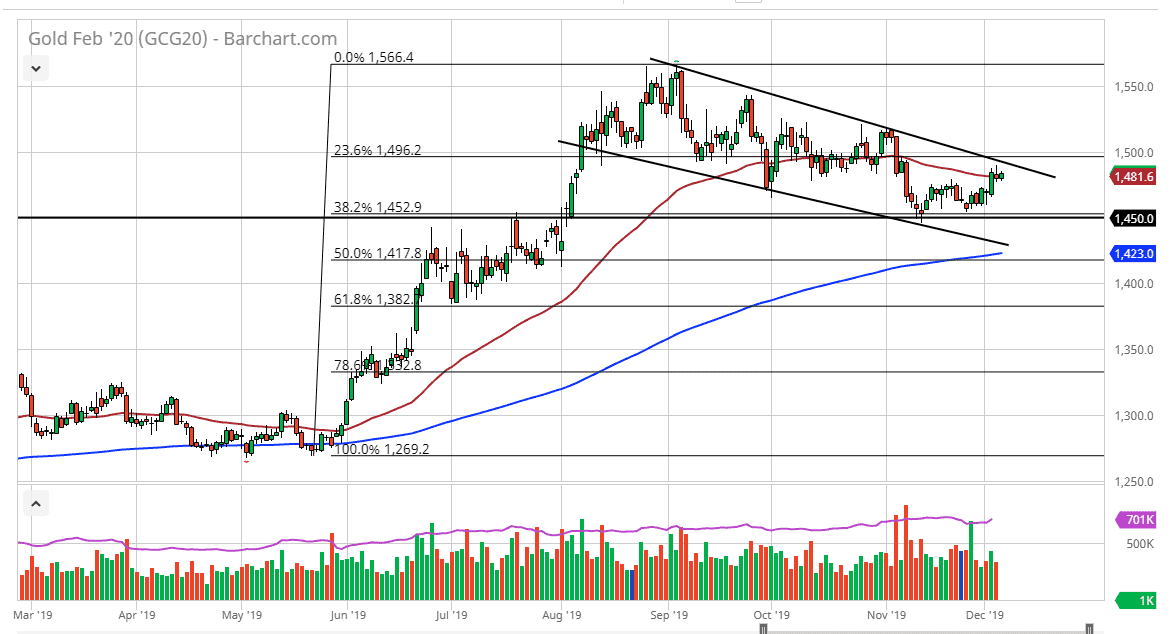

Gold markets did very little during the trading session on Thursday as you would anticipate, mainly because we are awaiting the jobs figure. Beyond that though, we had formed a shooting star on the Wednesday session that shows signs of exhaustion. At this point, it’s very interesting to see how gold is continuing to follow this downtrend in channel, and it should also be noticed that the 50 day EMA has come into play as well. Overall, it looks as if it is a market that is ready to continue grinding lower, but I think we will probably have to wait until the employment figures come out at 8:30 AM in the United States before we get some type of resolution to the sideways action in the short term.

To the upside, I see the $1500 level as massive resistance, and I do not think that we can get above there anytime soon without some type of absolutely negative headline. As the Federal Reserve has stepped to the side and is very unlikely to continue cutting rates, it’s likely that gold will continue to suffer as a result. Having said that though, there is also the possibility that we get some type of negativity out there that sends the market back to the upside.

To the downside I see the $1450 level as massive support, as it is an area that has been massive support previously, and the scene of a gap. The gap has not been filled yet, and the 200 day EMA is at the bottom of the channel. It is because of this that I envision a possibility of breaking down below the $1450 level. This would also be in reaction to more of a “risk off” type of scenario, and as the market is starting to price and some type of “phase 1 deal” between the united states in China, that also puts downward pressure on Gold in general. That being said though, if we were to break out to the upside it would be an extraordinarily bullish sign and could send this market looking at another $50 or so to the upside. It certainly seems as if we are starting to get towards an inflection point, something that will determine the longer-term trend of gold. Once we have that clearly, then we can start playing longer-term trades. That being said though, the next couple of days could be a bit rough.