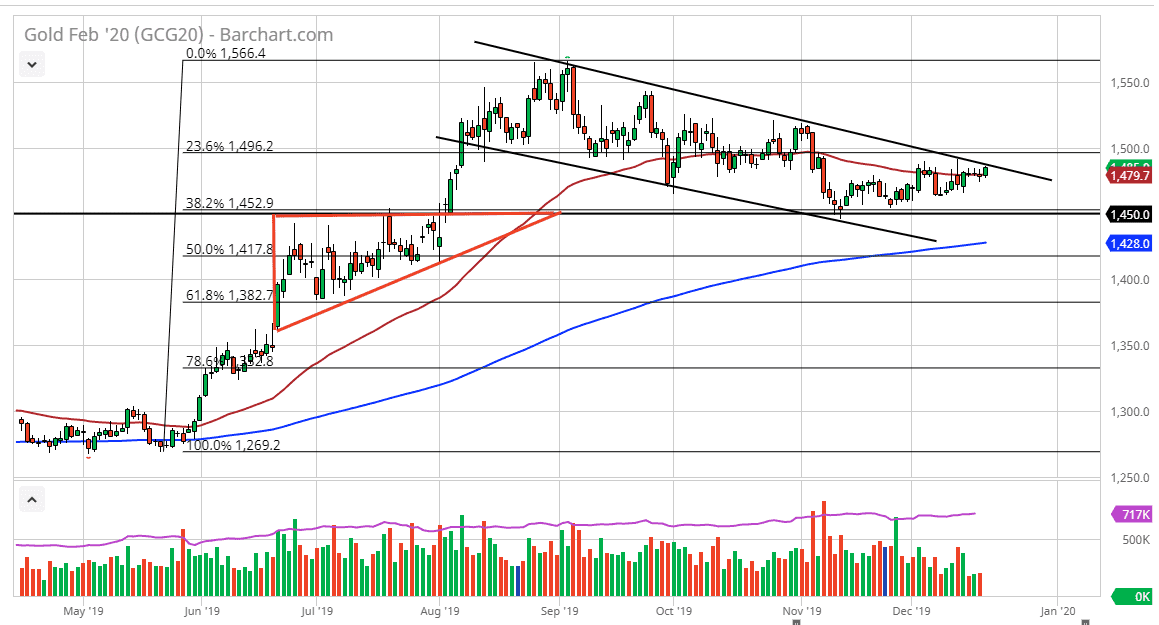

Gold markets have rallied slightly during the trading session on Thursday, reaching towards the top of the downtrend line. The downtrend line is the top of the descending channel that we have been stuck in, and it’s very likely that we will find sellers coming back into this market again. At this point, there should be more sellers coming into play as it’s the wrong time of year to expect a lot of momentum unless of course we get some type of headline crossing the wires that shocks people. The $1500 level above will be massive resistance, but if we can break above that level, then we will get a longer-term move to the upside. Having said that, I fully anticipate that we will see a little bit of selling pressure here, but nothing major.

The market looks very likely to continue to go back and forth around the 50 day EMA, as it has most of the week. You can see where the sellers have come back in and it’s very likely that they will again. Even if we did break above the $1500 level, we need some type of movement and momentum to get involved based upon a headline, perhaps something along the lines of a breakdown in the US/China trade situation.

To the downside, the $1450 level continues to be massive support, so it’s not until we break down below there that I would be concerned. Overall, this is a market that should continue to see a lot of choppy trading and looking at short-term charts will probably be the best way going forward. Ultimately, this is a market that continues to see noisy behavior, but if that’s going to be the case you will have to be cautious about the position size that you use. Longer-term, it is likely that we continue to see buyers underneath and we could turn things around but it’s all going to come down to that trade deal which is still fresh in the back of the mind of traders and general. At this point, take a look at the $1500 level as a signal. If the market breaks above there, it’s likely that we then go looking towards the $1550 level longer-term. If we did break down below the $1450 level, it could bring around a fresh selling into this market, depending on the exact nature of bearish pressure.