The gold markets rallied slightly during the trading session on Friday, and what would have certainly been very thin volume. At this point, the US dollar is on its back foot, but not necessarily down completely. The $1520 level should offer resistance, I think at this point we will probably see some selling pressure come in, but that doesn’t necessarily mean that it is a market that you should be selling anytime soon. In fact, I think that the lack of volume will probably cause a bit of a drift, but quite frankly it’s nice to find a bit of value going forward.

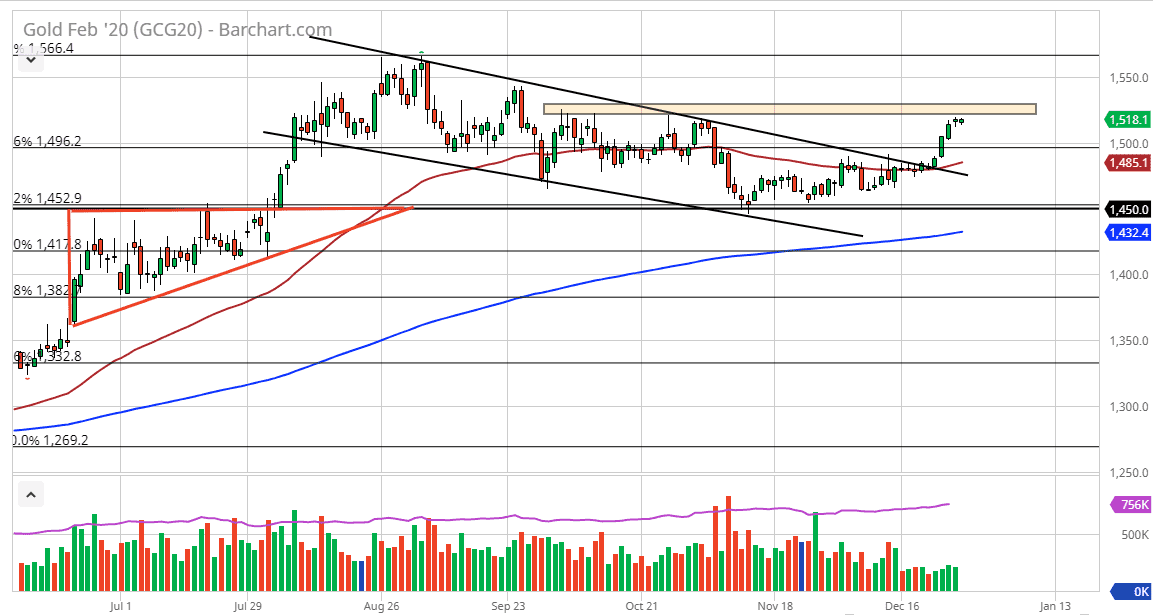

After all, we have broken out significantly over the last several days, clearing the $1500 level after breaking out of the descending channel. That suggests that the trend has changed completely, and we are ready to go much higher given enough time as the market is simply continuing and overall uptrend. The 50 day EMA is starting to curl higher, and I think it will offer a certain amount of support. Ultimately, I think that the next couple of days being low-volume sets up quite nicely for short-term pullback that you can take advantage of. I don’t think that the market is going to break down significantly, so looking at this market I think it’s simply a value proposition.

At this point, several central banks around the world continue to loosen monetary policy and we do continue to get a plethora of disappointing economic announcements coming out of the United States, which of course gives the idea that the Federal Reserve may have to loosen monetary policy relatively soon. The market could start to factor in the idea of the Federal Reserve loosening monetary policy, and that of course drives up the value of gold as it dries down the value of the US dollar. Ultimately, this is a market that looks like it’s ready to continue reaching towards the highs again, and then much higher than that. Based upon very long term analysis I anticipate that the gold markets will go looking towards the $1800 level. At this point, it’s not until we break down below the $1450 level that I would consider shorting this market, and quite frankly that doesn’t look very likely to happen.