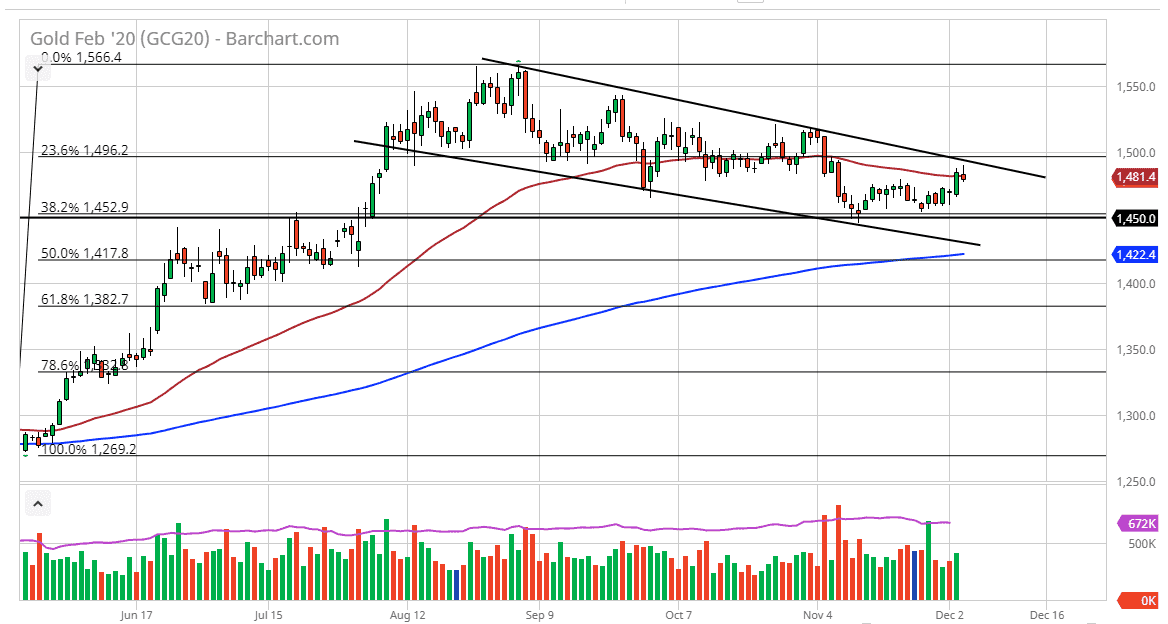

Gold markets initially tried to rally during the trading session on Monday, but then on Wednesday turned around to show signs of exhaustion at the top of the downtrend channel that we have been in. Beyond that, the 50 day EMA looks as if it is offering resistance as well, and the shooting star candlestick of course is negative. Furthermore, above there, meaning the top of the candlestick, the $1500 level looms large as resistance.

The market has been grinding lower for some time, and as a result we have tested the $1450 level. Overall, this is a market that has been selling off for some time, suggesting that there is more of a “risk on” feeling around the world. Beyond that, the Federal Reserve looks to be done cutting interest rates and that of course has a significant effect on gold as well. Remember, wasn’t that long ago that gold was reacting to a Federal Reserve that was likely to continue doing so. Now that the market is continuing to drift lower, I think it’s only a matter of time before it tries to break down below the $1450 level. If it does, that would be a very negative sign and could send the market down to the 200 day EMA. Alternately, if the market was to turn around a break above the $1500 level, then it’s likely that we go much higher. That would be a continuation of the longer term uptrend. That being said, in the meantime at the $1450 level underneath should be a massive support level.

Ultimately, gold will continue to move upon geopolitical concerns, and of course the latest headline. The US/China trade situation obviously has a lot to do with what the risk appetite is around the world, and as a result is likely that the market should continue to go back and forth based upon that. Having said that, if we were to break down below the $1450 level, then we will go looking to test the 200 day EMA. If we were to break down below there, then it’s the absolute end of the uptrend. At this point, it looks very likely to continue being noisy and difficult to trade, but one thing is for sure, we continue to make lower highs, so that something that you can’t ignore. If we can break above that $1500 level though, we have a chance to change the downtrend back into the longer term uptrend.