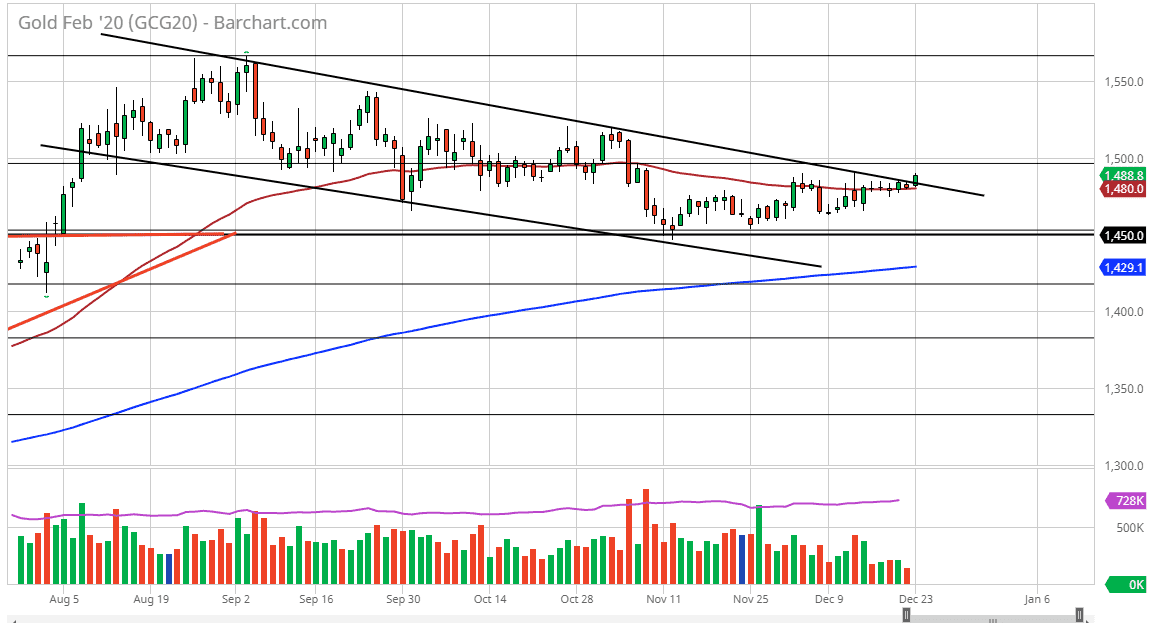

Gold markets rallied a bit during the trading session on Monday, and what would have been relatively light trading volume. With that being said, we have broken above a downtrend line and that of course is crucial to pay attention to. At this point, it looks as if the market will probably try to reach the $1500 level which of course is a large, round, psychologically significant figure. We have built a little bit of a base and quite frankly this is interesting to see considering that the US/China situation supposedly had been one of the bigger drivers of gold. However, we have seen a real change in the attitude of traders, and gold had since stabilized at the $1450 level, building a base.

With the market breaking above the trend line and using the 50 day EMA as support, it does look as if gold is trying to rally into the holidays. Just above the $1500 level there will be a certain amount of interest by both buyers and sellers, so that will be the next major hurdle to overcome. With only a limited amount of trading going on Christmas Eve, it’s very unlikely to happen during Tuesday. However, as we get through the holiday season it’s possible that we could get some type of headline to push this market higher. Ultimately, once we break above the $1500 level it’s very likely the gold will continue to go looking towards the $1520 level, which is the next resistance barrier. Above there, then the market is very likely to go looking towards the $1550 level.

The $1450 level has been shown to be supportive more than once, and it is also above 38.2% Fibonacci retracement level from the bigger move. Because of this, we have seen a lot of value buying in that area, and it looks as if gold may be getting a bit of a boost based upon the perception that the Federal Reserve may have to cut interest rates and continuing loose monetary policies into the 2020 year. While they have not stated so yet, there are absolutely no signs of inflation at this point, and economic numbers are starting to turn sour in the United States. Ultimately, it does look like gold is going to try to make a move higher in January, and the next couple of days may be an opportunity for the market to try to pick up a little bit of momentum.