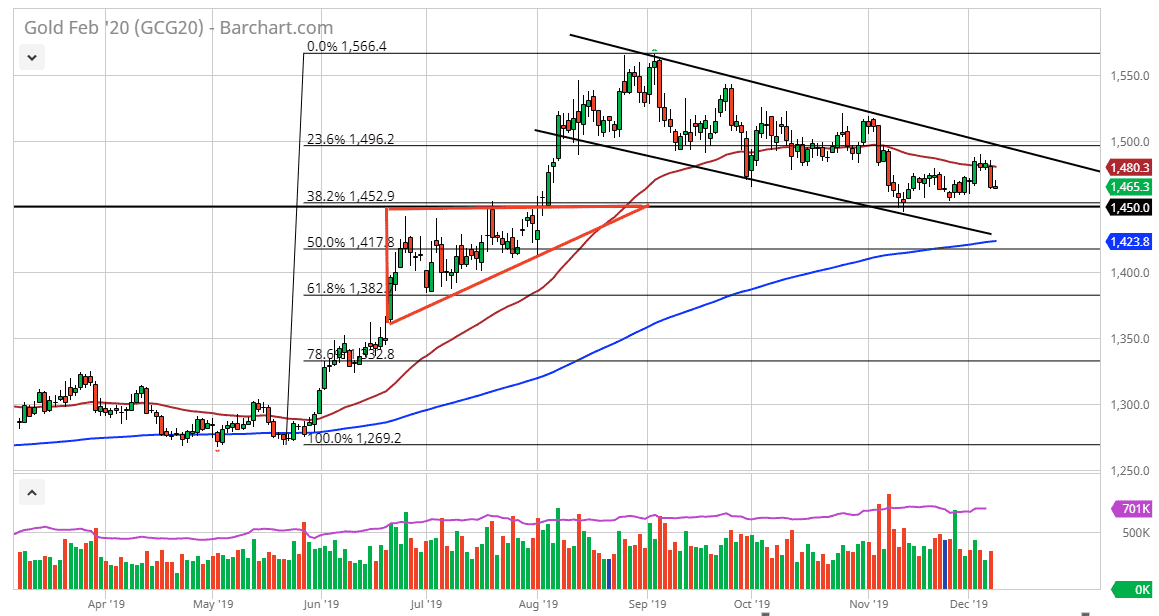

Gold markets initially tried to rally during the trading session on Monday but gave back quite a bit of the gains to end up forming a relatively lackluster session. This is basically how gold has performed lately, giving up gains very quickly. As long as there is a “risk on” type of field of the marketplace gold will continue to struggle. Beyond that, the central banks around the world might be lose, but the Federal Reserve is on the sidelines and that’s really all that matters. It looks as if the market is trying to continue to go lower, testing the major support area in the form of $1450.

Looking at the longer-term chart, this was the top of an ascending triangle that offered quite a bit of resistance, and it now should offer quite a bit of support. All things being equal it’s very likely that the market will continue to test this area to see whether or not it will hold. If it does not hold it’s likely that the market will probably break towards the 200 day EMA which is closer to the $1425 level. That is an area that will continue to be important, and if that one gets broken the uptrend is over with and gold will continue to fall quite drastically.

Just above, the 50 day EMA offers resistance at the $1480 level, and that is an area that should be important. That being said, the market looks as if it continues to offer selling opportunities every time we rally, and I do not trust to rally until we break above the $1500 level. If that happens, the market is likely to go much higher, perhaps reaching towards the $1550 level. I like gold longer-term, but we may be in for a pretty nasty pull back over the next couple of months the way things are going. That being said, if the US/China trade situation gets to be worse then it’s likely that gold will rally based upon a “risk off” type of trade. Otherwise, I think gold is going to continue to struggle as there is so many reasons to think that the markets will remain somewhat optimistic. If the United States fails to levy tariffs on the Chinese December 15, that might be the final nail in the coffin for the uptrend. That would be an extraordinarily bullish sign for risk appetite and that would obviously work against this market.