While the long-term fundamental outlook for gold remains extremely bullish, traders should expect a short-term pull-back over the holiday-shortened trading week. The majority of market participants choose to ignore global risks looming in 2020, on the back of all-time highs in US equity markets. This complacency further enhances the upside potential for gold, after a correction into its short-term support zone, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. You can learn more about a support zone here.

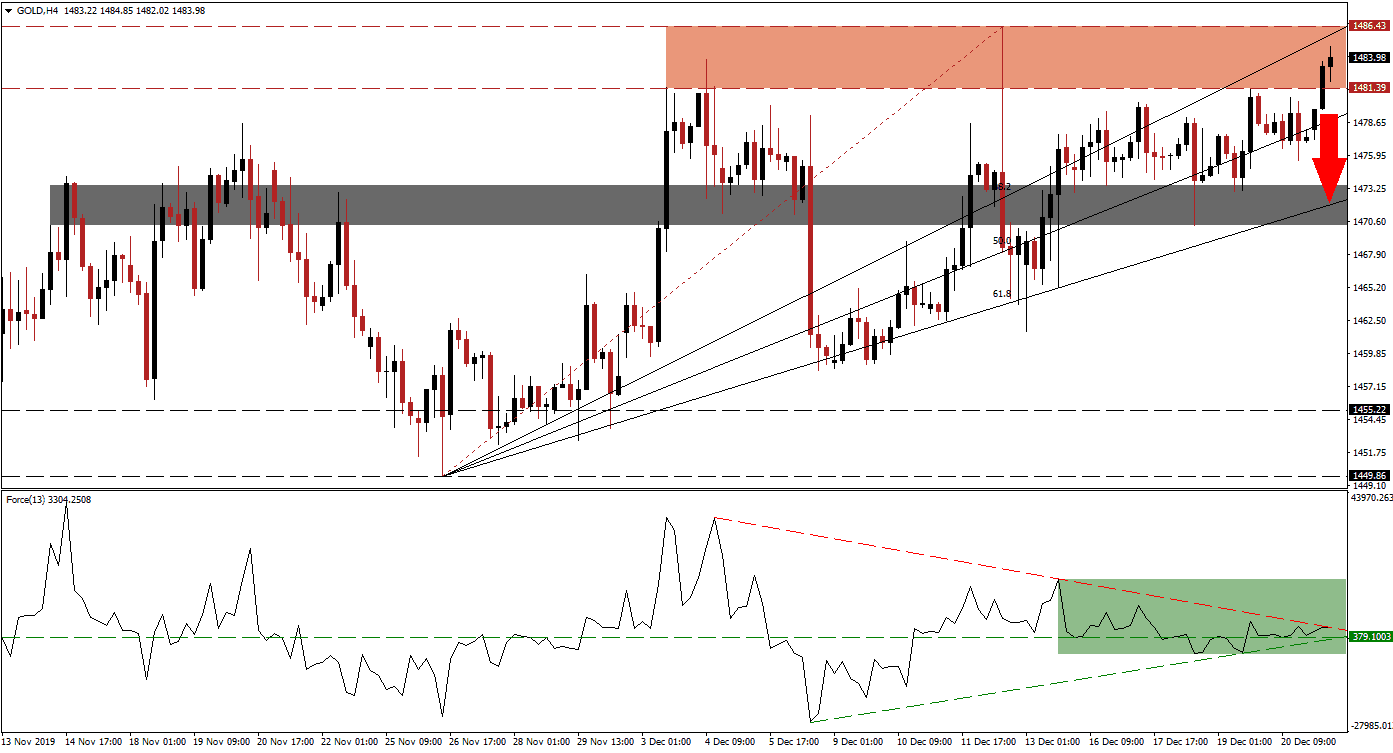

The Force Index, a next-generation technical indicator, confirmed the recovery in this precious metal by advancing from a fresh low. An ascending support level formed and continues to pressure the Force Index to the upside. The increase in bullish momentum allowed this technical indicator to convert its horizontal resistance level back into support, as marked by the green rectangle. The Force Index is now faced with its descending resistance level, likely to halt the advance and push gold into a reversal.

Price action has struggled with its current resistance zone located between 1,481.39 and 1.486.43, as marked by the red rectangle. It rejected two previous breakout attempts, both resulting in a sell-off into its 61.8 Fibonacci Retracement Fan Support Level, followed by a recovery, and a higher high. A repeat of this sequence is favored to unfold and extend the bullish chart formation. Despite bullish sentiment in financial markets, gold maintained its upside in a sign that there is a disconnect between expectations and fundamental conditions. You can learn more about the Fibonacci Retracement Fan here.

Gold is anticipated to correct into its next short-term support zone located between 1.470.23 and 1,473.52, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is passing through this zone and expected to end the short-term pull-back. The limited downside potential in this precious metal would require an unlikely fundamental catalyst to extend a breakdown into its next long-term support zone located between 1,449.86 and 1,455.22. Any such move should be viewed as an excellent long-term buying opportunity

Gold Technical Trading Set-Up - Short-Term Pull-Back Scenario

Short Entry @ 1,484.00

Take Profit @ 1,472.00

Stop Loss @ 1,487.00

Downside Potential: 1,200 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 4.00

In case of a sustained breakout in the Force Index above its descending resistance level, gold is favored to follow suit with a breakout of its own. Geopolitical risks remain elevated, and so are threats to the global economy, recession risks are not priced into the markets. This precious metal is expected to eclipse its 2019 high in 2020 and extend its advance, assisted by its safe-haven status. The next resistance zone is located between 1,510.64 and 1,519.20, from where more upside is favored.

Gold Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1,495.00

Take Profit @ 1,519.00

Stop Loss @ 1,487.00

Upside Potential: 2,400 pips

Downside Risk: 800 pips

Risk/Reward Ratio: 3.00