After completing the reaction from the announcement of the US Central Bank about its monetary policy decisions, the gold price awaits important events, most notably the reaction from the results of the first meeting of Christine Lagarde as President of the European Central Bank, along with the beginning of voting in the general elections in Britain, which will determine the fate of Brexit, in addition to learning about the decision of whether the US will impose higher tariffs on other Chinese imports, or not, as it is scheduled to do so on December 15. The price of gold went higher to reach the $1479 resistance before settling around $1474 at the time of writing.

As expected, the US Federal Reserve, led by Jerome Powell, kept the US interest rate at 1.75% unchanged. At the same time, Powell reiterated the bank's confidence in the country's economic performance, and that the American inflation is on the way to rise and that the American labor market is still strong, as the country's unemployment rate is the lowest in about 50 years. Powell said, "Although we have a 3% unemployment, there is actually a somewhat more recession." “The risks of using our accommodative monetary policy, our tool, to explore this, are relatively low,” Powell said, adding that he was optimistic about the economy and reliefed that the Fed’s interest rate cuts this year may have helped to prolong growth. "Both the economy and monetary policy are in a good place," he said.

In Britain today, citizens will begin to vote on the choice of who will lead the United Kingdom in a very sensitive and crucial period, as the winner of this vote will be historically responsible for the fate of Brexit, and gold will react strongly if the conservatives do not win, or if the results come out with a suspended parliament.

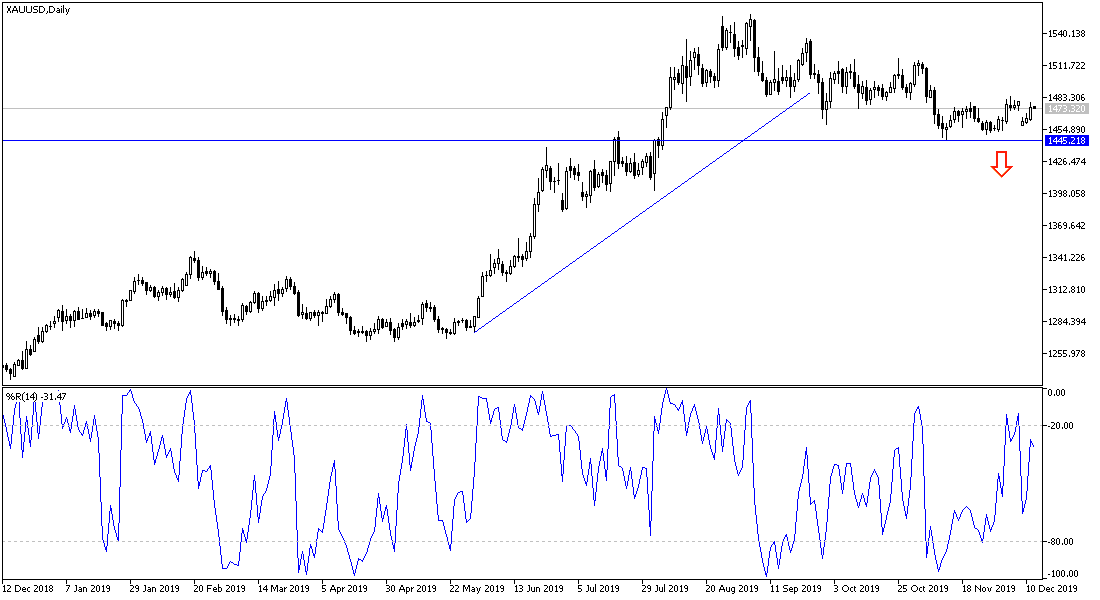

According to the technical analysis of gold today: There is no change in my future technical view of the gold price, which is still under pressure of a downward correction, and the current trend reversal will be strengthened if the prices move towards 1458, 1445 and 1430 dollars, respectively. The continuation of the recent gains will change the trend towards the upside if it moves towards $1500 psychological resistance again. Factors that renew global trade and political tensions remain, and according to their results, the price of the yellow metal will determine its fate.