Since the correlation between the US dollar and gold prices is inverse, it was normal with the dollar decline, and investors’ flight out of risk, that gains of gold prices increase, which reached the $1482 resistance of, the highest in a month, and is stable around that at the time of writing. Gold gains were supported by renewed fears that the upcoming US-China trade deal would fail after President Donald Trump hinted that the start of the “Phase 2 deal” with China might happen in 2020. After constant assurances from him and China of a near deadline for the completion of the deal.

US President Trump and his trade secretary also said December 15 will continue to see tariffs on all of China's remaining annual exports to the United States, unless agreed otherwise by then, raising fears of a renewed revenge tariff war between the world two largest economies, threatening the future of global economic growth.

The US administration opened a new front for tariff warfare. The Office of the US Trade Representative (USTR) said that France's new tax on online sales discriminates against US companies, contravenes some international tax agreements and is “extraordinarily heavy” for those US companies that implement them. The trade representative recommended a tariff of up to 100% on French goods worth $ 2.4 billion a year. However, President Donald Trump and Emmanuel Macron expressed confidence at a NATO summit in London that differences over taxes and other issues could be resolved. All these developments were in favor of gold.

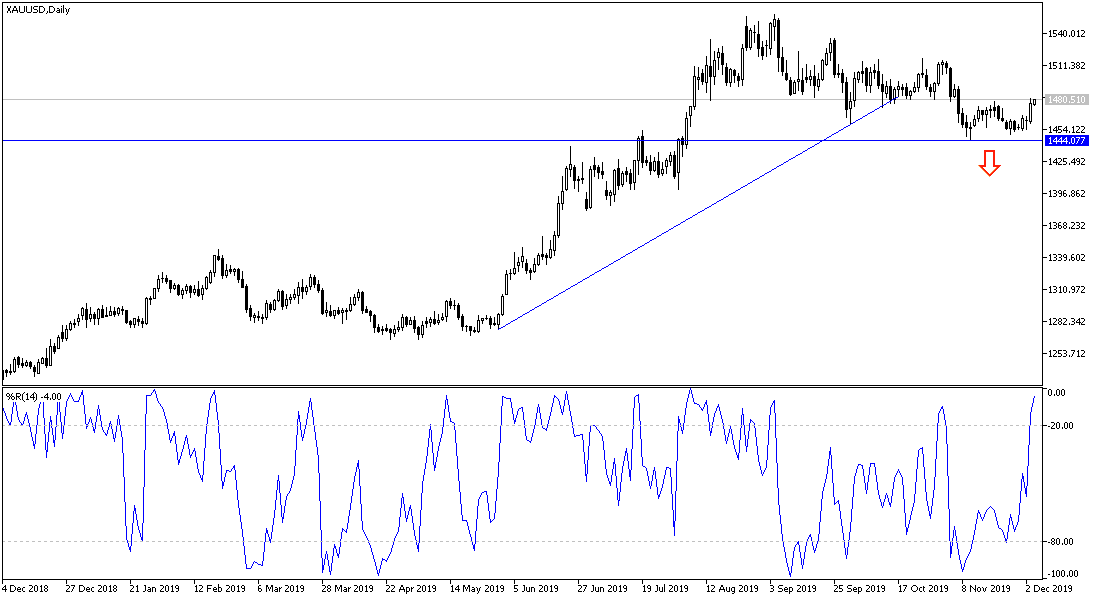

According to the technical analysis of gold: The stability of gold prices above the $1480 resistance will pave the way for the yellow metal to move towards $1500 psychological resistance as soon as possible. On the downside, the nearest gold support levels are currently at 1473, 1465 and 1450 respectively, and we still prefer to buy gold from every bearish level. Gold, in addition to the renewed trade and political tensions around the world, will react with the release of the Services Purchasing Managers' Index (PMI) from China, the Eurozone, Britain and the United States and then with the first US ADP Nonfarm Employment Change report.