The US dollar got a strong momentum amid positive and better than expected US jobs results during the month of November, along with the strength of the dollar, it was natural that the price of gold fell to the $1458 support, and attempts to rebound before the report pushed the price of the yellow metal to the $1480 level, and it is now stable around $1461 at the time of writing. Any drop in gild prices in the coming days will be a buying opportunity, as the financial markets have an important date with a package of important economic data and fateful political events, and gold are among the most important safe havens for investors in times of uncertainty.

The US Federal Reserve will announce its monetary policy, and the European Central Bank will have its first meeting under the leadership of Christine Lagarde. General elections will be held in Britain, the results of which will determine the fate of the Brexit, and we will be on a date of Trump's decision regarding increasing US tariffs on the rest of China's imports. Will he impose it on December 15, or will he postpone or suddenly speak to everyone by announcing details of an agreement and timing of a formal signature? All scenarios are open and may happen.

Will the US inflation numbers be on the same pace of improvement as the US job numbers or not? We will find out this week, and it will echo in the statement of the Federal Reserve Policy and the statements of its Governor Jerome Powell next Wednesday. The U.S. non-farm sector succeeded in creating a total of 266,000 jobs in November after increasing by 156,000 in October. Economists had expected an increase of only 180,000 jobs. Job growth was much stronger than expected due partially to a recovery in employment in the industrial sector, which rose by 54,000 in November after falling by 43,000 in October as striking GM workers returned.

The Ministry of Labor also indicated significant gains in health care, professional and technical services. With jobs growing stronger than expected, the US unemployment rate fell to 3.5 percent in November from 3.6 percent in October. The unemployment rate was expected to remain the same. The unexpected drop brought the unemployment rate to its lowest level in nearly 50 years, which it hit in September.

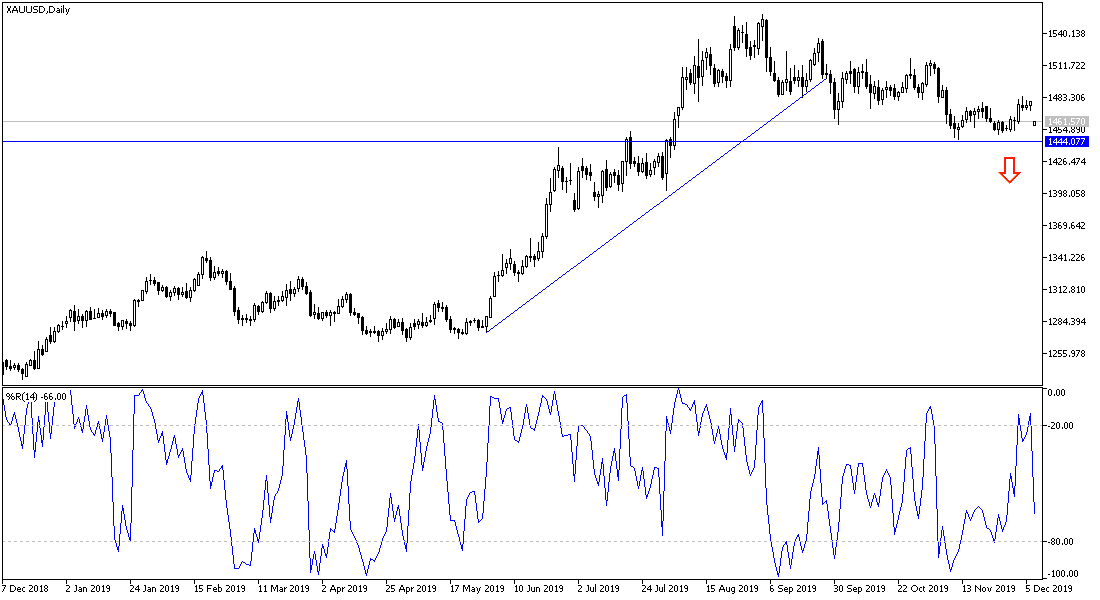

According to the technical analysis of gold: The downward momentum of gold prices will increase, as shown on the daily chart below, by moving around and below the $1450 support. At the same time, investors will nevertheless think about returning to think about buying in the event of increased pressure and push the price to 1444, 1438 and 1425 levels, respectively. On the upside, the closest resistance levels are now at 1472, 1485 and 1500 respectively. We might witness a strong fluctuation in the price of gold this week, so be careful.

As for the economic calendar data: From Japan, the GDP and current account growth will be announced. From the Eurozone, the German trade balance will be announced. From Canada, building permits and housing starts will be announced. There are no significant US economic releases today.