On the gold daily chart, price is moving in a narrow and limited range despite the announcement of important economic data and global developments, most notably the trade agreement between the United States and China and the results of parliamentary elections in the United Kingdom. Which sets the stage for a price explosion soon. Since the beginning of trading this week, the price of the yellow metal has been moving between $1473 and $1478 an ounce. Optimism prevailed in the financial markets recently and increased investor risk appetite, who gave up on safe havens, most notably gold. Despite the recent optimism, Europe is still in a recession, and expectations of growth in the United States against the rest of the world are showing signs of stability at levels would not lead to a significant dollar weakness.

In contrast, the UK economy is likely to have stalled in the last quarter, according to IHS Markit PMI surveys, which indicated that manufacturing and services sectors fell in December, prompting economists to warn the Bank of England of the possibility of lowering interest rates if growth did not increase soon. Surveys have indicated an economic crisis for months.

Forex traders try to monitor everything, whether from the results of economic data, which is being intensified currently,or statements or decisions to close their financial positions before the end of 2019.

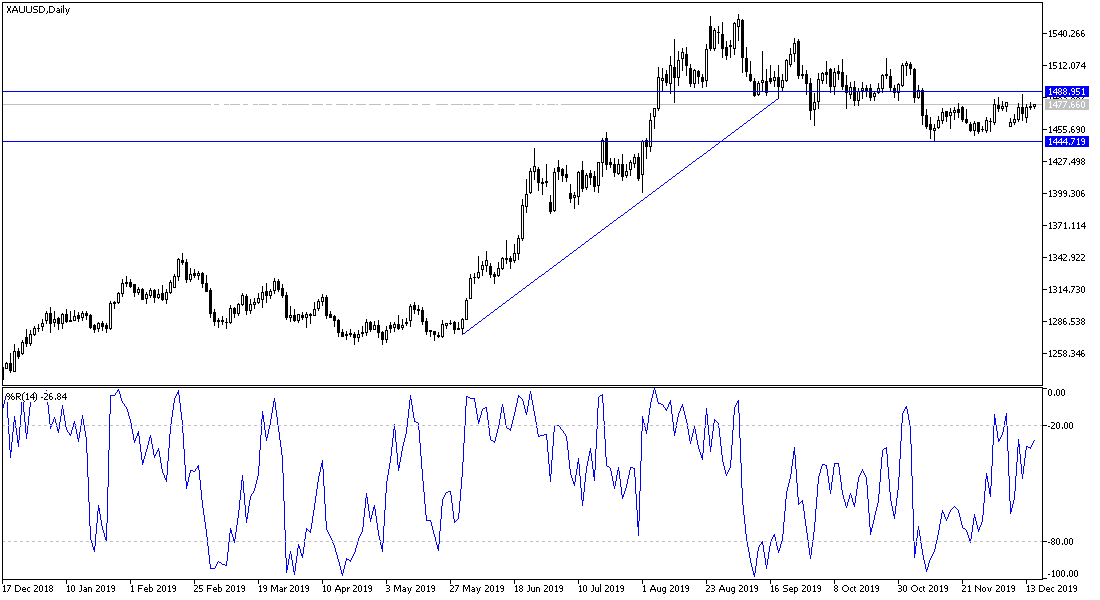

According to the technical analysis of gold: The general trend of the yellow metal is in a neutral position with more upward tendency, and this expectation will be strengthened if the price of gold stabilizes above the 1485 resistance, which paves the way towards the $1500 psychological. On the downside, the closest support levels for gold prices are at 1468, 1455 and 1440, respectively, and the last level is an end to bulls' aspirations. It must be borne in mind that the return of trade and political tensions around the world mean the return of gold price gains as one of the most important safe havens for investors in times of uncertainty.

As for the economic calendar data: Gold will interact with Britain's announcement of job numbers and wages. During the American session, building permits, housing starts and industrial production will be announced, which was greatly affected by the trade dispute with China.