For the fourth consecutive day, gold prices stabilized around and above the $1500 psychological resistance level, with gains that extended to $1515, the highest level in nearly two months. Gains were supported by the decline of the US dollar, and renewed investor fears about the future of the trade agreement between the United States and China, as well as Brexit. Gold is one of the most important safe havens for investors in times of uncertainty, and accordingly, it may receive the 2020 transactions by settling on its current gains. At the same time, if the official date for the signing of the commercial deal between the two largest economies in the world was announced, and its details were satisfactory to the markets, the price of gold could quickly collapse.

The price of gold rose by 2.4% last week and was the largest rise in four months, and progress for three weeks was the longest since August. The precious metal closed its trading above $1500 an ounce for the first time in eight weeks. The yields of the ten-year bonds were mostly the least during the holiday week, with gains for both stocks and gold.

US, German and Japanese yields increased by 10-12 basis points this month, which is in line with the deflationary situation. December will be the fourth month in a row that US, German and Japanese bond yields have increased for 10 years. The American yield increased from about 1.50% to near to 1.87%. German yield increased from minus 70 basis points to just over 25 basis points before the weekend. The yield on Japanese government bonds for 10 years increased from minus 26 basis points to zero before the end of the week. At the height of August, there were approximately $17.03 trillion of negative-yielding bonds, and now there are about $11.5 trillion.

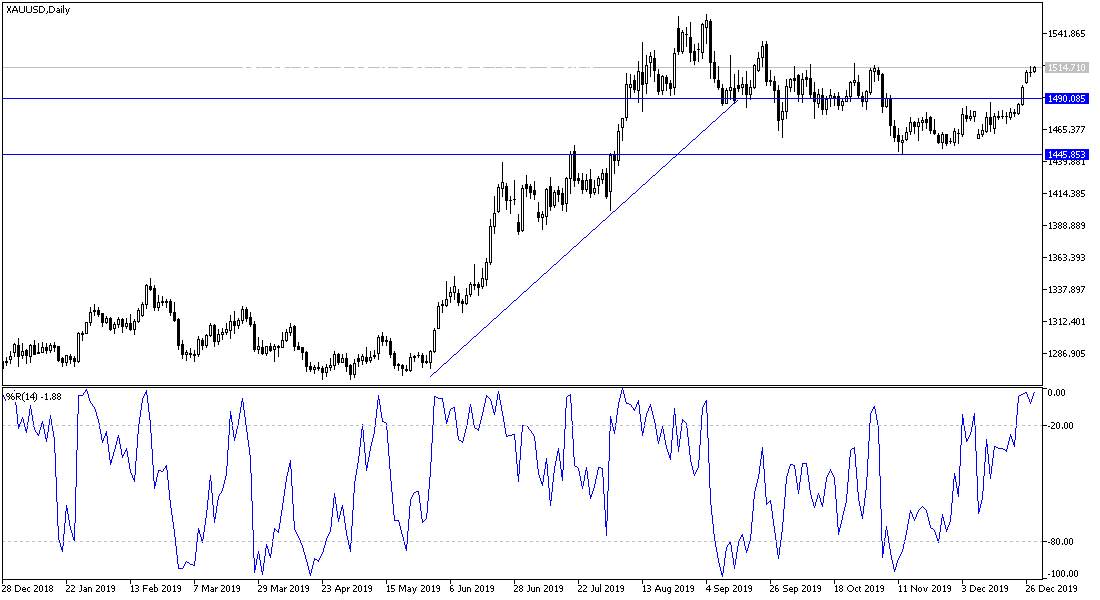

According to the technical analysis of gold: the price of the yellow metal rose last week to the $1515 resistance, close to its highest level in four months. Thus, gold succeeded in breaking the downtrend. The MACD indicator shows room for launch, while the Slow Stochastic indicator completes the performance. The attempts of October and November to rise in a range between $1515 and $1520 faltered, but if this space is broken, gold may go further to the $1557 resistance of an ounce, its highest level in six years, which was recorded in early September. And there will be no bears controlling the performance without returning to the $1480 support. As we had expected before, we now confirm that continued global trade and geopolitical tensions will be in favor of stronger gold gains.

For today's economic data: All focus well be on US data, as the PMI from Chicago and pending US home sales data will be released.